Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

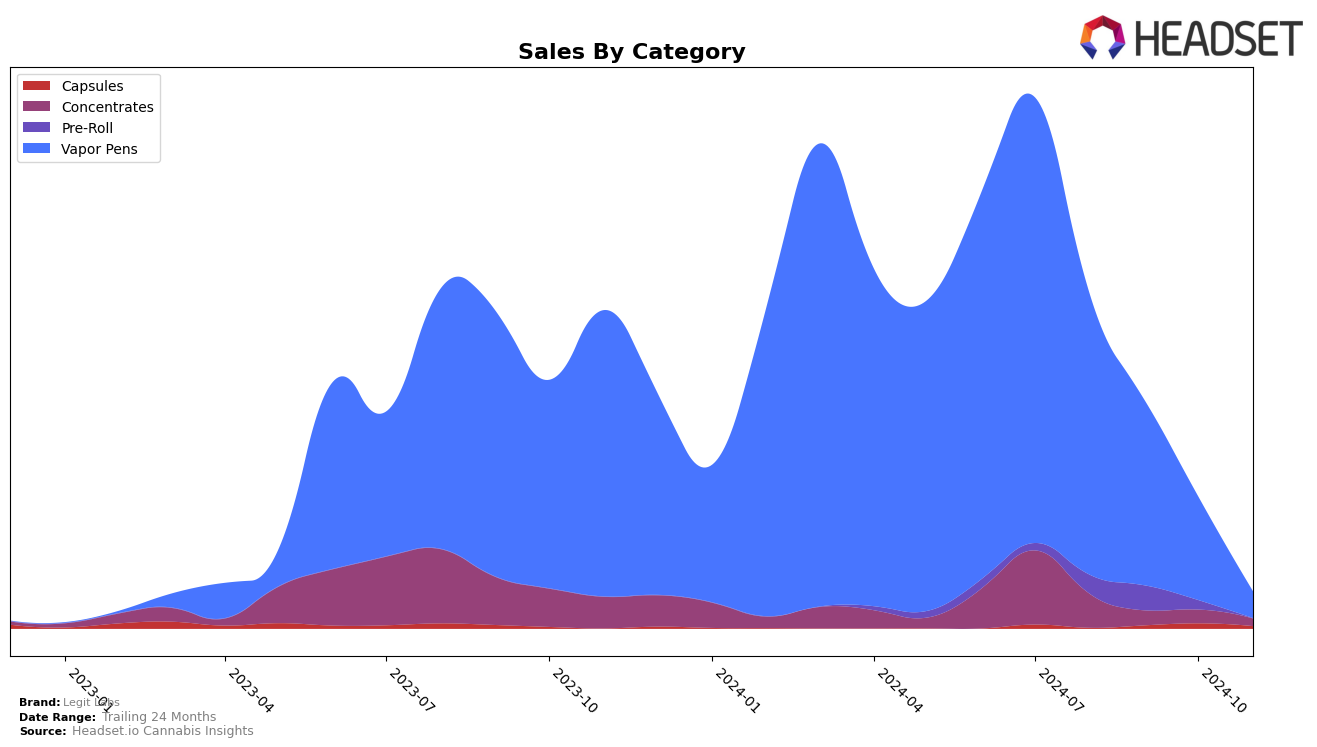

Legit Labs has experienced significant fluctuations in its performance across different categories and states. In the Vapor Pens category, the brand has seen a downward trend in Michigan, where it ranked 62nd in August 2024 and dropped to 90th by October 2024, eventually falling out of the top 30 by November. This movement suggests challenges in maintaining market share or possibly increased competition within the state. The absence of a ranking in November highlights a critical area for improvement for Legit Labs if they wish to regain their standing in this category.

While the decline in Michigan's Vapor Pens category is notable, the overall sales data reveals a broader trend of diminishing sales figures over the months, indicating potential issues with brand strategy or market conditions. The lack of a ranking in November could be seen as a setback, but it also presents an opportunity for Legit Labs to reassess and potentially pivot their approach to regain momentum. Understanding these dynamics can provide valuable insights for stakeholders looking to navigate the evolving cannabis market landscape.

```Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Legit Labs has experienced a notable decline in both rank and sales over the past few months. Starting in August 2024, Legit Labs was ranked 62nd, but by October, it had fallen to 90th, and by November, it was no longer in the top 20. This downward trend is mirrored in its sales figures, which have decreased significantly from August to November. In contrast, Gas Station has shown a positive trajectory, moving up from not being in the top 20 in August to 81st by October, with a corresponding increase in sales. Similarly, Cheech & Chong's entered the rankings at 53rd in October, indicating a strong market presence. These shifts suggest that Legit Labs may need to reassess its market strategy to regain its competitive edge in the Michigan vapor pen category.

Notable Products

In November 2024, the top-performing product from Legit Labs was Tropicana Cookies Cured Resin Disposable (1g) in the Vapor Pens category, securing the number one rank with notable sales of 173 units. Halle Berry Cured Resin Disposable (1g), also in the Vapor Pens category, maintained its second-place position from October, though its sales decreased to 124 units. Memory Loss Live Resin (1g) and Truffle Treats Flan Resin (1g), both in the Concentrates category, shared the third rank, indicating strong performance in this category. Canna Caps 10-Pack (100mg) in the Capsules category was ranked fourth, showcasing its entry into the top ranks. Overall, Vapor Pens dominated the top spots for Legit Labs, with consistent performance from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.