Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

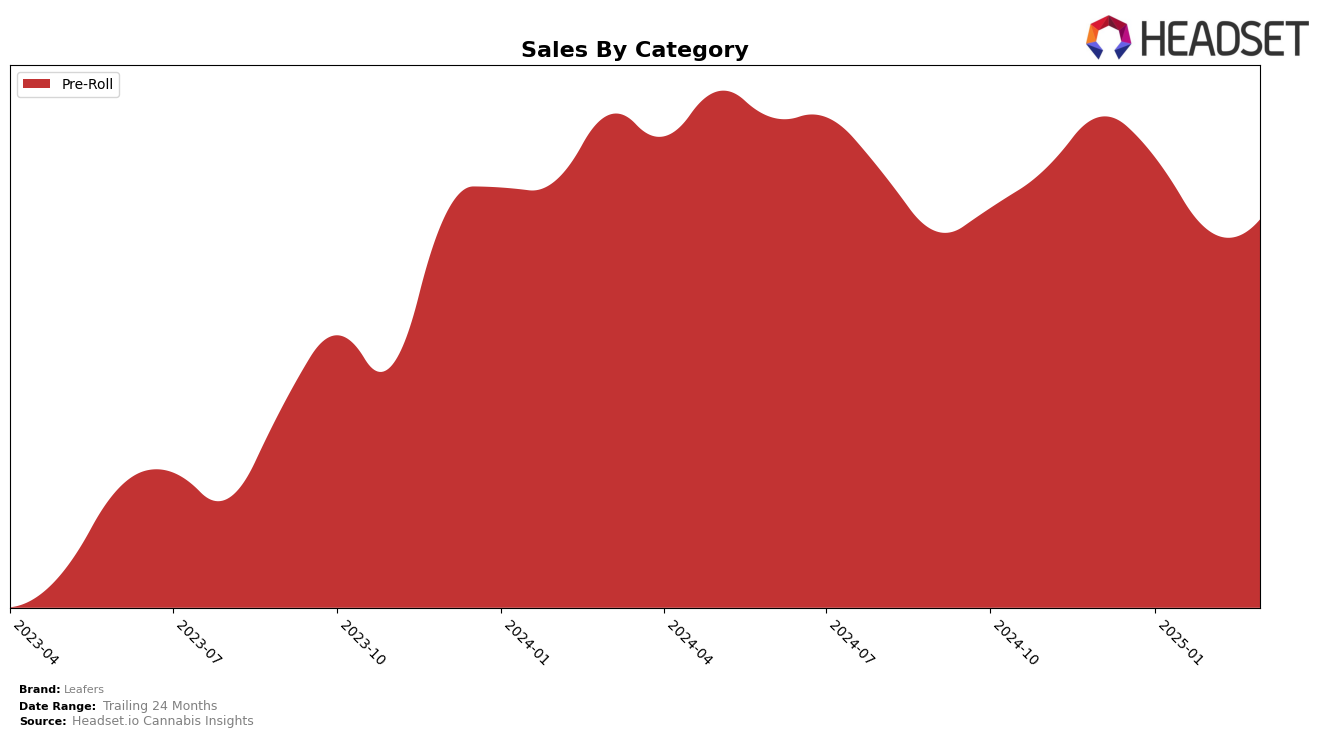

Leafers has demonstrated consistent performance in the Pre-Roll category within the state of Arizona. For the months of December 2024 through February 2025, Leafers maintained a strong position, ranking third. However, by March 2025, there was a slight dip as the brand moved to fourth place. This shift might indicate increased competition or changes in consumer preferences, but it remains noteworthy that Leafers stayed within the top five, highlighting its strong market presence. The decline in sales from December to February, followed by a slight recovery in March, suggests potential seasonal factors or strategic adjustments by the brand.

Interestingly, Leafers did not appear in the top 30 rankings for any other states or categories during this period. This absence could be seen as a limitation in their market penetration beyond Arizona or a strategic focus on a specific market segment. While the performance in Arizona is commendable, the lack of presence in other markets might suggest opportunities for expansion or a deeper focus on strengthening their standing in other states. The data provides a glimpse into Leafers' market strategy and performance, leaving room for further exploration into how they might capitalize on these insights moving forward.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, Leafers has experienced a notable shift in its market position from December 2024 to March 2025. Initially holding a solid 3rd rank, Leafers saw a decline to 4th place by March 2025. This change in rank is significant as it reflects a decrease in sales performance, particularly when compared to competitors like Cheech & Chong's, which improved its rank from 4th to 3rd over the same period. Meanwhile, STIIIZY maintained a strong and consistent 2nd place, indicating a stable market presence. Leafers' sales trajectory shows a downward trend from December 2024 to February 2025, with a slight recovery in March 2025, yet this was not enough to reclaim its previous rank. The competitive dynamics suggest that Leafers may need to innovate or adjust its marketing strategies to regain its former standing and counteract the upward momentum of its competitors.

Notable Products

In March 2025, the top-performing product from Leafers was the Exotic Blend Live Resin Diamond Infused Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, achieving the number one rank with sales of 5163. This product climbed from the fourth position in December 2024 to lead the sales in March. The Indica Blend Infused Live Resin Diamond Pre-Roll 3-Pack (1.5g) maintained strong performance, holding the second position, although it experienced a slight decline in sales from previous months. The Indica Blend Live Resin Diamond Infused Pre-Roll (1g) consistently ranked third in March, showing stability in its market position. Lastly, the Sativa Blend Live Resin Diamond Infused Pre-Roll 3-Pack (1.5g) remained in fourth place, marking a drop from its first-place rank in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.