Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

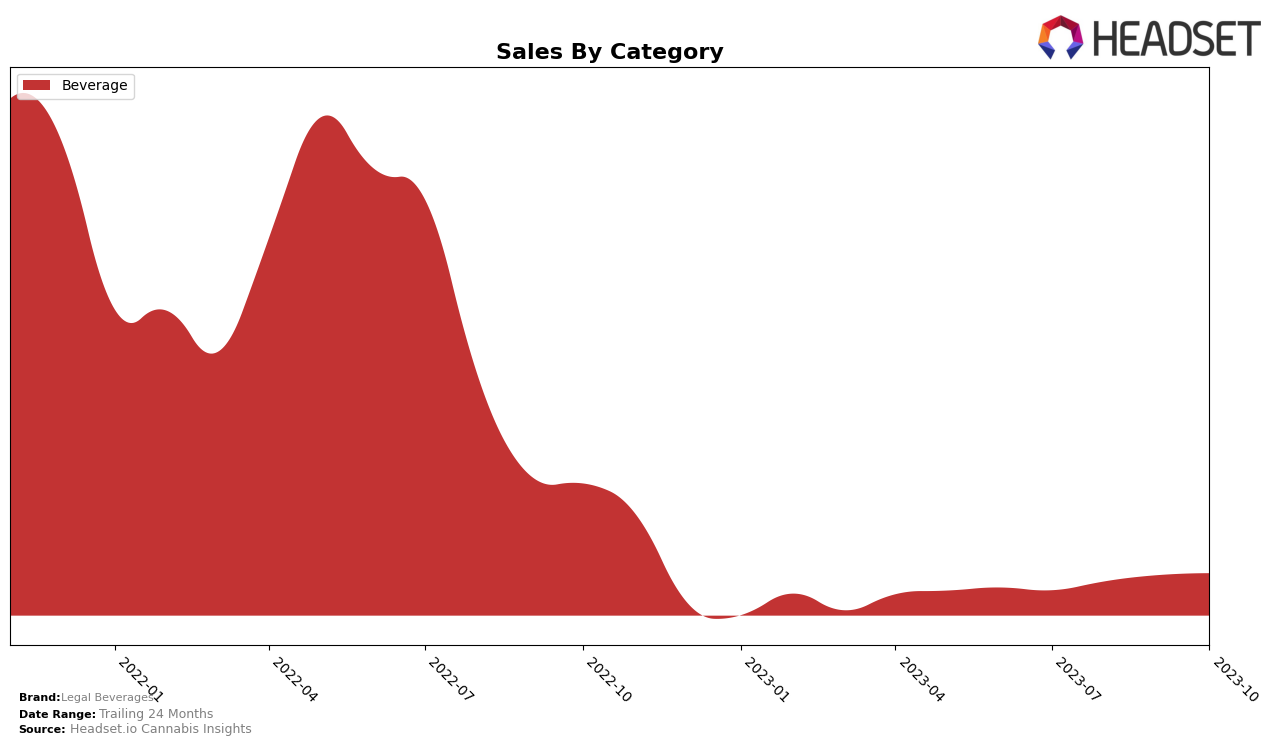

Legal Beverages, a prominent cannabis brand, has been steadily performing in the Beverage category in Washington. The brand has consistently made it to the top 20 brands in the state over the last four months. Starting at rank 20 in July 2023, Legal Beverages climbed up to rank 18 in August, further improved to rank 17 in September, before settling back to rank 18 in October. This shows a positive trend in the brand's performance, despite the minor dip in October. The brand's sales also saw an uptick over these months, which is a good indicator of its growing popularity.

However, it's important to note that while Legal Beverages has maintained its place in the top 20, it has not been able to break into the top 15. This suggests that while the brand is performing well, there is still room for improvement. The consistent presence in the top 20 and increasing sales figures demonstrate the brand's potential, but it will be interesting to see if Legal Beverages can further elevate its ranking in the coming months. This is something that stakeholders and interested parties should keep an eye on, as it could indicate the brand's future trajectory in the Washington cannabis market.

Competitive Landscape

In the beverage category within the Washington state cannabis market, Legal Beverages has shown a consistent presence in the top 20 brands over the period from July to October 2023. It has seen a slight improvement in its ranking, moving from 20th to 18th place, and maintaining a steady sales growth. Among its competitors, Fairwinds has experienced a decline, dropping from 17th to 20th place, while Olala has remained relatively stable, hovering around the 19th rank. Slab Mechanix and SipCool have consistently ranked higher than Legal Beverages, but their sales have shown a downward trend. This indicates that while Legal Beverages is not the leading brand, it has potential for growth and is holding its own in a competitive market.

Notable Products

In October 2023, the top-performing product from Legal Beverages was 'Cherry Lemonade (100mg, 11.5oz)', which held the first rank with sales figures reaching 109 units. The 'Indica Lemon Ginger Sparkling Tonic (100mg)' came in second, despite dropping from first place in September to second in October, with a total of 39 units sold. Third place was claimed by 'Blackberry Lemonade (100mg)', maintaining its rank from the previous month with 26 units sold.

The 'Sativa Pomegranate Sparkling Tonic (10mg)' made a comeback in the rankings after not being listed in the previous two months, securing the fourth position with 26 units sold. Finally, 'Indica Lemon Ginger Sparkling Tonic (10mg)' entered the rankings for the first time in October, taking the fifth spot with 22 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.