Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

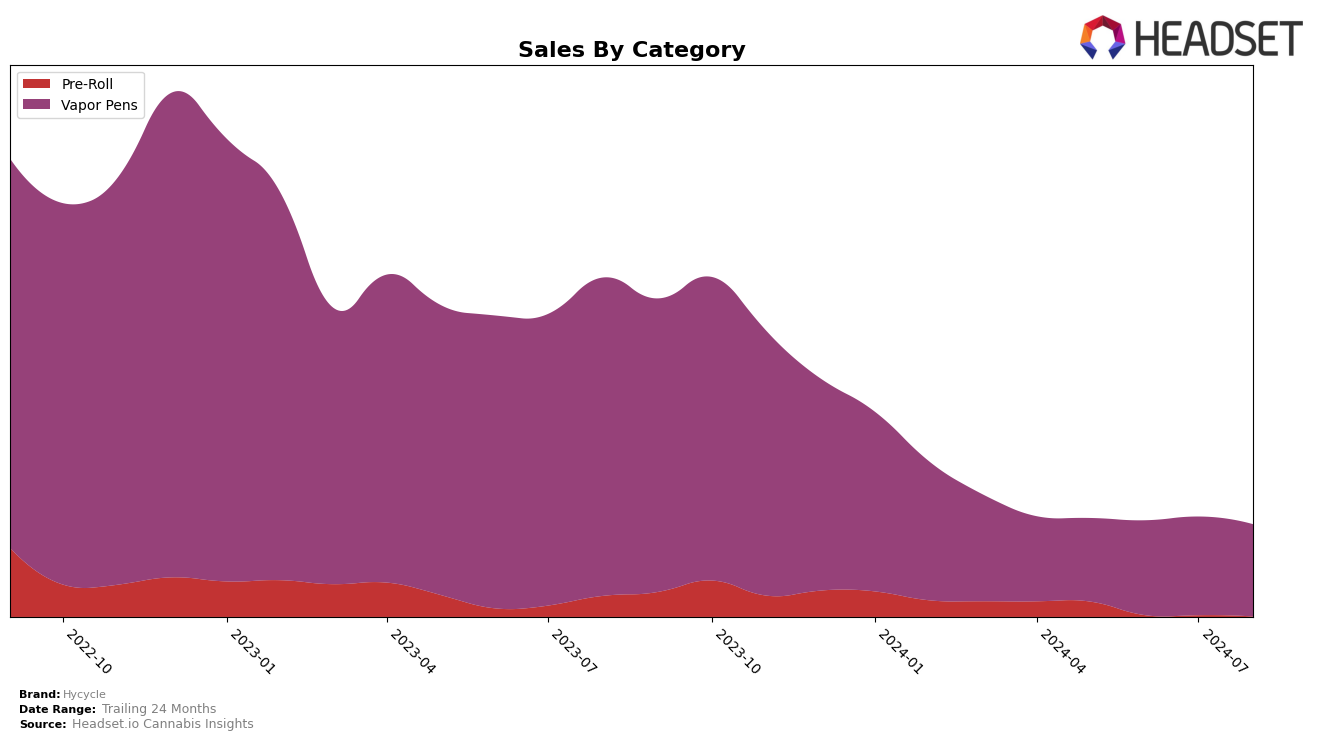

Hycycle's performance in the Vapor Pens category has shown varied trends across different provinces. In British Columbia, the brand experienced a notable rise in rankings, moving from 33rd place in June 2024 to 27th place in both July and August 2024. This upward movement suggests a strengthening presence in the market, supported by a significant increase in sales from June to July. However, in Ontario, Hycycle's rankings have been less impressive, hovering around the 50th position for both July and August 2024. This indicates a struggle to break into the top tier of brands in this region, which could be a point of concern for the company's market strategy.

Despite not making it into the top 30 brands in Ontario, Hycycle's sales figures reveal interesting insights. For example, the brand saw a peak in sales in June 2024, followed by a decline in subsequent months. This could indicate a seasonal or promotional spike that wasn't sustained. On the other hand, the steady ranking improvement in British Columbia suggests a more consistent and possibly organic growth. The contrasting performances across these two provinces highlight the importance of localized strategies and market-specific approaches for Hycycle to optimize its presence and sales in different regions.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Hycycle has experienced fluctuating rankings over the past few months, indicating a volatile market position. Despite a peak in June 2024, where Hycycle climbed to rank 44, it has since dropped back to rank 50 by August 2024. This decline in rank is notable when compared to competitors like Dab Bods, which maintained a relatively stable position, ranking 47 in both July and August 2024. Similarly, PAX showed strong performance, peaking at rank 38 in July before dropping to 48 in August, still outperforming Hycycle. Meanwhile, Sticky Greens and Divvy have shown gradual improvements, with Divvy climbing from rank 74 in May to 55 in August. These trends suggest that while Hycycle's sales have seen some growth, the brand faces stiff competition and needs to strategize effectively to regain and sustain a higher market rank in Ontario's vapor pen category.

Notable Products

In August 2024, the top-performing product for Hycycle was the Raw Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank for the fourth consecutive month with sales of 1565 units. The CBD/THC 1:1 Orange Cookies Distillate Cartridge (1g) also held steady at the second position, consistent with its ranking since May. The Indica Terpene Cartridge (1g) showed significant improvement, climbing to third place from fifth in the previous months. Hella Jealousy Distillate Cartridge (1g) entered the top five, securing the fourth position after not being ranked in July. Lastly, the Sativa Lemon Riot Terpene Cartridge (1g) made its debut in the rankings, coming in fifth for August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.