Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

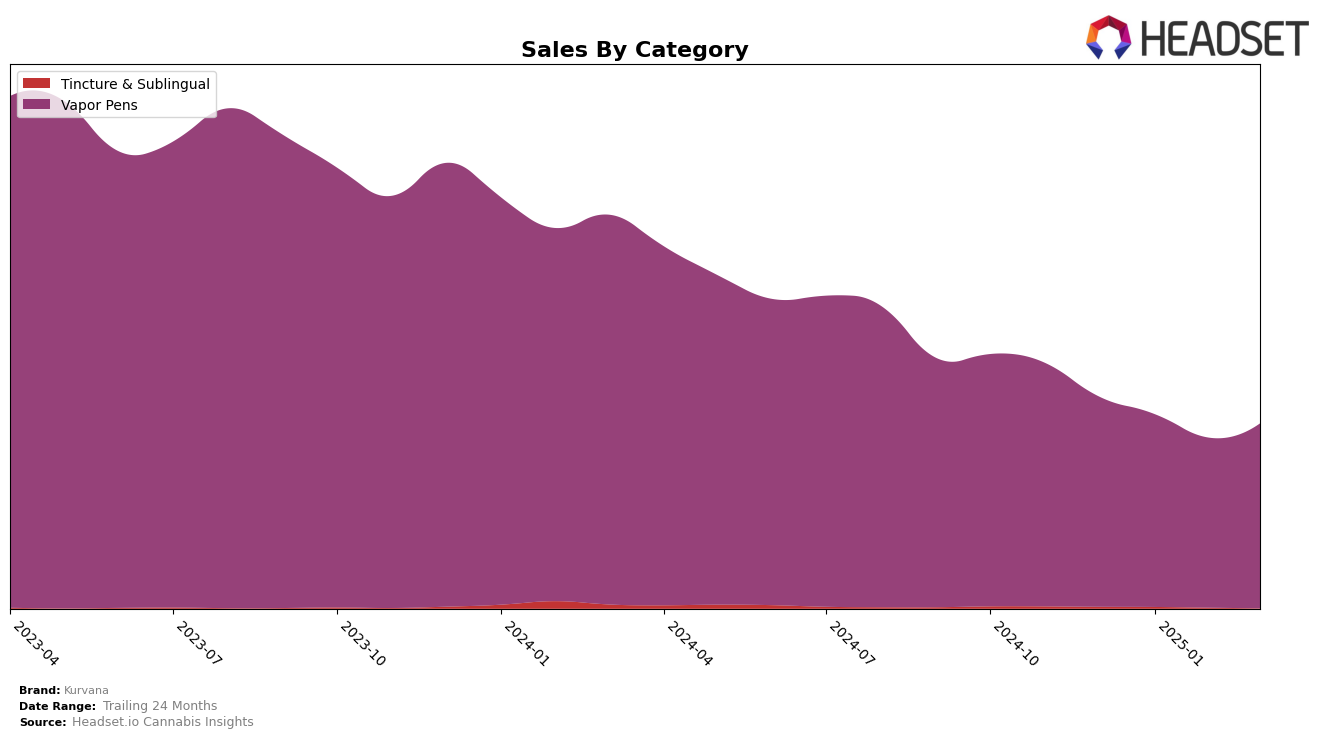

Kurvana's performance in the Vapor Pens category in California shows a consistent presence within the top 30 brands, maintaining its position from December 2024 through March 2025. The brand started at rank 21 in December and saw a slight dip to rank 22 in both January and February, before improving to rank 20 in March. This upward movement in March suggests a positive trend, indicating a potential recovery or strategic improvement in their market approach. Despite the fluctuations in rankings, Kurvana's ability to remain in the top 30 highlights its resilience and brand recognition within the competitive California market.

While Kurvana has managed to hold its ground in California, it is notable that it did not appear in the top 30 brands in other states or provinces during the same period. This absence could be perceived as a limitation in Kurvana's market penetration outside of California, suggesting room for growth and expansion. The sales figures also reflect a downward trend from December to February, with a slight rebound in March, indicating challenges in maintaining consistent sales volume. These insights provide a snapshot of Kurvana's market dynamics, where California remains a stronghold while other regions present opportunities for future growth.

Competitive Landscape

In the competitive landscape of vapor pens in California, Kurvana has experienced notable fluctuations in its rank and sales over the recent months. Despite not being in the top 20 brands from December 2024 to February 2025, Kurvana made a comeback in March 2025, securing the 20th position. This upward movement suggests a potential recovery in market presence. In contrast, ABX / AbsoluteXtracts maintained a relatively stable performance, consistently ranking between 18th and 19th, indicating a steady consumer base. Meanwhile, Papa's Herb showed a positive trend, climbing to 17th in February before settling at 18th in March, which may reflect effective marketing strategies or product offerings. Sauce Essentials and UP! also demonstrated dynamic shifts, with Sauce Essentials peaking at 20th in February and UP! improving its rank from 37th in December to 22nd in March. These movements highlight a competitive and evolving market where Kurvana's recent rank improvement could signal a strategic opportunity to enhance its market share further.

Notable Products

In March 2025, the top-performing product from Kurvana was the ASCND - Alien Kush Full Spectrum Cartridge (1g), which climbed to the number one spot in the Vapor Pens category, up from its second-place position in February. Following closely, the ASCND - Jet Fuel Full Spectrum Cartridge (1g) made a strong debut at second place with sales reaching 1245 units. The ASCND - Astro Queen Full Spectrum Cartridge (1g) maintained its third-place ranking from the previous month, showing consistent sales performance. The ASCND - Purple Punch Full Spectrum Cartridge (1g) dropped to fourth place, despite having led the category in December 2024. Lastly, the ASCND - Northern Lights Full Spectrum Cartridge (1g) saw a significant decline, falling from first place in February to fifth in March, with sales decreasing to 885 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.