Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

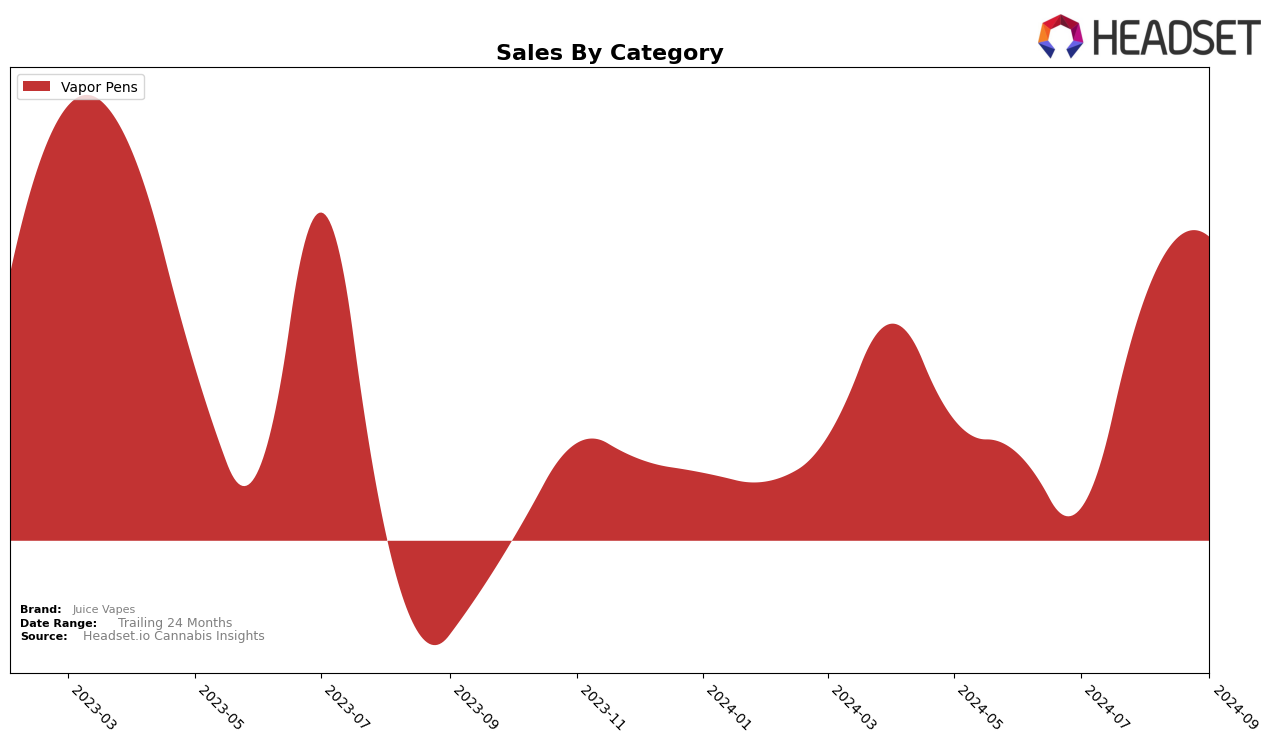

Juice Vapes has shown notable progress in the Vapor Pens category within the state of Missouri. Starting from a rank of 56 in June 2024, the brand has made a significant climb, reaching the 30th position by September 2024. This upward trajectory indicates a positive reception and growing market presence in Missouri, particularly noteworthy given the competitive nature of the vapor pen market. The leap from being outside the top 30 in earlier months to breaking into it by September is a testament to their strategic improvements or possibly new product offerings that have resonated well with consumers.

Despite the impressive gains in Missouri, Juice Vapes does not appear in the top 30 rankings for any other state or province across the same category and time period, suggesting that their market influence is currently concentrated in Missouri. This could be seen as both a challenge and an opportunity for the brand: while they have yet to establish a broader geographical footprint, the success in Missouri could serve as a blueprint for expansion into other regions. Such concentrated success might also reflect strategic market targeting, where resources are focused on areas with the highest growth potential or market receptivity.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Juice Vapes has shown a notable upward trajectory in rankings over the past few months, climbing from 56th in June 2024 to 30th by September 2024. This improvement in rank suggests a significant increase in market presence and consumer preference, likely driven by strategic marketing or product innovation. In contrast, Flora Farms experienced a decline, dropping out of the top 20 by August and reaching 29th in September, indicating potential challenges in maintaining market share. Meanwhile, Smokey River Cannabis and Franklin's have maintained relatively stable positions, with Franklin's slightly outperforming Smokey River Cannabis. Plume Cannabis (MO) consistently ranked higher than Juice Vapes, but the gap has been narrowing, highlighting Juice Vapes' potential to challenge top competitors in the Missouri vapor pen market.

Notable Products

In September 2024, the top-performing product for Juice Vapes was the Sour Mango Distillate Cartridge (1g) in the Vapor Pens category, which reclaimed the number one spot with impressive sales of 1089 units. The Pineapple Orange Distillate Cartridge (1g) followed closely, dropping to second place from its previous top rank in August. The Watermelon Mojito Distillate Cartridge (1g) made a notable entry into the rankings, securing the third position after being unranked in June and August. The Grape Distillate Cartridge (1g) debuted at fourth place, showing a solid performance. Meanwhile, the Honeydew Cucumber Distillate Cartridge (1g) maintained its fourth position from August, indicating consistent sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.