Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

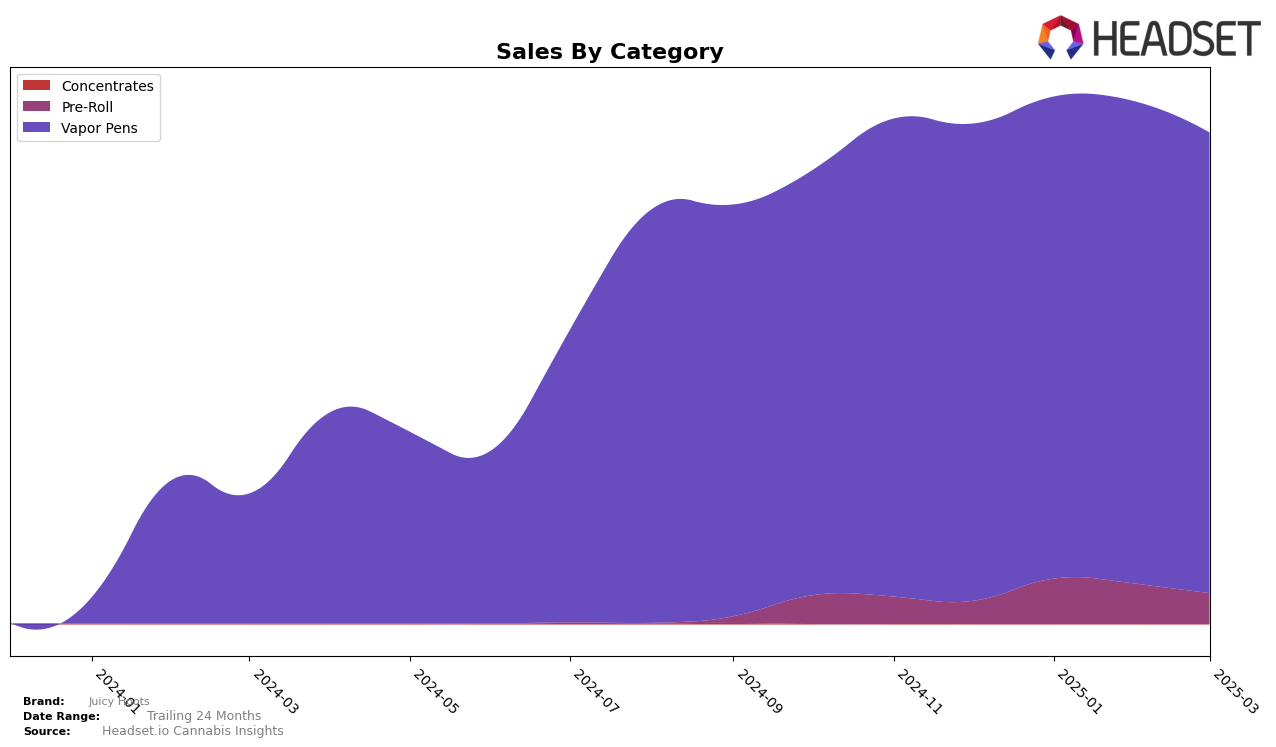

Juicy Hoots has shown a varied performance across different categories and regions. In the province of Alberta, the brand's presence in the Pre-Roll category is notably absent from the top 30 rankings, which might indicate a challenging market or a need for strategic adjustments. However, in the Vapor Pens category, Juicy Hoots has demonstrated a notable upward trajectory, moving from 72nd to 47th place by February 2025 before experiencing a slight dip to 67th in March. This fluctuation suggests a competitive landscape and potential for growth with the right market strategies.

In contrast, Juicy Hoots has maintained a consistent presence in the Vapor Pens category in Ontario, holding steady at 17th place for three consecutive months before a slight drop to 18th in March 2025. This consistency reflects a strong market position in Ontario, despite a gradual decrease in sales figures over the months. Meanwhile, in Saskatchewan, Juicy Hoots has made significant strides, climbing from 20th to 8th place in the same category, indicating a robust market penetration and growing consumer preference. Such movements underscore the brand's potential for expansion and highlight key areas for strategic focus.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Juicy Hoots has maintained a steady presence, consistently ranking 17th from December 2024 to February 2025, before slightly dropping to 18th in March 2025. This stability in rank is notable given the fluctuations observed among its competitors. For instance, Fuego Cannabis (Canada) experienced a decline from 14th to 16th place over the same period, while The Loud Plug improved its position from 21st to 17th. Despite the competitive pressure, Juicy Hoots' sales trajectory has shown a downward trend, mirroring the broader market challenges. However, it remains ahead of 1964 Supply Co, which fluctuated between 18th and 20th place, and Versus, which dropped to 19th in March 2025. This analysis highlights the importance for Juicy Hoots to strategize on enhancing its market share amidst dynamic shifts in competitor rankings and sales performance.

Notable Products

For March 2025, Juicy Hoots' top-performing product was the Double Melon Gulp Mochi CO2 Cartridge in the Vapor Pens category, maintaining its first-place position consistently over the past four months with sales of 5183 units. The Double Blue Cherry Co2 Cartridge also held steady in second place, though it experienced a decline in sales compared to previous months. Following closely, the Double Berry Punch Co2 Cartridge remained in third place, showing a slight increase in sales from February. The Double Yuzu Splash Boba Co2 Cartridge consistently held the fourth position, but its sales showed a downward trend. The Sour Strawberry and Grape Flip Distillate Disposable continued to rank fifth, with a modest increase in sales from February to March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.