Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

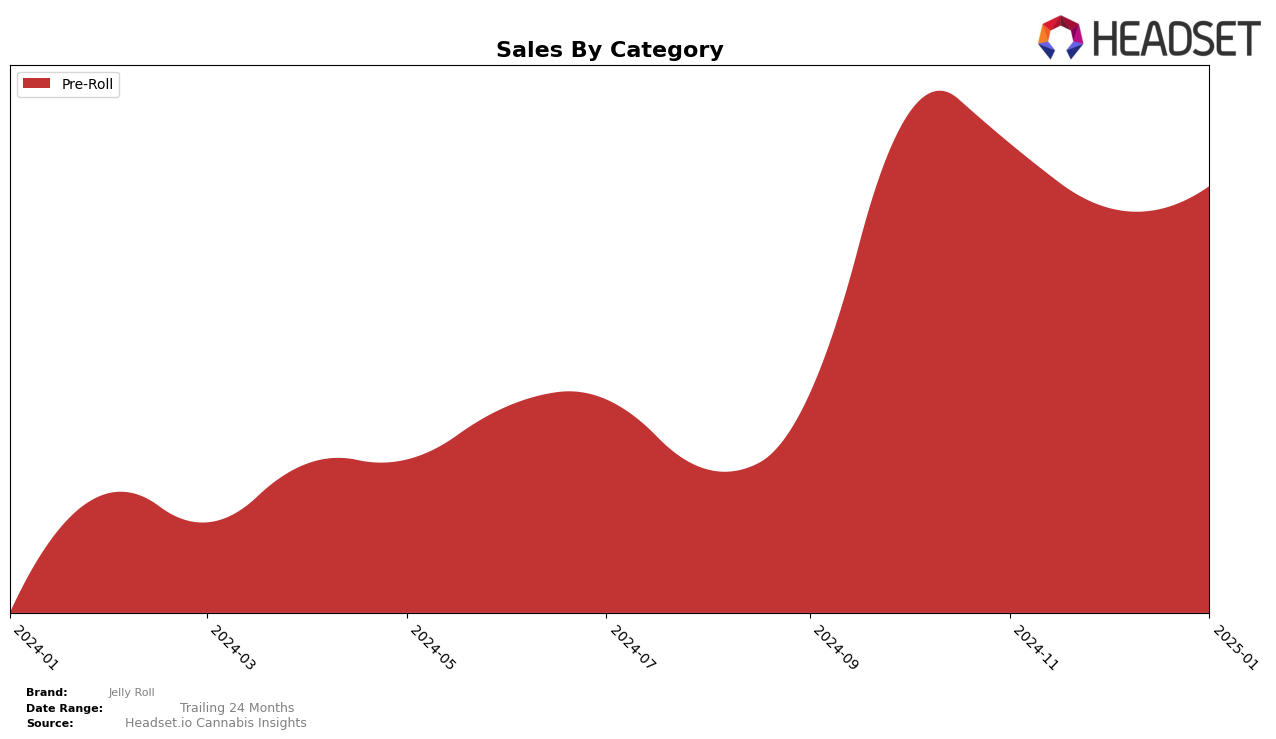

The performance of Jelly Roll in the Pre-Roll category within Missouri shows a consistent presence in the top 10 rankings over the past few months. Starting in October 2024, Jelly Roll maintained its 8th position for three consecutive months before climbing to 6th place in January 2025. This upward movement in rankings, despite a decrease in sales from October to December, suggests a strengthening market position or a potential shift in consumer preferences favoring Jelly Roll's offerings. The ability to improve rank while sales fluctuate indicates a strategic advantage or successful adaptation to market conditions.

However, it's notable that Jelly Roll does not appear in the top 30 rankings in any other state or category during this period, which could be seen as a limitation in their market reach or an opportunity for expansion. The absence from other states' rankings highlights a potential area for growth, especially if Jelly Roll can replicate its Missouri success in other markets. This focused presence in Missouri could imply a strong local brand loyalty or effective regional marketing strategies, but expanding beyond this single market could be crucial for long-term growth and stability.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, Jelly Roll has shown a notable upward trajectory in its ranking from October 2024 to January 2025. Initially positioned at 8th place in October 2024, Jelly Roll maintained this rank through December, before climbing to 6th place in January 2025. This improvement in rank is particularly significant given the fluctuating performances of its competitors. For instance, Amaze Cannabis experienced a decline from 4th to 7th place, while Elevate (Elevate Missouri) consistently held strong positions, peaking at 3rd place in November and December. Meanwhile, Sinse Cannabis improved its rank from 7th to 5th over the same period. Jelly Roll's sales figures, although lower than some top competitors, have demonstrated resilience and potential for growth, particularly as it surpassed Vivid (MO), which remained outside the top 6. This upward movement in rank suggests a strengthening market presence and potential for increased sales momentum in the Missouri pre-roll market.

Notable Products

In January 2025, the top-performing product for Jelly Roll was Cherry Infused Pre-Roll (1.1g), securing the number one rank with sales of $4,411. Grape Infused Pre-Roll (1.1g) followed closely in second place, dropping from its previous top position in December 2024. Peaches N Cream Infused Pre-Roll (1.1g) moved down to third place, continuing its descent from first in November 2024. Blue Razz Infused Pre-Roll (1g) maintained a consistent presence in the top four, despite not being ranked in December 2024. Watermelon Infused Pre-Roll 5-Pack (3.5g) entered the top five for the first time, indicating a successful launch or increased popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.