Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

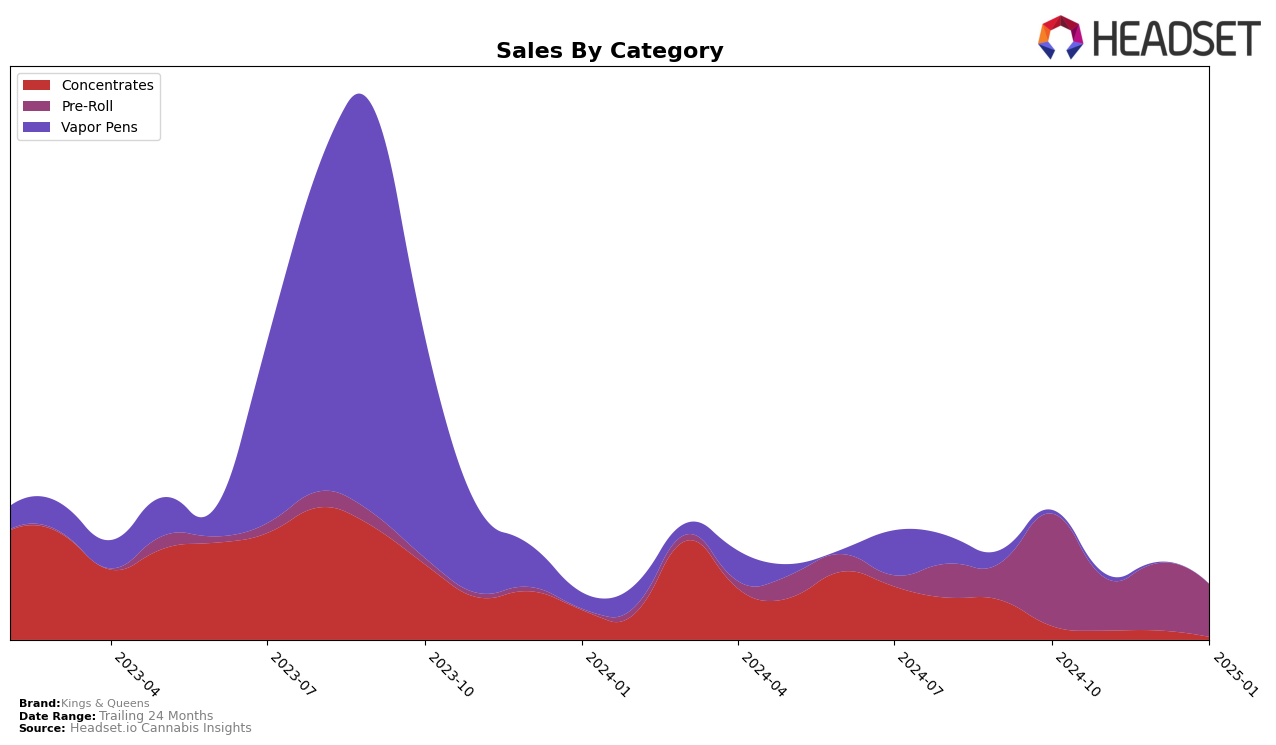

In the state of Maryland, Kings & Queens experienced fluctuating performance in the Pre-Roll category over the last few months. The brand was ranked 29th in October 2024, but dropped out of the top 30 in November and December 2024, before maintaining a position outside the top 30 in January 2025. This indicates a challenge in sustaining their market presence in this category within Maryland. The sales figures reflect this volatility, with a notable decrease from October to November, followed by a slight recovery in December, before dropping again in January. This pattern suggests that while there was some attempt to regain traction, consistent ranking within the top 30 remains elusive for Kings & Queens in Maryland's Pre-Roll market.

Across other states and categories, Kings & Queens' performance varies, highlighting both opportunities and challenges. The absence of a top 30 ranking in months where data is missing could be a point of concern, as it may indicate underperformance or strong competition in those markets. For brands like Kings & Queens, understanding these dynamics is crucial for strategizing future growth and improving market share. While specific sales numbers are not disclosed here, the directional trends provide a clear picture of the brand's current standing and areas that may require strategic focus. Observing these movements can offer insights into market conditions and competitive pressures, which are critical for making informed business decisions.

Competitive Landscape

In the competitive landscape of the Maryland pre-roll category, Kings & Queens experienced fluctuating ranks from October 2024 to January 2025, indicating a volatile market position. Starting at rank 29 in October 2024, Kings & Queens saw a decline to rank 36 in November, a slight recovery to rank 34 in December, and a return to rank 36 in January 2025. This variability suggests challenges in maintaining consistent market traction. Notably, Beezle Extracts showed a stable yet competitive presence, with ranks hovering in the low 30s, and a notable sales increase in January 2025, potentially drawing customers away from Kings & Queens. Meanwhile, Eden Solventless displayed a positive sales trajectory, climbing from rank 39 in October to 34 in January, possibly indicating a growing consumer preference for their offerings. The data suggests that Kings & Queens may need to strategize to address these competitive pressures and stabilize their market position in Maryland's pre-roll segment.

Notable Products

In January 2025, Gorilla Glue Infused Pre-Roll (1.5g) maintained its position as the top-performing product for Kings & Queens, with sales reaching 313 units. Following closely, Strawberry Cough Infused Pre-Roll (1.5g) held steady at the second rank, despite a slight dip in sales compared to the previous months. Pink Passionfruit Infused Pre-Roll (1.5g) rose to third place, showcasing a notable increase in popularity since it was unranked in December 2024. Duct Tape Infused Pre-Roll (1.5g) remained consistent at the fourth position, while Ultimate Purple Infused Pre-Roll (1.5g) retained the fifth spot, experiencing a gradual decline in sales over the months. The rankings indicate a stable preference for infused pre-rolls, with minor shifts in consumer preference among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.