Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

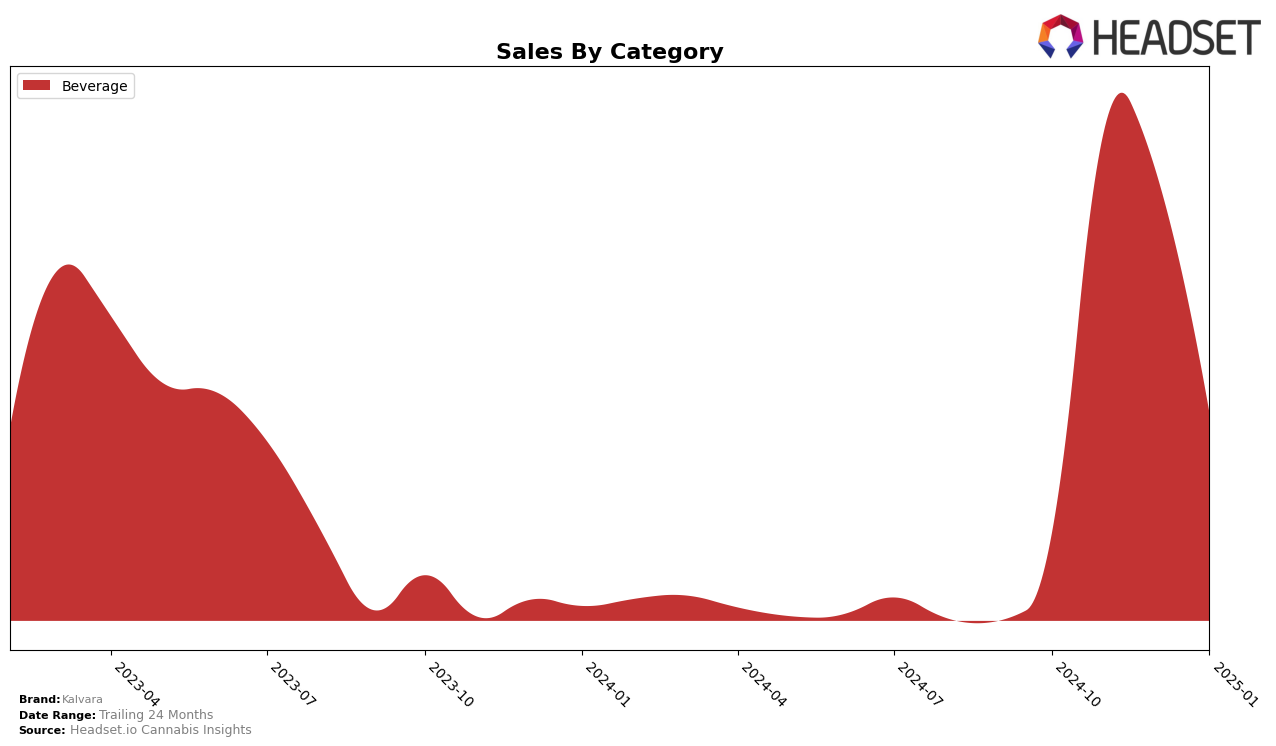

Kalvara's performance in the beverage category across different regions has shown interesting trends in recent months. In Alberta, Kalvara made its presence felt by securing the 16th position in November 2024 and slightly dropping to 17th in December 2024. However, it is noteworthy that Kalvara did not appear in the top 30 brands in October 2024, which could be seen as a positive development indicating growth and increased market penetration over time. The brand's sales trajectory in Alberta also reveals a decline from October to November, suggesting potential challenges or increased competition in the market.

The absence of Kalvara from the top 30 rankings in other states or provinces during the analyzed period suggests that the brand might be focusing its efforts or experiencing more success in specific markets like Alberta. This could imply strategic regional investments or varying consumer preferences across different locations. While the data hint at some challenges, particularly with maintaining or improving rankings consistently, the movement into the top 20 in Alberta is a promising sign of potential for further growth. The dynamics of Kalvara's performance across categories and regions offer a glimpse into their market strategies and the competitive landscape they navigate.

```Competitive Landscape

In the competitive landscape of cannabis beverages in Alberta, Kalvara has experienced a dynamic shift in its market position over recent months. After not ranking in the top 20 in October 2024, Kalvara entered the scene at 16th place in November 2024 and slightly dropped to 17th in December 2024. This movement reflects a competitive market where brands like 7 Acres and Vacay also show fluctuations, with Vacay sharing the 17th spot in November. Meanwhile, Palmetto maintains a strong position, having ranked 13th in October 2024, indicating a significant sales lead over Kalvara. The emergence of Astro Lab in January 2025 at 15th place further intensifies the competition. These shifts suggest a volatile market where Kalvara must strategically navigate to enhance its ranking and sales performance amidst strong competitors.

Notable Products

In January 2025, the top-performing product for Kalvara was the CBD:THC 1:1 Berry Chill Cocktail, which climbed to the number one rank from the second position in December 2024, achieving sales of 424 units. The CBD:THC 1:1 Orange Mango Chill Beverage, which held the top spot in December, slipped to second place with a notable decrease in sales. The Tropical Inspire Cocktail rose to the third rank, maintaining a consistent upward trend from its fourth position in the previous months. The CBD:THC 2:1 Pomegranate Chill Beverage experienced a drop to fourth place after leading in October and November, indicating a significant decline in its sales trajectory. Lastly, the THC Citrus Beverage remained steady at the fifth rank, showing minimal changes in its performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.