Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

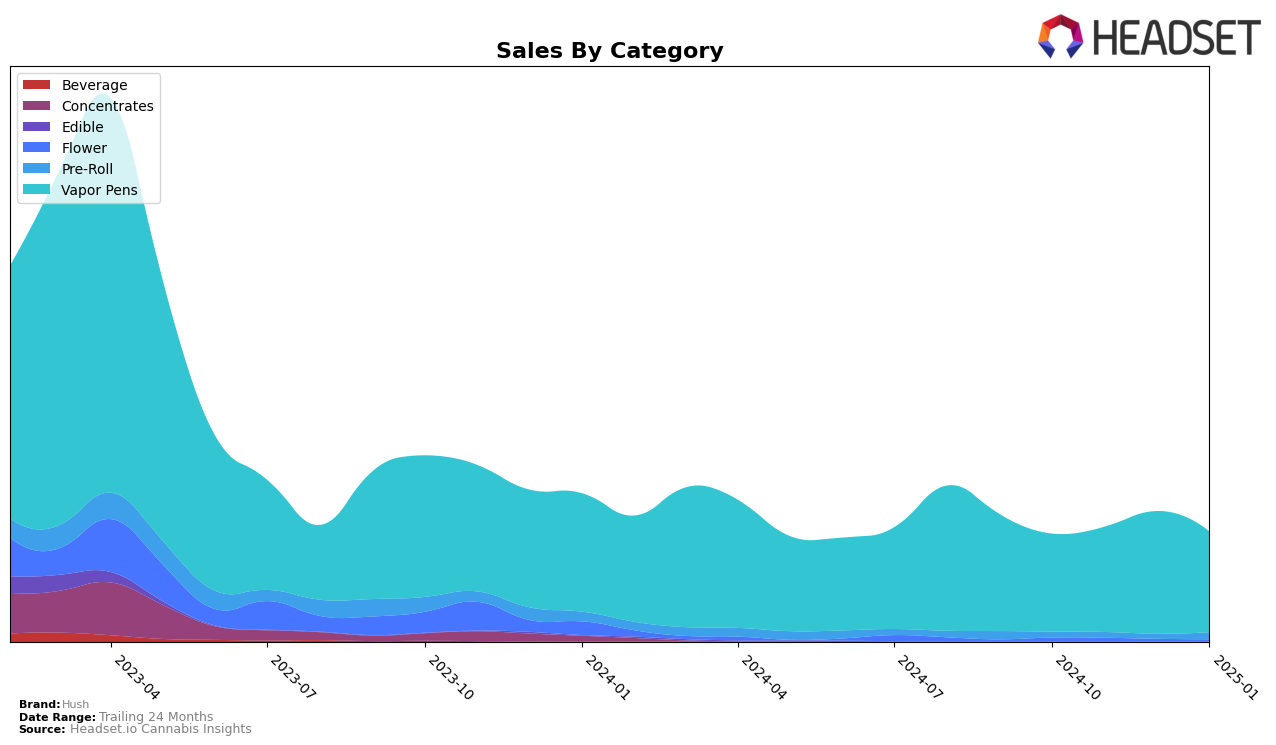

In the competitive landscape of cannabis brands, Hush has shown varied performance across different states and product categories. In California, Hush's presence in the Vapor Pens category has been relatively stable, though not within the top 30 brands. Despite a dip in January 2025, where their rank fell to 58th, Hush experienced a notable increase in sales in December 2024, suggesting a potential seasonal boost or successful promotional efforts. This fluctuation indicates that while Hush has not broken into the top tier, there is consumer interest that could be capitalized on with strategic initiatives.

In Oregon, Hush has seen more dynamic movement, particularly in the Pre-Roll category where they improved their ranking from 81st in October 2024 to 65th by January 2025. This upward trend, coupled with a sales increase in the same period, may reflect growing brand recognition or a successful product launch. Conversely, in the Vapor Pens category, Hush has maintained a more consistent presence, peaking at 35th in January 2025, which suggests a steady demand. The brand's ability to climb the ranks in Oregon could indicate a strong market strategy or consumer preference shifts, which could be crucial for future growth.

Competitive Landscape

In the competitive landscape of vapor pens in California, Hush has experienced fluctuating rankings from October 2024 to January 2025, reflecting a dynamic market environment. During this period, Hush's rank improved from 57th in October to 50th in December, before dropping to 58th in January. This volatility contrasts with competitors like Timeless, whose rank declined steadily from 54th to 59th, and Sherbinskis, which maintained a relatively stable position around the mid-50s. Notably, Cream Of The Crop (COTC) demonstrated significant upward momentum, climbing from 53rd in October to 34th in December, although it fell back to 56th in January. This suggests that while Hush has seen some improvement in sales, as evidenced by the peak in December, it faces stiff competition from brands like COTC that have shown the ability to capture market share rapidly. Meanwhile, Amber has seen a consistent decline in rank, indicating potential challenges in maintaining its market position. These insights highlight the importance for Hush to strategize effectively to capitalize on its sales growth and improve its competitive standing in the California vapor pen market.

Notable Products

In January 2025, the top-performing product for Hush was the Halo Haze Pre-Roll (0.5g) which maintained its number 1 rank from December 2024, with impressive sales of 9712 units. The Blue Razz Flavored Distillate Cartridge (1g) rose to the 2nd position, showing a significant resurgence after not being ranked in the previous two months. London Pound Mintz Pre-Roll (1.1g) entered the rankings in January at the 3rd position, indicating a strong market entry. Green Crack Distillate Cartridge (1g) dropped to the 4th position from its previous top ranking in October 2024. Lastly, Strawberry Cough Flavored Distillate Cartridge (1g) slipped to the 5th position, down from its 2nd place in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.