Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

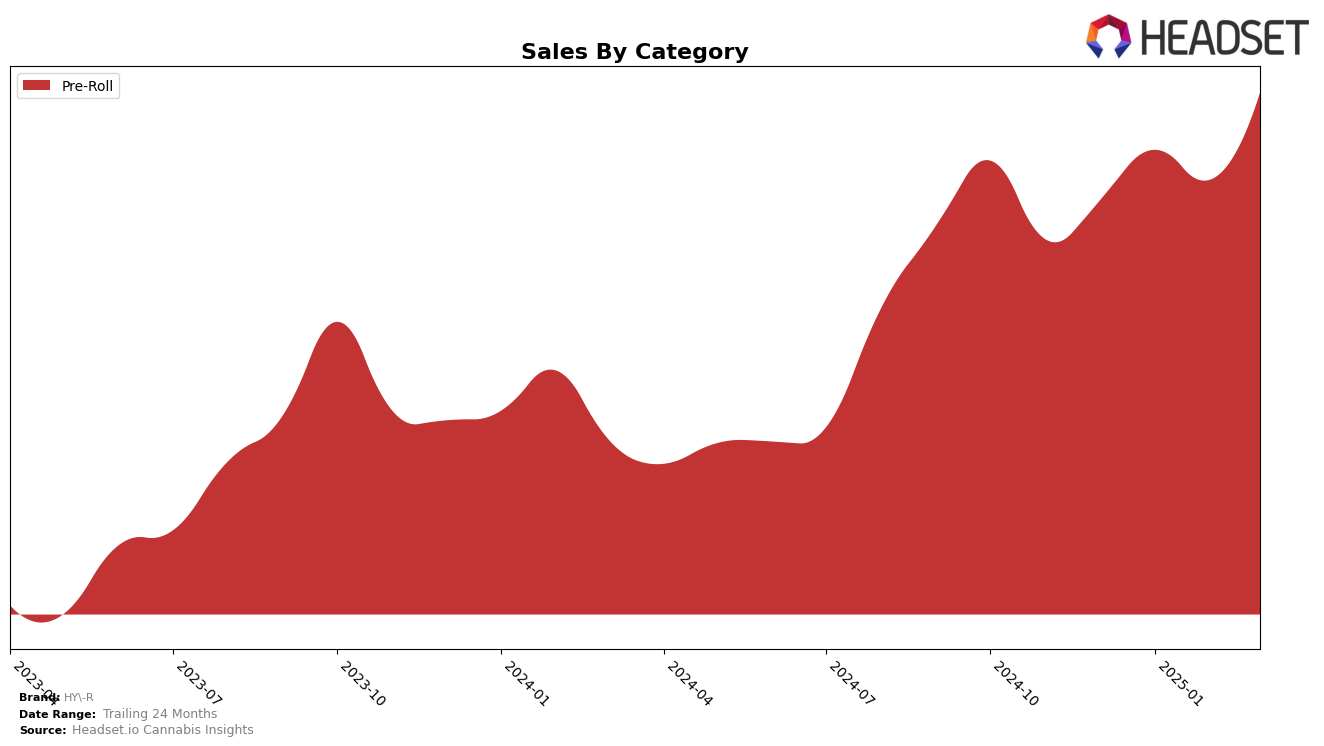

In the state of Michigan, HY-R has demonstrated consistent performance within the Pre-Roll category, maintaining a steady rank at 9th place from January through March 2025. This consistency suggests a strong foothold in the market, as the brand has managed to sustain its position within the top 10. The upward trend in sales, peaking at over $1 million in March, indicates a positive reception from consumers and a potential increase in market share. However, it should be noted that the brand's presence in other categories or states is not highlighted, suggesting either a focus on this particular category in Michigan or a lack of penetration elsewhere. This could be seen as a limitation if the brand aims for broader market diversification.

Interestingly, the absence of HY-R in any other state or category rankings within the top 30 could signal a strategic concentration on the Michigan Pre-Roll market, or it might highlight areas for potential growth. While the brand's performance in Michigan is commendable, especially with its ability to maintain a top 10 position consistently, the lack of visibility in other regions or categories may suggest untapped opportunities. This could be a pivotal point for the brand, as expanding its footprint could lead to increased brand recognition and revenue streams. Stakeholders might want to consider exploring these avenues to enhance brand presence and market competitiveness further.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll market, HY-R has shown a consistent performance, maintaining its rank at 9th place from January to March 2025. This stability is noteworthy, especially when compared to brands like Pro Gro, which climbed from 19th in December 2024 to 10th by March 2025, indicating a significant upward trajectory. Meanwhile, STIIIZY and Glorious Cannabis Co. have experienced fluctuations, with STIIIZY dropping to 7th place in January and March 2025, and Glorious Cannabis Co. slipping from 5th to 8th place by March 2025. Despite these shifts among competitors, HY-R's steady rank suggests a strong brand presence and customer loyalty, even as it faces competitive pressures from brands like Rollz, which improved its rank from 16th to 11th over the same period. This consistent performance in rank, coupled with an upward trend in sales from December 2024 to March 2025, positions HY-R as a resilient player in the Michigan Pre-Roll market.

Notable Products

In March 2025, Blueberry Crumble Infused Pre-Roll (1g) emerged as the top-performing product for HY-R, climbing from its previous rank of third in January to first place, with notable sales reaching 14,465 units. Kiwi Pie Infused Pre-Roll (1g) maintained strong performance, securing the second position, although it dropped from its first-place rank in February. Laughing Grape Infused Pre-Roll (1g) showed significant improvement, rising to third place after not being ranked in the previous months. Cherry Punch Infused Pre-Roll (1.5g) also reappeared in the rankings, achieving fourth place. Despite consistent performance, Banana Candy Infused Pre-Roll (1g) fell to fifth place, having maintained the second position in both December and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.