Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

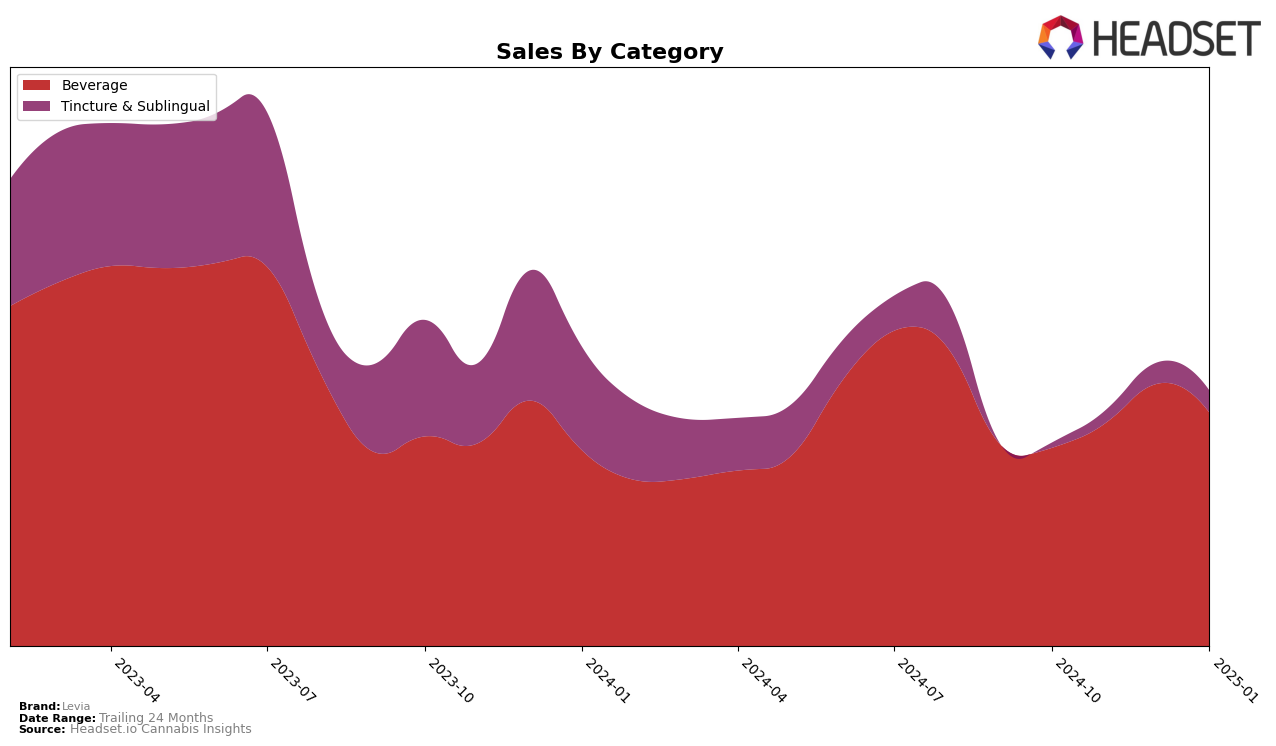

Levia has demonstrated a strong and consistent performance in the Massachusetts market, particularly in the Beverage category. Over the past few months, Levia has maintained its top position, ranking first from October 2024 through January 2025. This consistent ranking highlights Levia's dominance and consumer preference in the Beverage category within Massachusetts. The brand's ability to hold the number one spot suggests a strong market presence and potentially effective marketing strategies or product offerings that resonate well with consumers. Despite the competitive nature of the cannabis beverage market, Levia's steady sales growth, such as the increase from $226,277 in October to $254,872 in January, underscores its robust performance.

In the Tincture & Sublingual category, Levia has also shown commendable performance, consistently ranking third over the same period. This indicates a solid foothold in another product category, although it hasn't reached the top spot as it has with beverages. The consistent third-place ranking suggests that while Levia is a preferred choice for many consumers, there might be opportunities for growth or challenges in overtaking the top two competitors in this category. The steady increase in sales from $69,342 in October to $83,175 in January indicates a positive trend, reflecting growing consumer interest or effective brand strategies. However, the absence of rankings in other states or provinces suggests that Levia's market presence might be concentrated in Massachusetts, presenting both a challenge and an opportunity for expansion.

Competitive Landscape

In the Massachusetts beverage category, Levia has maintained its dominant position as the top-ranked brand from October 2024 through January 2025. This consistent leadership is underscored by its impressive sales trajectory, peaking in December 2024 before a slight dip in January 2025. Despite this minor decline, Levia's sales remain significantly higher than its closest competitors. Hi5 Seltzer, consistently ranked second, and CANN Social Tonics, holding the third position, both show steady sales growth, yet neither has been able to surpass Levia's commanding market presence. This sustained leadership suggests that Levia's brand strength and consumer loyalty remain robust, even as competitors continue to enhance their market strategies.

Notable Products

In January 2025, the top-performing product for Levia was Dream - Indica Jam Berry Seltzer (5mg THC, 12oz), which climbed to the first rank with sales reaching 15,366 units. Celebrate - Hybrid Pride Lemon Lime Seltzer (5mg THC, 12oz) dropped from its consistent first-place ranking in the previous months to second place. Achieve - Raspberry Lime Sativa Seltzer (5mg THC, 12oz) maintained a steady third place, showing consistent performance over the months. Pomegranate Punch Seltzer (5mg THC, 12oz) held its fourth position, while Kowloon Scorpion Bowl Seltzer (5mg THC, 12oz) entered the rankings in fifth place. Notably, the sales figures for Dream - Indica Jam Berry Seltzer showed a significant increase compared to December 2024, indicating a growing consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.