Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

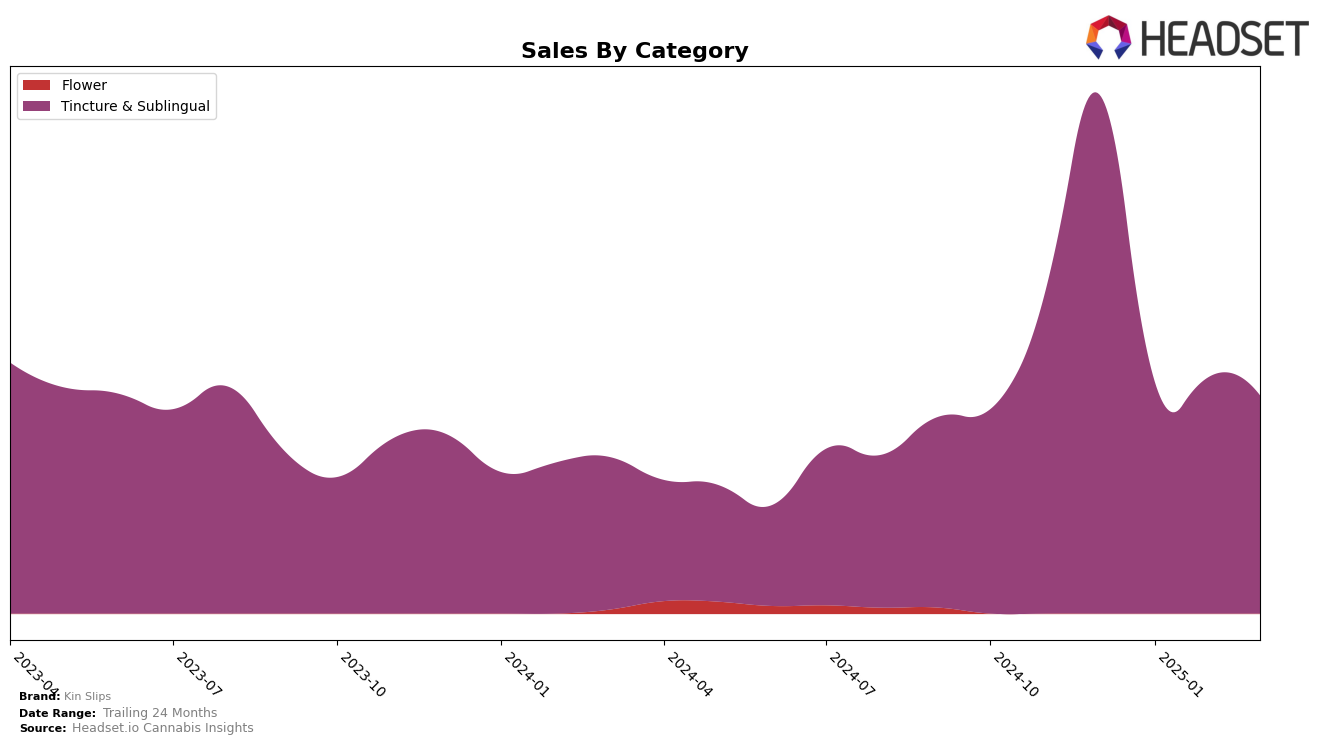

Kin Slips has maintained a strong presence in the Tincture & Sublingual category across several Canadian provinces. In Ontario, Kin Slips consistently held the top position from December 2024 through March 2025, showcasing their dominance in the market. Despite a decline in sales from December to March, their ability to retain the number one rank indicates a strong brand loyalty or limited competition. Meanwhile, in Alberta, Kin Slips experienced fluctuations, dropping to the second position in January and February 2025 before reclaiming the top spot in March. This suggests a competitive landscape where Kin Slips managed to regain momentum after a brief dip in rankings.

In Saskatchewan, Kin Slips was ranked first in December 2024, but data for subsequent months is missing, indicating that the brand did not remain in the top 30 in this category. This absence could point to either a strategic withdrawal or increased competition that affected their ranking. The varying performance across these provinces highlights the different market dynamics and competitive pressures Kin Slips faces. While they have managed to secure a stronghold in some areas, maintaining or improving their position in others remains a challenge. These insights provide a glimpse into the brand's regional strengths and areas for potential growth.

Competitive Landscape

In the Ontario Tincture & Sublingual category, Kin Slips has consistently maintained its top position from December 2024 through March 2025, indicating a strong brand presence and customer loyalty. This stability is noteworthy, especially when compared to competitors like Dosist and 1906, which have experienced fluctuations in their rankings, often falling out of the top 20. While Kin Slips' sales have seen a slight decline over the months, their ability to hold the number one rank suggests a robust market strategy and a loyal consumer base. This contrasts with the broader market trend where other brands have struggled to maintain consistent sales and rankings, highlighting Kin Slips' competitive edge in the Ontario market.

```

Notable Products

In March 2025, the top-performing product from Kin Slips was the Cloud Buster Sublingual Strip 10-Pack (100mg) in the Tincture & Sublingual category, maintaining its number one rank consistently from December 2024 with sales of 1782 units. The Float On Balance & Tranquility Sublingual Strip 10-Pack (100mg) held steady in second place, although its sales figures have decreased since December 2024. The CBD/CBN 1:1 Shut Eye Sublingual Strip 10-Pack (50mg CBD, 50mg CBN) moved up to third place, showing a slight improvement in rank from previous months. Meanwhile, the CBD/THC 10:1 Park Life Comfort & Relief Sublingual Strips 10-Pack dropped to fourth place, reflecting a decline in sales compared to previous months. The CBD/CBN/THC 1:1:1 Shut Eye Sublingual Strip 10-Pack (50mg CBD, 50mg CBN, 50mg THC) remained in fifth place, with minimal changes in its sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.