Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

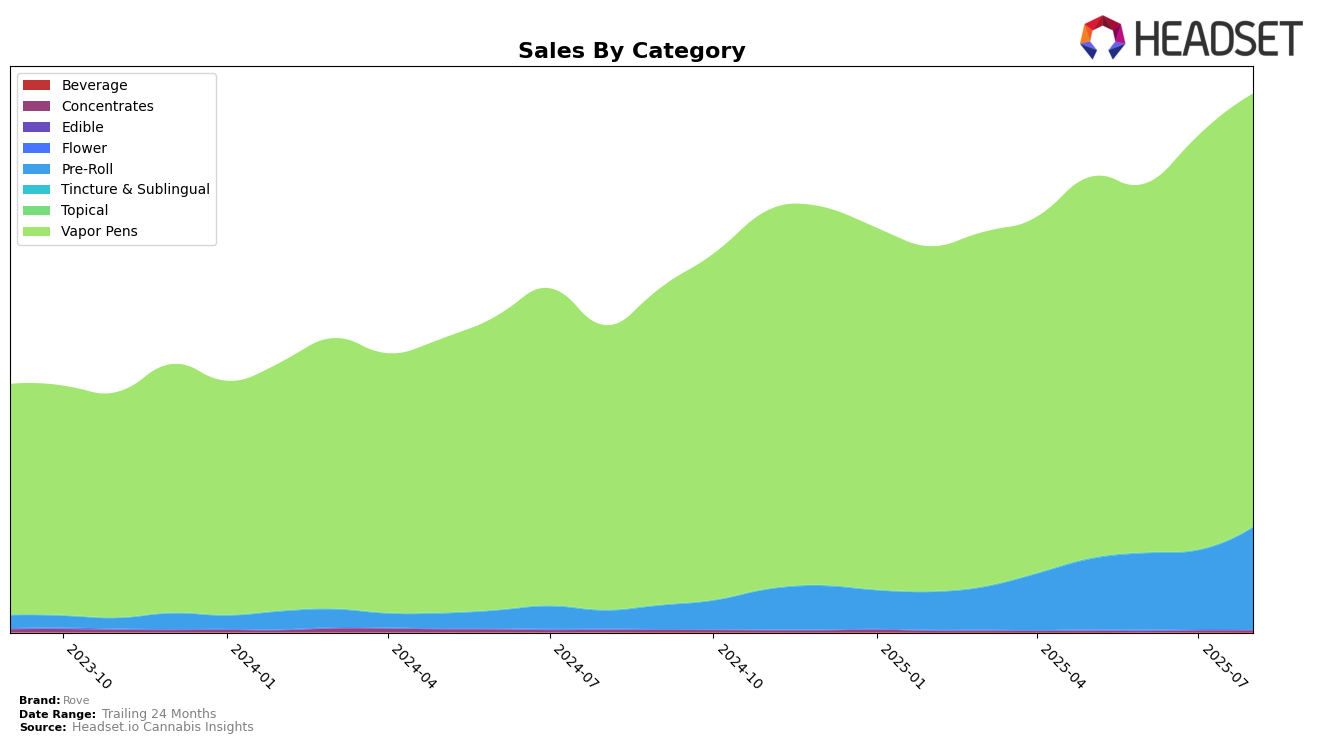

Rove has demonstrated a strong presence in the Vapor Pens category across several states, with notable performances in both California and Illinois. In California, Rove maintained a consistent rank of 9th from June to August 2025, with a steady increase in sales over these months, indicating a solid foothold in this competitive market. Meanwhile, in Illinois, Rove improved its ranking to 5th place by July 2025, reflecting a positive trajectory in sales performance. However, Rove's performance in Michigan showed some fluctuation, where it dropped to 9th in July before recovering to 8th in August, suggesting a need for strategic adjustments to maintain a stable market position.

In the Pre-Roll category, Rove's performance varied significantly across states. In Massachusetts, Rove was absent from the top 30 in May 2025 but made a notable entry at 11th place by June, eventually reaching 10th by August, indicating a successful penetration into this market. Conversely, in Missouri, Rove's ranking saw a dip from 4th to 7th in July before rising back to 5th in August, highlighting some volatility in consumer demand. In New Jersey, Rove entered the top 10 by August, suggesting a growing acceptance and popularity of their products. These movements across states and categories underscore Rove's strategic adaptability and potential for growth in diverse markets.

Competitive Landscape

In the competitive landscape of vapor pens in California, Rove has shown a steady performance, maintaining its rank at 9th place from June to August 2025. This consistency is notable given the fluctuations seen in other brands. For instance, Gramlin experienced a significant drop from 6th to 10th place in June, which allowed Rove to close the gap in sales figures. Meanwhile, Heavy Hitters and Turn have consistently held higher ranks at 8th and 7th places respectively, but their sales figures have shown a downward trend, unlike Rove's upward trajectory. This suggests potential for Rove to climb the ranks if it continues its sales growth. Additionally, Jeeter, ranked 11th, has been increasing its sales, but remains behind Rove, indicating that Rove's market position is currently stable against lower-ranked competitors.

Notable Products

In August 2025, Rove's top-performing product was the Apple Jack Live Resin Diamond Reload Pod (1g) in the Vapor Pens category, maintaining its consistent first-place ranking across all months with a notable sales figure of 13,925. The Ice Packs - Acapulco Gold Ice Hash Live Rosin Diamonds Infused Pre-Roll (1g) achieved the second spot, climbing from its absence in July to reclaim its June position. The Blue Dream Live Resin Diamond Disposable (1g) in Vapor Pens dropped to third place, a slight decline from its second rank in July. The Fruit Punch Live Resin Diamond Reload Pod (1g) saw a minor decline, moving from third to fourth place. Finally, the Maui Waui Liquid Diamond Live Resin Disposable Reload Pod (1g) maintained a steady fifth position, highlighting its consistent performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.