Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

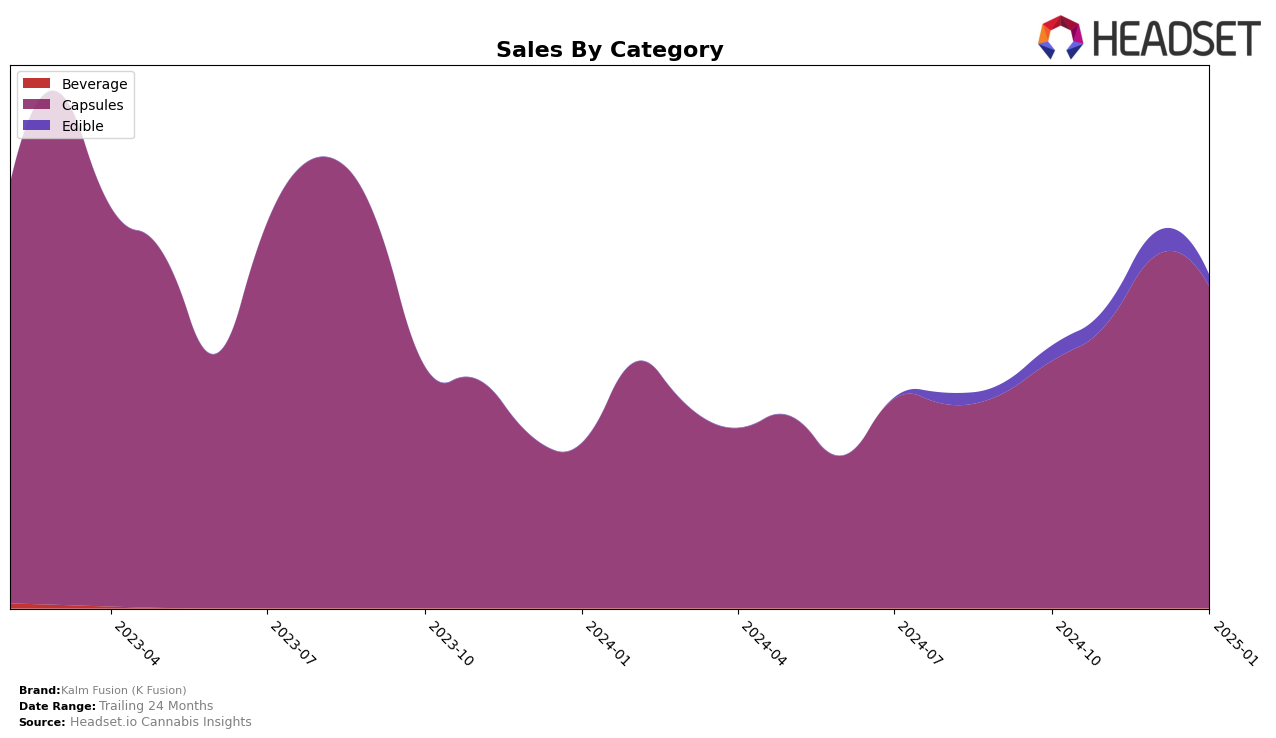

Kalm Fusion (K Fusion) has demonstrated a strong presence in the Capsules category across several states, with notable performances in both Illinois and Massachusetts. In Illinois, the brand has maintained a steady position, ranking consistently at number 5 from November 2024 through January 2025, reflecting a solid market presence and consumer preference. The brand's sales trajectory in Illinois shows a significant upward trend, with sales figures nearly doubling from October 2024 to January 2025. Meanwhile, in Massachusetts, Kalm Fusion has secured the second spot consistently over the same period, suggesting a strong foothold and possibly a loyal customer base in this state. It's worth noting that the brand's performance in Massachusetts, while stable in ranking, saw a peak in December 2024 before a slight dip in January 2025.

In contrast, Kalm Fusion's performance in Maryland presents a different picture. The brand held the 7th position in the Capsules category from October to December 2024, but it did not make it into the top 30 by January 2025. This drop could indicate increased competition or a shift in consumer preferences within the state. The sales figures in Maryland also reflect a downward trend, decreasing from October to December 2024. This decline in sales and ranking suggests challenges that Kalm Fusion may need to address to regain its position. The contrasting performances across these states highlight the varying market dynamics and consumer behaviors that Kalm Fusion navigates in its operations.

Competitive Landscape

In the competitive landscape of the capsules category in Illinois, Kalm Fusion (K Fusion) has demonstrated a notable upward trajectory in its market positioning. From October 2024 to January 2025, Kalm Fusion (K Fusion) improved its rank from 7th to 5th, maintaining this position through the subsequent months. This positive shift is indicative of a strategic gain in market share, likely driven by increased consumer preference or effective marketing strategies. In contrast, Remedi experienced a decline, moving from 5th to 6th place, suggesting potential challenges in sustaining its market presence. Meanwhile, Breez and Pure Essentials maintained their stable positions at 4th and 3rd, respectively, indicating consistent performance. Despite Kalm Fusion (K Fusion)'s advancements, it still trails behind these competitors in terms of rank, highlighting opportunities for further growth and competitive strategies to climb higher in the rankings.

Notable Products

In January 2025, Kalm Fusion's top-performing product was the CBD/THC 1:1 Black Cherry Chewable Tablets 20-Pack, maintaining its number one rank from previous months, with sales reaching 1,388 units. The Pineapple Chewable Tablets 20-Pack climbed to the second position, overtaking the Blue Mint Chewable Tablets, which settled at third place. The CBD/THC 1:1 Fruit Punch Chewable Tablets dropped to fourth, reflecting a significant decrease in sales compared to December. Orange Cream Chewable Tablets remained stable, holding the fifth position consistently over the months. Notably, the top two products in January saw an increase in sales, while the others experienced a decline compared to December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.