Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

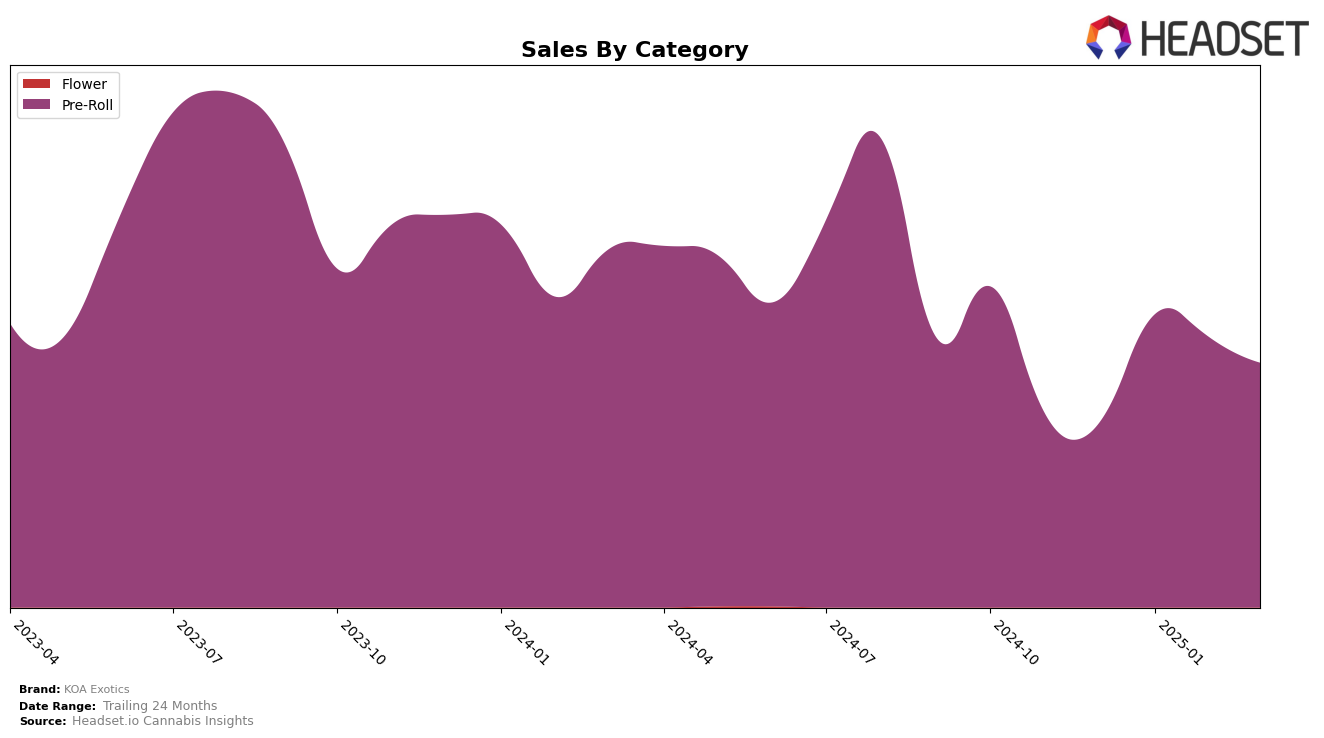

KOA Exotics has demonstrated varying performance across different states and categories, with notable fluctuations in rankings. In California, the brand's presence in the Pre-Roll category has seen a decline, with rankings slipping from 55th in December 2024 to 71st by March 2025. This downward trend is accompanied by a consistent decrease in sales figures over the same period. In contrast, their performance in New York has been more favorable. After starting outside the top 30 in December 2024, KOA Exotics made a significant leap to 21st place in January 2025, maintaining a solid position in the top 25 through March 2025, indicating a strong foothold in the New York market.

The contrasting performance of KOA Exotics in these two states underscores the importance of regional market dynamics. While the brand struggled to maintain its ranking in California's competitive Pre-Roll segment, its success in New York highlights the potential for growth in markets where they can achieve a higher penetration. The absence of top 30 rankings in other states or categories suggests areas where KOA Exotics may need to focus on strategic improvements or marketing efforts to enhance their visibility and market share. These insights can be crucial for stakeholders looking to understand the brand's trajectory and potential areas for expansion.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, KOA Exotics has demonstrated a remarkable upward trajectory in brand ranking and sales performance. Starting from a rank of 61 in December 2024, KOA Exotics surged to 21 in January and February 2025, before slightly dropping to 25 in March 2025. This significant improvement in rank is indicative of a strong market presence and growing consumer preference. In comparison, brands like Dogwalkers experienced a decline, moving from rank 13 in December 2024 to 22 by March 2025, while CRU Cannabis and P3 maintained relatively stable positions, with CRU Cannabis not breaking into the top 20. The consistent sales growth of KOA Exotics, despite a slight dip in March, contrasts with the fluctuating sales of competitors like To The Moon, which saw a notable decline from December to February. KOA Exotics' ability to climb the ranks and sustain sales momentum in a competitive market underscores its potential for continued success and market share expansion.

Notable Products

In March 2025, KOA Exotics' top-performing product was the Apples and Bananas Live Resin Infused Pre-Roll 10-Pack (3.5g) in the Pre-Roll category, maintaining its leading position from February with sales of 1,529 units. The Orange Lime Sorbet Live Resin Infused Pre-Roll 10-Pack (3.5g) secured the second rank, showing a notable entry into the top rankings for March. Pound Town Diamond Infused Pre-Roll 10-Pack (3.5g) improved its position to third place from fourth in February, demonstrating a positive trend in sales. Meanwhile, Vanilla Latte Live Resin Infused Pre-Roll 10-Pack (3.5g) dropped to fourth, having previously ranked third in February. Lastly, the Italian Ice Live Resin Infused Pre-Roll 10-Pack (3.5g) made its debut in the top five, ranking fifth for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.