Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

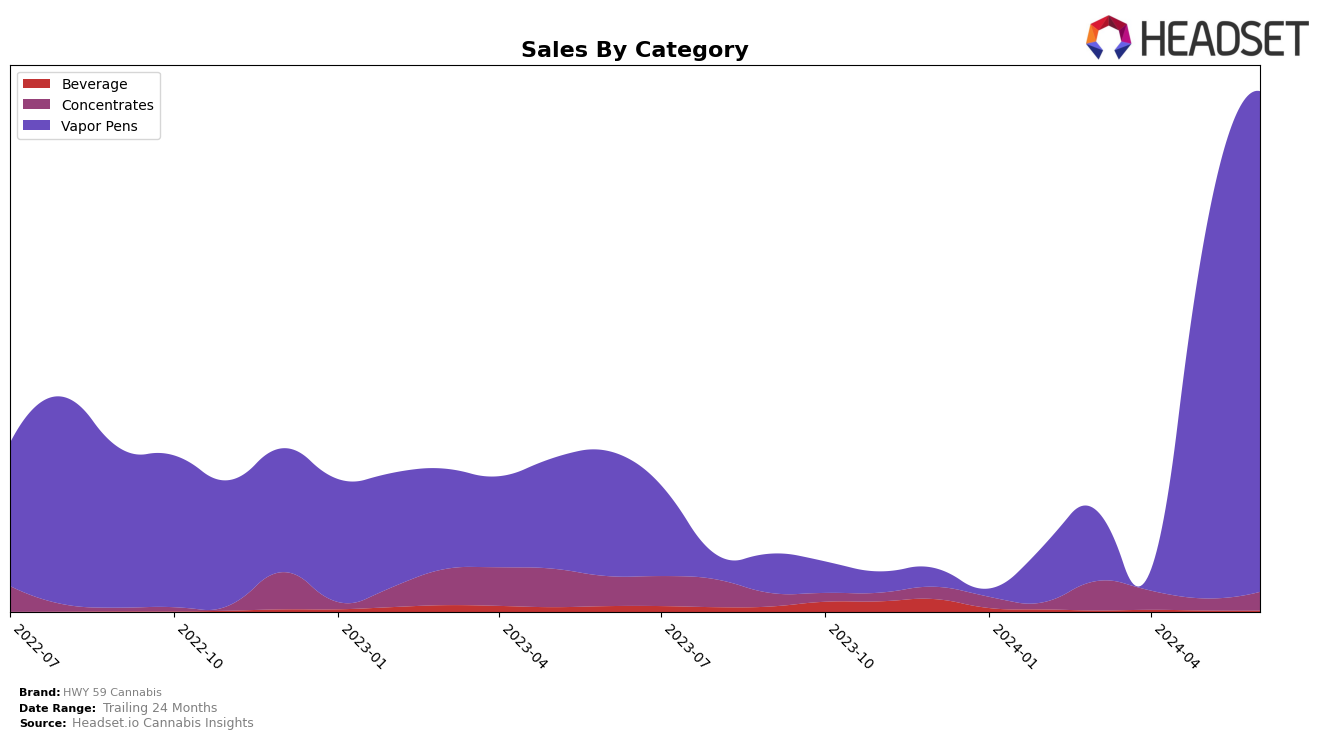

HWY 59 Cannabis has shown notable performance improvements in the Vapor Pens category in Alberta over the past few months. Starting off the period without a ranking in March 2024, the brand made significant strides by securing the 30th position in May and climbing to the 23rd spot by June. This upward trend suggests a growing consumer preference for HWY 59 Cannabis's vapor pen products in Alberta, reflecting effective marketing strategies or product improvements. The brand's sales figures also support this positive movement, with a substantial increase from $116,113 in May to $157,348 in June.

In contrast, HWY 59 Cannabis's performance in Saskatchewan tells a different story. The brand did not make it into the top 30 rankings in the Vapor Pens category from April to June 2024, only appearing in 36th place in March. This absence from the top 30 indicates a competitive market where HWY 59 Cannabis has yet to establish a significant foothold. The lack of ranking could be seen as a call to action for the brand to reassess its strategy in Saskatchewan to better capture market share and consumer interest.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, HWY 59 Cannabis has shown a notable improvement in rank and sales over the past few months. After not being in the top 20 brands in March and April 2024, HWY 59 Cannabis made a significant entry at rank 30 in May and climbed to rank 23 by June. This upward trend indicates a growing market presence and increasing consumer preference. In contrast, 1964 Supply Co did not make it to the top 20 in any of the months, suggesting a potential decline or stagnant performance. Pure Sunfarms experienced a drop from rank 18 in April to rank 22 in May and June, reflecting a downward trend in sales. Similarly, Ness saw a decline from rank 20 in March to rank 24 in June. Meanwhile, Coterie showed a steady improvement, moving from rank 30 in March to rank 25 in June. These shifts in rankings highlight HWY 59 Cannabis's potential to capture more market share if the current trend continues.

Notable Products

In June 2024, the top-performing product for HWY 59 Cannabis was Jealousy Kush Live Terp Diamond Cartridge (1g) in the Vapor Pens category, maintaining its rank from May 2024 with impressive sales of 4221 units. Multipack Shatter (1g) in the Concentrates category held steady at the second position for four consecutive months. Fruity Pebbles OG Sugar Wax (1g), also in the Concentrates category, ranked third, showing a slight decline from its top position in April. Caramel Hot Chocolate Drink Mix 2-Pack (10mg) in the Beverage category remained consistent at fourth place since April. Notably, Orange Tingz Diamond Cartridge (1g) saw a significant drop, falling to the fifth position after leading in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.