Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

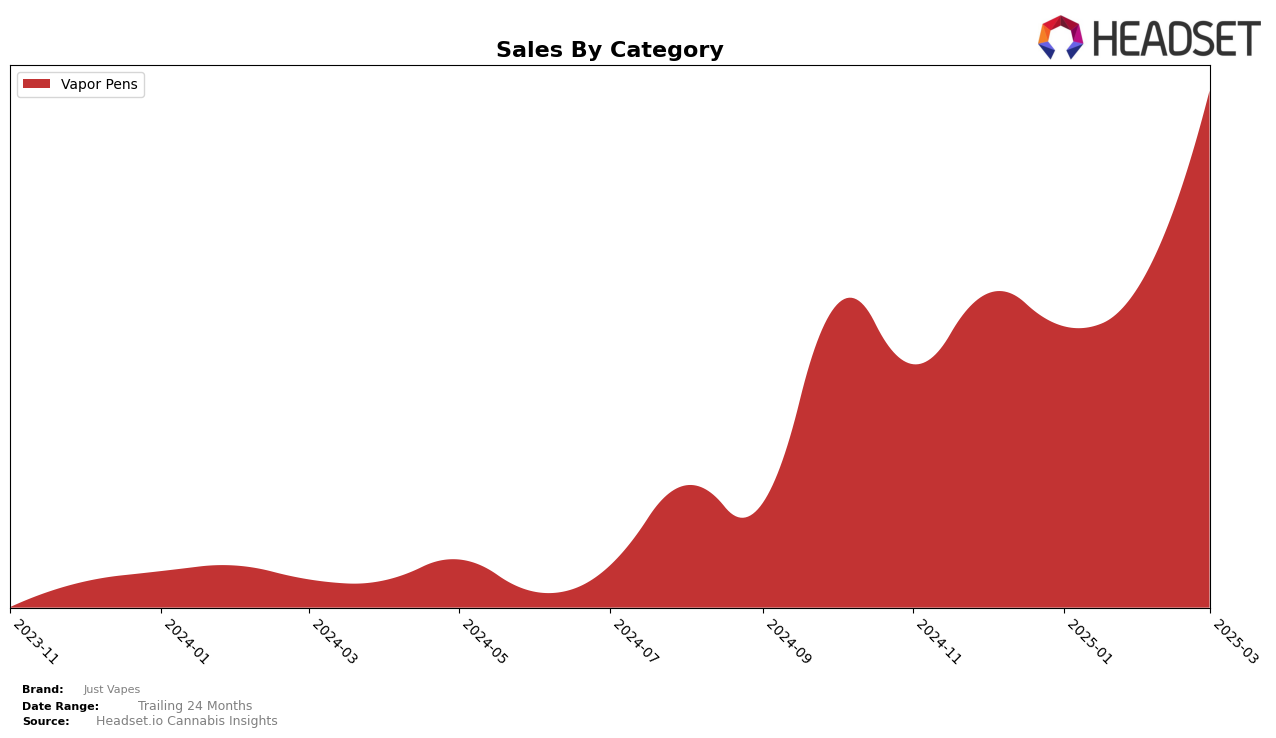

In the Massachusetts market, Just Vapes has experienced fluctuations in its ranking within the Vapor Pens category. Starting from a 39th position in December 2024, the brand's ranking slipped to 42nd in January 2025 and further down to 47th in February, before recovering slightly to 44th in March. This movement indicates a challenging period for the brand in Massachusetts, as it consistently remained outside the top 30, suggesting potential difficulties in maintaining a competitive edge in this specific market. The sales figures reflect a similar trend, showing a decline from December to February, with a slight uptick in March, hinting at a possible stabilization or recovery phase.

In contrast, the performance of Just Vapes in Maryland tells a more positive story. The brand's ranking in the Vapor Pens category improved significantly from 40th in December 2024 to 23rd by March 2025. This upward trajectory suggests a strengthening market presence and increasing consumer interest in Maryland. The sales figures in Maryland align with this positive trend, showing a substantial increase from January to March, indicating robust growth. This performance may highlight successful strategic initiatives or favorable market conditions that have benefited Just Vapes in Maryland, distinguishing it from its performance in Massachusetts.

Competitive Landscape

In the Maryland vapor pens category, Just Vapes has demonstrated a noteworthy upward trajectory in recent months. Starting from a rank of 40 in December 2024, Just Vapes improved significantly to reach the 23rd position by March 2025. This rise is indicative of a strategic shift or successful marketing efforts, especially when compared to competitors like District Cannabis, which maintained a relatively stable rank around the mid-20s, and Equity Extracts, which fluctuated but ended strong at rank 20. Notably, Blink consistently outperformed Just Vapes, holding a steady position around the 21st rank, suggesting a competitive edge in brand loyalty or product differentiation. Meanwhile, Grass showed less stability, with ranks varying between 25 and 30, highlighting potential volatility in their market presence. This competitive landscape suggests that while Just Vapes is gaining ground, there remains a significant gap to close with the top-tier brands in Maryland's vapor pen market.

Notable Products

In March 2025, Just Vapes' top-performing product was Bubba Haze Distillate Cartridge (1g) in the Vapor Pens category, maintaining its leading position from January. Strawberry Cough Distillate Cartridge (1g) followed closely as the second-ranking product, showing consistent performance since January. Blueberry Dream Distillate Cartridge (1g) ranked third, a drop from its top position in February, with sales figures reaching 882 units. Cotton Candy Kush Distillate Cartridge (1g) entered the rankings for the first time, securing the fourth position. Blackberry Kush Distillate Cartridge (1g) remained steady at fifth place, improving its sales from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.