Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

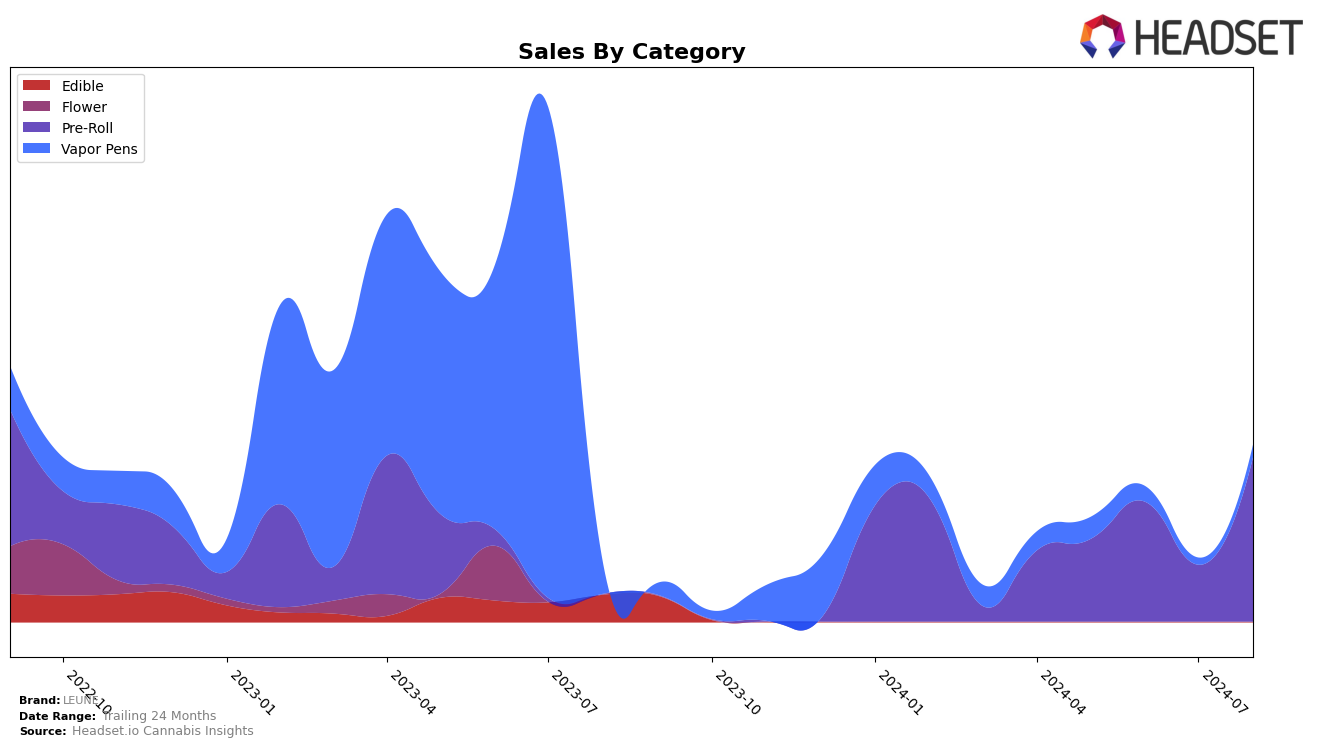

LEUNE has shown notable performance across various states and categories, with significant movements in rankings that highlight both opportunities and challenges. In Arizona, LEUNE's Pre-Roll category experienced a substantial rise in ranking from 60th in May 2024 to an impressive 25th by August 2024. This upward trajectory is bolstered by a marked increase in sales, which saw a notable jump from $17,016 in May to $64,815 in August. This positive movement suggests a growing consumer base and effective market strategies within the state. In contrast, the brand's performance in Missouri for the same category did not manage to break into the top 30 rankings for July and August, indicating potential hurdles in market penetration or competition.

Examining the trends further, it is evident that LEUNE's presence in the Pre-Roll category is gaining momentum in certain regions while facing challenges in others. The absence of top 30 rankings in Missouri for July and August could be seen as a negative indicator, suggesting that the brand may need to reassess its strategies or product offerings in this market. Conversely, the significant leap in Arizona not only highlights successful market adaptation but also points towards a promising growth trajectory in that state. These contrasting performances underscore the importance of localized strategies and the varying consumer preferences across different states.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, LEUNE has shown a significant upward trend in rank and sales over the past few months. Starting from a rank of 60 in May 2024, LEUNE climbed to an impressive rank of 25 by August 2024, indicating a strong market presence and growing consumer preference. This rise is particularly notable when compared to competitors like High Grade, which saw fluctuating ranks and even dropped out of the top 20 in July 2024, and Shorties (AZ), which experienced a decline from rank 15 in May to 28 in August. Another competitor, Riggs Family Farms, maintained a relatively stable position but did not exhibit the same rapid growth as LEUNE. The consistent improvement in LEUNE's rank, coupled with a substantial increase in sales from $17,016 in May to $64,815 in August, underscores its growing dominance in the Arizona Pre-Roll market.

Notable Products

In August 2024, the top-performing product from LEUNE was Sol Berry Infused Pre-Roll (0.6g) in the Pre-Roll category, maintaining its number one ranking from July with notable sales of 5963 units. Desert Gold Infused Pre-Roll (0.6g) rose to the second position, showing a significant increase in sales from 367 units in July to 4207 units in August. Cloud Berry Infused Pre-Roll (0.6g) secured the third spot, up from second place in June, with a steady sales increase to 3507 units. Desert Gold Live Sauce Disposable (0.5g) in the Vapor Pens category improved to fourth place from fifth in July. Cloud Berry Live Resin Cartridge (1g) entered the rankings in fifth place for the first time, indicating growing consumer interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.