Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

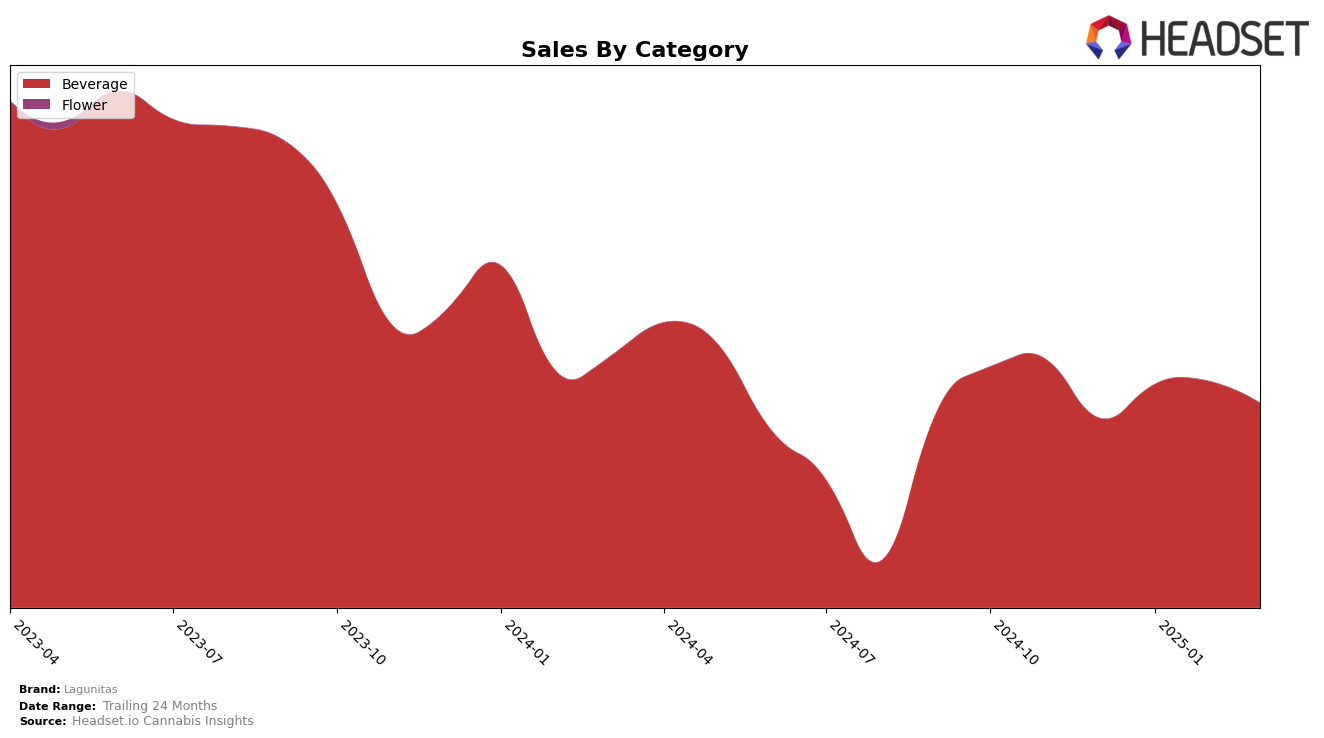

Lagunitas has consistently maintained its position as a top 10 brand in the Beverage category in California, holding steady at the 8th rank from December 2024 through March 2025. This consistency suggests a strong brand presence and customer loyalty within the state. Despite a slight dip in sales from February to March 2025, the brand's overall performance in California remains robust, indicating resilience in a competitive market. The stability in their ranking is a testament to their effective market strategies and product offerings that continue to resonate with consumers.

Interestingly, Lagunitas is not featured in the top 30 brands in other states or provinces for the Beverage category during this period. This absence could be interpreted as a potential area for growth or a strategic focus on their stronghold in California. The lack of presence in other markets might suggest opportunities for expansion or an indication of competitive challenges in those regions. Nonetheless, their consistent performance in California provides a solid foundation for potential growth strategies beyond their current geographical focus.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Lagunitas has consistently maintained its position at rank 8 from December 2024 through March 2025. Despite facing stiff competition, Lagunitas has demonstrated resilience, particularly against brands like Keef Cola and Lime, both of which have remained steady at rank 9 and 10 respectively during the same period. Notably, Pabst Labs has outperformed Lagunitas, holding a higher rank at 5 or 6, with sales figures significantly surpassing those of Lagunitas. Meanwhile, Almora Farms has consistently ranked just above Lagunitas at position 7. While Lagunitas experienced a dip in sales from February to March 2025, it still managed to maintain its rank, indicating a stable brand presence amidst fluctuating market dynamics. This stability suggests that Lagunitas has a loyal customer base, but there is potential for growth if it can capture market share from higher-ranked competitors.

Notable Products

In March 2025, the top-performing product for Lagunitas was HiFi Sessions Mango Sparkling Water (10mg THC, 12oz), maintaining its first-place rank from the previous three months, with sales of 3,266 units. Hi-Fi Sessions Hoppy Chill Sparkling Water (10mg THC, 12oz) held the second position, having dropped from its top spot in December 2024. The CBD/THC 1:1 Hoppy Balance Infused Sparkling Water (5mg CBD, 5mg THC, 12oz) ranked third, consistent with its February position but up from its third-place rank in January. The Hoppy Chill Sparkling Water 4-Pack (40mg) remained in fourth place, showing stability since its appearance in January 2025. Lastly, the Hoppy Chill Sparkling Water 10-Pack (100mg THC, 12oz) stayed in fifth place, reflecting a consistent performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.