Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

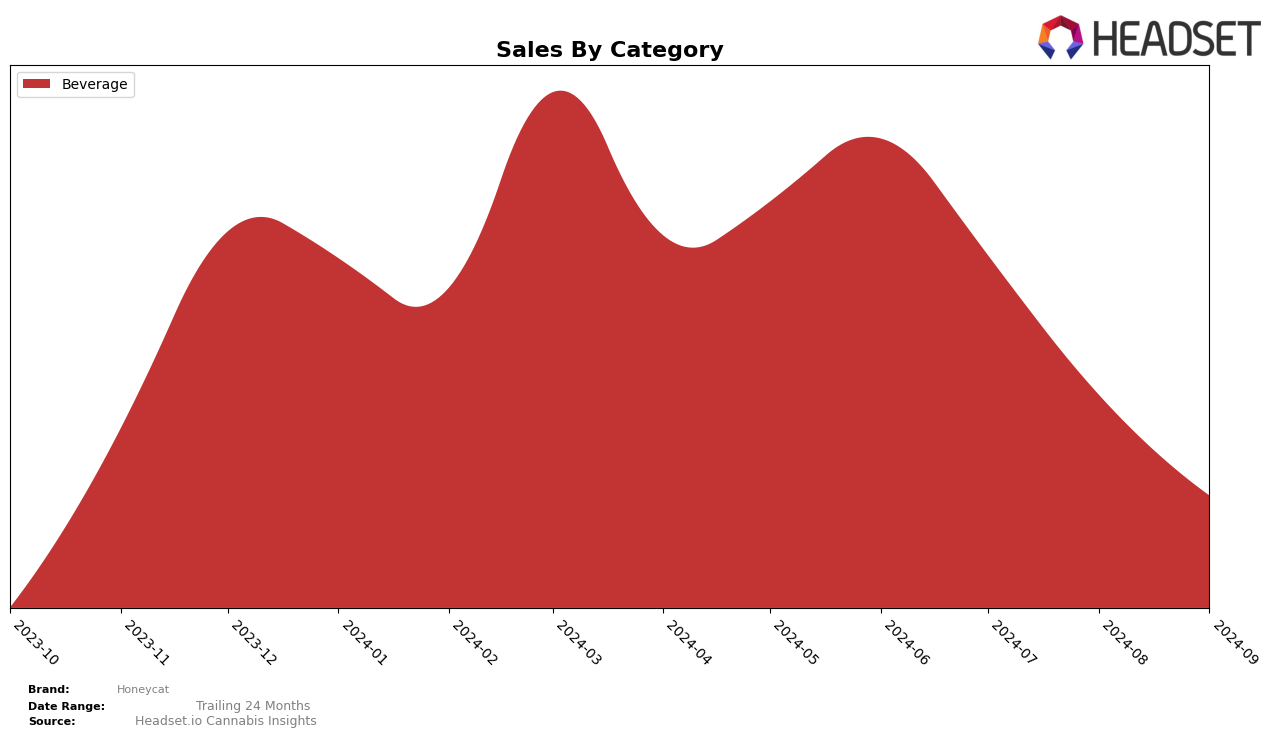

Honeycat's performance in the Beverage category in Massachusetts shows an interesting trend. In June 2024, Honeycat managed to secure the 19th position, but unfortunately, they did not appear in the top 30 rankings for July, August, and September. This drop can signify increased competition or changes in consumer preferences within the state. Despite this, the sales figure in June was notable, indicating a strong start to the summer season. The absence from the top rankings in subsequent months might suggest a need for strategic adjustments to regain market presence.

Across other states and categories, Honeycat's visibility varies, with some regions not yet seeing the brand break into the top 30. This could be perceived as a challenge or an opportunity, depending on the market dynamics and Honeycat's strategic goals. The data suggests that while Honeycat has made a mark in Massachusetts, there is potential for growth and expansion in other states or categories. This mixed performance highlights the importance of targeted marketing and adaptation to local market conditions to enhance Honeycat's standing in the competitive cannabis industry.

Competitive Landscape

In the Massachusetts beverage category, Honeycat has experienced notable fluctuations in its market presence, with its rank dropping out of the top 20 after June 2024, where it held the 19th position. This decline in visibility suggests a challenging competitive landscape, particularly against brands like Wynk and Good Feels Inc, which consistently maintained their positions within the top 20 throughout the summer months. Wynk showed a slight upward trend, improving from 17th to 16th place by September 2024, while Good Feels Inc experienced a minor decline, moving from 15th to 18th place. These shifts indicate a dynamic market where Honeycat's absence from the rankings post-June could be attributed to intensified competition and possibly the need for strategic adjustments to regain market share and visibility.

Notable Products

In September 2024, Honeycat's top-performing product was the Dark Roast Cold Brew Beverage (5mg THC, 8oz), maintaining its consistent first-place ranking since June, despite a notable decrease in sales to 225 units. The Lemon Lime Soda (5mg THC, 8oz) held the second position, showing a slight increase in sales from the previous month. Classic Margarita Beverage (5mg THC, 8oz) continued to rank third, although its sales have steadily declined since June. This consistent ranking pattern indicates a strong consumer preference for the Dark Roast Cold Brew Beverage, while the other beverages have seen minor fluctuations in their popularity. Overall, Honeycat's beverage category remains a stable performer with slight shifts in consumer preferences over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.