Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

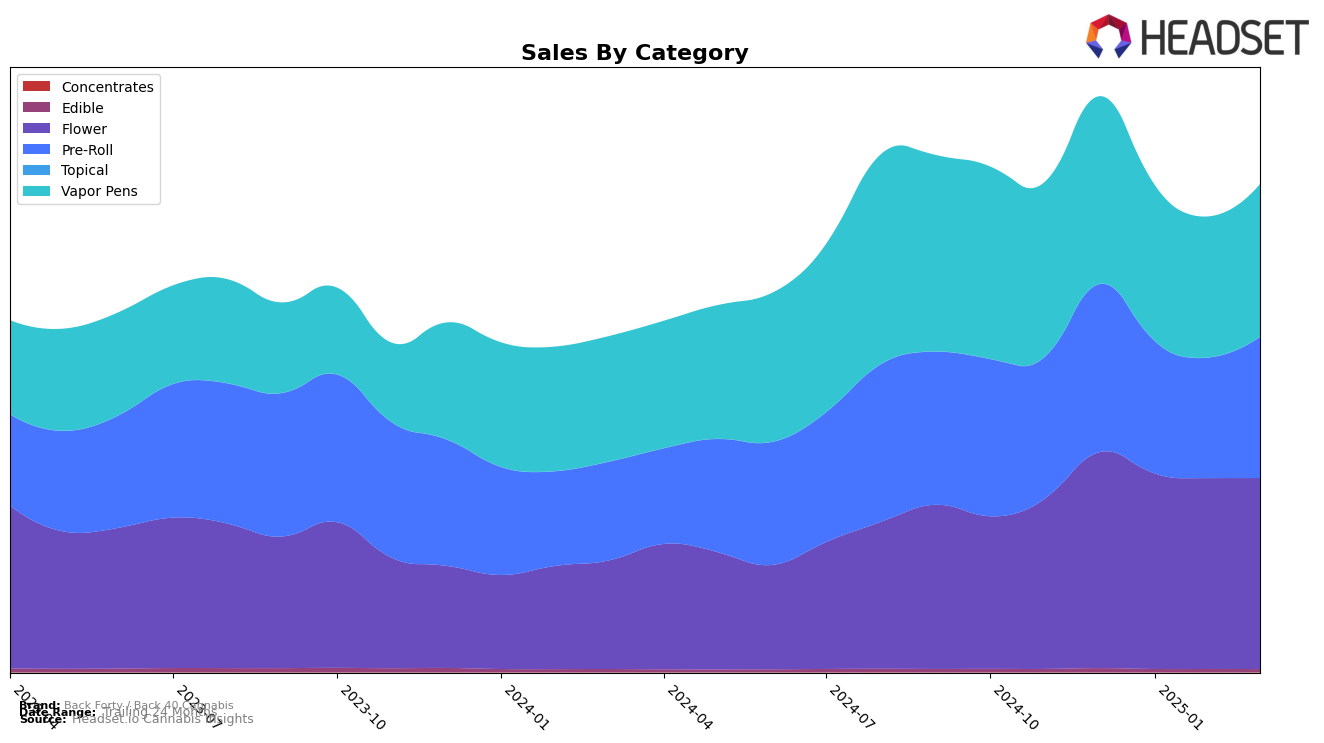

Back Forty / Back 40 Cannabis has demonstrated a strong presence in the Canadian cannabis market, particularly in the Ontario region. In the Flower category, the brand consistently held the top position from January to March 2025, indicating a dominant market presence. Similarly, in the Vapor Pens category in Ontario, Back Forty maintained its number one ranking throughout the same period, underscoring its strong brand loyalty and product appeal in this segment. However, in the Alberta market, while the brand started the year strong in the Flower category, it experienced a slight dip from the first position in December 2024 to the second position by March 2025. This movement suggests a competitive landscape where maintaining the top spot requires constant innovation and customer engagement.

In British Columbia, Back Forty / Back 40 Cannabis showed notable improvement in the Flower category, moving from the 14th position in December 2024 to an impressive 5th place by February 2025, before slightly declining to 8th in March. This fluctuation highlights the dynamic nature of consumer preferences and the importance of strategic positioning. Conversely, in the Alberta market for Vapor Pens, the brand's rank dropped from 4th to 6th by March 2025, suggesting potential challenges in maintaining its market share within this category. Notably, in Saskatchewan, the brand's absence from the top 30 rankings post-December 2024 in the Vapor Pens category signals a potential area for growth or reevaluation of market strategies.

Competitive Landscape

In the competitive landscape of the Ontario flower category, Back Forty / Back 40 Cannabis has demonstrated a remarkable ascent in the rankings, securing the top position from January to March 2025. This is a significant improvement from its third-place ranking in December 2024. This upward trajectory is indicative of Back Forty / Back 40 Cannabis's growing market presence and consumer preference, likely driven by strategic marketing and product quality enhancements. In contrast, Shred, which held the top spot in December 2024, slipped to the second position from January onwards, suggesting a shift in consumer loyalty or competitive pricing strategies by Back Forty / Back 40 Cannabis. Meanwhile, Spinach maintained a steady third-place ranking from January to March 2025, highlighting a stable yet less aggressive growth compared to its competitors. The consistent top ranking of Back Forty / Back 40 Cannabis in the first quarter of 2025 underscores its dominance and potential for continued leadership in the Ontario flower market.

Notable Products

In March 2025, Back Forty / Back 40 Cannabis saw Lemon Diesel Pre-Roll 10-Pack (3.5g) rise to the top position, becoming the best-selling product with sales of 35,245 units. Liquid Imagination Pre-Roll 10-Pack (3.5g), which held the top spot in the previous two months, slipped to second place. Wedding Pie Pre-Roll 10-Pack (3.5g) maintained a strong presence, ranking third, despite a consistent decline from its initial first-place position in December 2024. Peach Lemonade Distillate Disposable (0.95g) and S'Mores Chocolates (10mg) retained their fourth and fifth positions, respectively, showing minor fluctuations in sales ranks over the past months. Overall, the Pre-Roll category dominated the top three spots, highlighting a strong consumer preference for these products in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.