Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

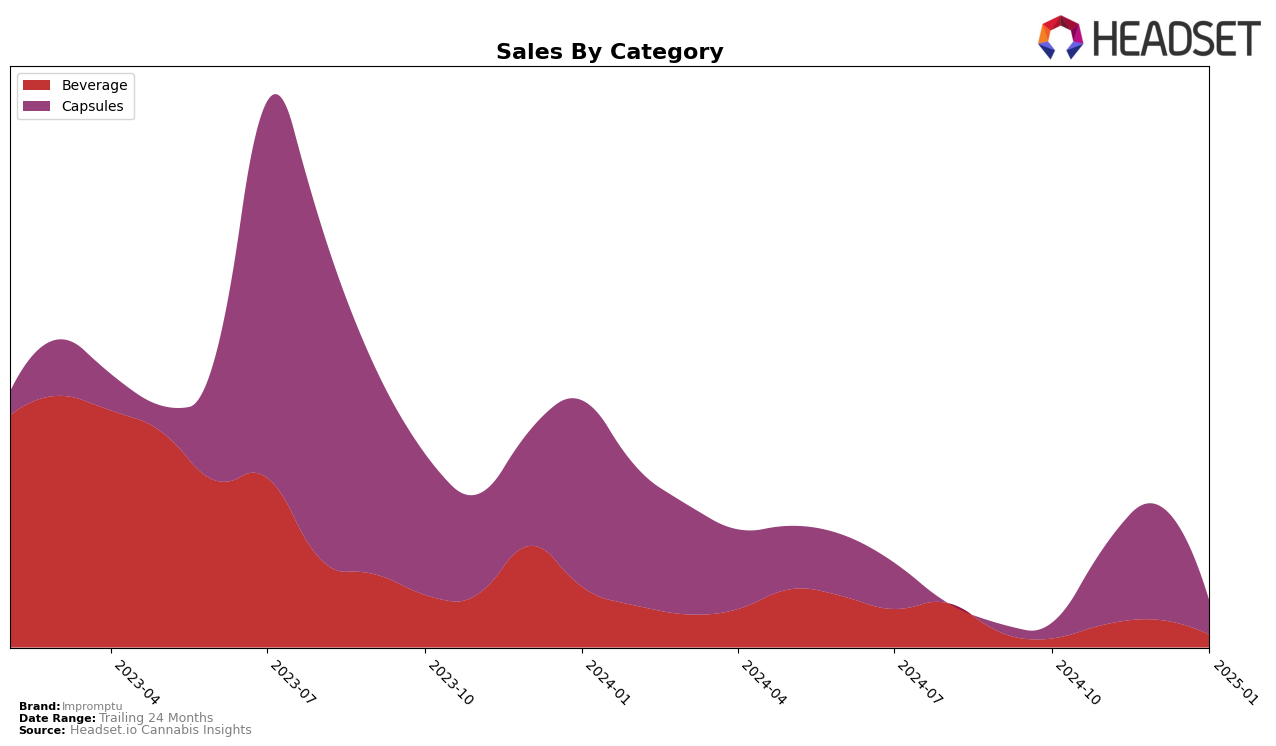

In the province of Ontario, Impromptu made a notable entry into the Capsules category by securing the 18th spot in January 2025, indicating a positive trajectory for the brand. This marks their first appearance in the top 30 rankings for this category and suggests a growing presence in the market. The absence of rankings in the previous months suggests either a late entry into the market or significant growth that only recently brought them into the spotlight. This upward movement could be indicative of successful marketing strategies or a strong consumer response to their products.

While Impromptu's performance in Ontario's Capsules category is promising, it's important to note that the brand did not appear in the top 30 rankings in the months leading up to January 2025. This lack of presence in earlier months might have been a point of concern, but their eventual breakthrough into the rankings could suggest a strategic shift or an introduction of new products that resonated well with consumers. The growth observed in Ontario could serve as a blueprint for expansion into other regions or categories where the brand is currently not ranked, offering potential for further market penetration and brand recognition.

Competitive Landscape

In the Ontario capsules market, Impromptu has shown a notable presence, although its competitive positioning has been challenged by other brands. As of January 2025, Impromptu re-entered the top 20 with an 18th rank, indicating a resurgence after not being ranked in the previous months. This reappearance suggests a potential upward trend in sales and market presence. In contrast, Vortex Cannabis Inc. maintained a stronger position, ranking 4th in October 2024 and 7th in November 2024, reflecting consistently higher sales performance. Meanwhile, Mood Ring experienced a decline, dropping from 13th in October 2024 to 18th in November 2024, and subsequently falling out of the top 20. These dynamics highlight the competitive pressures Impromptu faces from established brands, yet also underscore its potential for growth as it reclaims a spot in the rankings.

Notable Products

In January 2025, the top-performing product for Impromptu is THC Mighty Melts Tablets 10-Pack (100mg) from the Capsules category, maintaining its first-place ranking from the previous two months with sales of 266 units. The CBD:THC 10:1 Goji Grapefruit Kombucha Drink (20mg CBD, 2mg THC, 330ml) continues to hold the second position in the Beverage category, consistent with its performance since November 2024. The CBD:THC 1:10 Mango Kombucha Beverage (1mg CBD, 10mg THC, 330ml) ranks third, showing stability in its position over the last three months. Lime Rosin Seltzer (10mg THC, 330ml) remains in fourth place, reflecting a consistent trend in its sales rank. THC/CBG 1:2 Space Elevator Cola (10mg THC, 20mg CBG, 330ml) reappears in the rankings at fifth place after being unranked in December 2024, indicating a resurgence in sales activity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.