Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

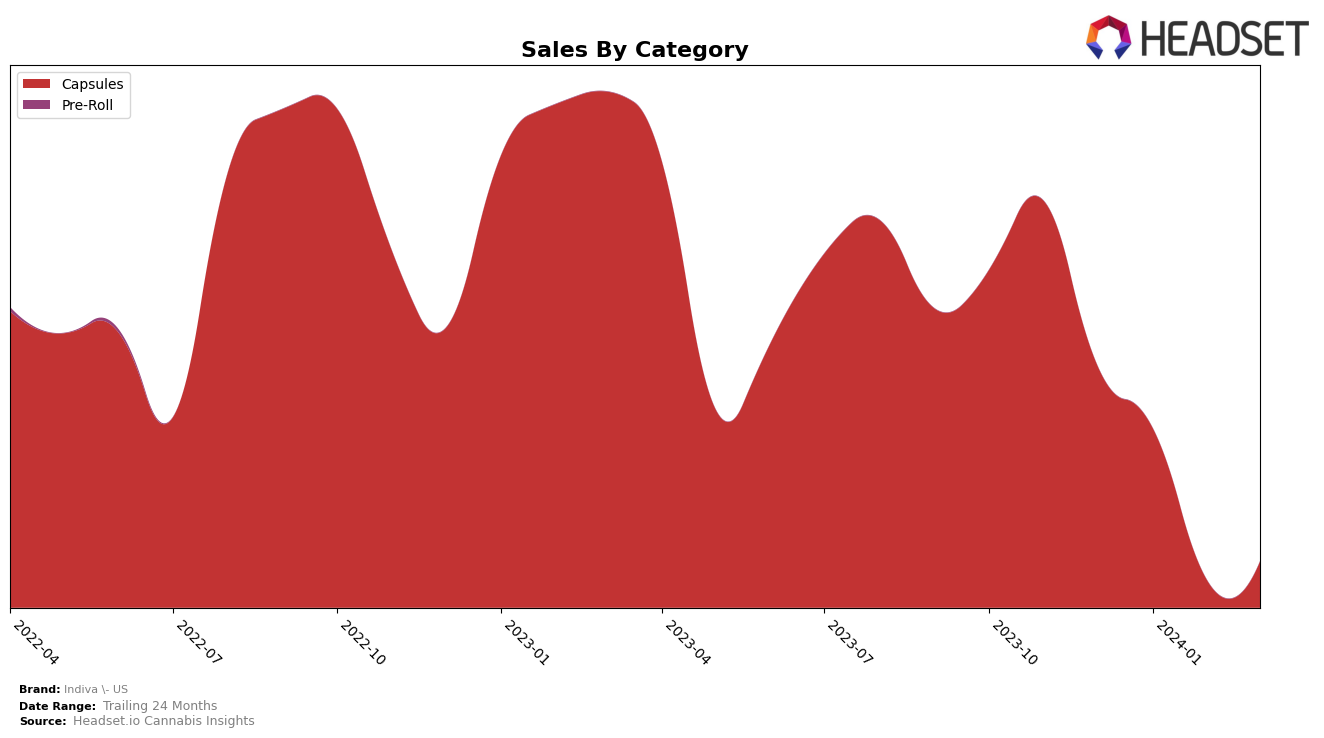

Indiva - US has shown a fluctuating performance in the Capsules category across different provinces in Canada, with notable movements in British Columbia and Ontario. In British Columbia, the brand maintained a stable presence within the top 15 ranks from December 2023 through March 2024, although there was a slight decline in rank from 11th to 12th between December and March. This consistency in ranking, however, masks a significant drop in sales from December's 5312 units to just 958 units in March, indicating a potential challenge in maintaining consumer interest or facing increased competition. In contrast, Ontario saw a more volatile ranking for Indiva - US, peaking at 30th in December 2023, dropping out of the top 30 in February 2024, and then making a comeback to 29th in March. This inconsistency in ranking, combined with a decrease in sales from 629 units in December to 169 units in March, suggests a struggle to secure a strong foothold in the Ontario market.

Meanwhile, in Saskatchewan, Indiva - US did not make it into the top 30 rankings for the Capsules category in the months provided, except for a brief appearance in February 2024 at the 16th position. This appearance, while notable, does not provide enough data to discern a clear trend or performance trajectory in the Saskatchewan market. The lack of consistent ranking data for Saskatchewan could be viewed as a missed opportunity for Indiva - US to capture market share in this province. Across these provinces, the brand's performance indicates a need for strategic adjustments to enhance its market positioning and address the apparent challenges in consumer engagement and competitive differentiation. The observed trends and directional movements suggest that while Indiva - US has managed to maintain a presence in certain markets, there is room for improvement in terms of sales volume and market penetration.

Competitive Landscape

In the competitive landscape of the capsules category in British Columbia, Indiva - US has experienced a fluctuating performance in terms of rank and sales over the recent months. Starting from December 2023 to March 2024, Indiva - US maintained a relatively stable position initially (11th in December and January) but saw a slight dip in February (13th) before recovering to 12th place in March. This fluctuation in rank is mirrored by a significant drop in sales in February, followed by a modest recovery in March. Competitors such as LoFi Cannabis, consistently outperforming Indiva - US, have shown a stronger hold in the top 10, indicating a more dominant presence in the market. Meanwhile, brands like Solei and Assuage have also experienced fluctuations but remain close contenders, highlighting a competitive environment where slight changes can significantly affect rankings. Nutra, showing a similar trend to Indiva - US but with a more stable sales volume, suggests that while Indiva - US is facing challenges, there are opportunities for recovery and growth amidst the competitive dynamics of the British Columbia capsules market.

Notable Products

In March 2024, Indiva - US saw the Indica Capsule 15-Pack (105mg) maintain its position as the top-selling product in the Capsules category, with sales figures reaching 67 units. Following closely was the Sativa Capsule 15-Pack (105mg), which held the second spot in the same category, though its sales dramatically decreased to just 6 units. This marked a significant shift from February 2024, where the Sativa Capsule was the leader in sales, indicating a change in consumer preference towards the Indica variant. The transition in rankings from February to March showcases a dynamic market, with the Indica Capsule 15-Pack (105mg) gaining traction over its counterpart. These insights highlight the fluctuating trends within Indiva - US's product lineup, emphasizing the importance of closely monitoring consumer behavior to maintain market competitiveness.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.