Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

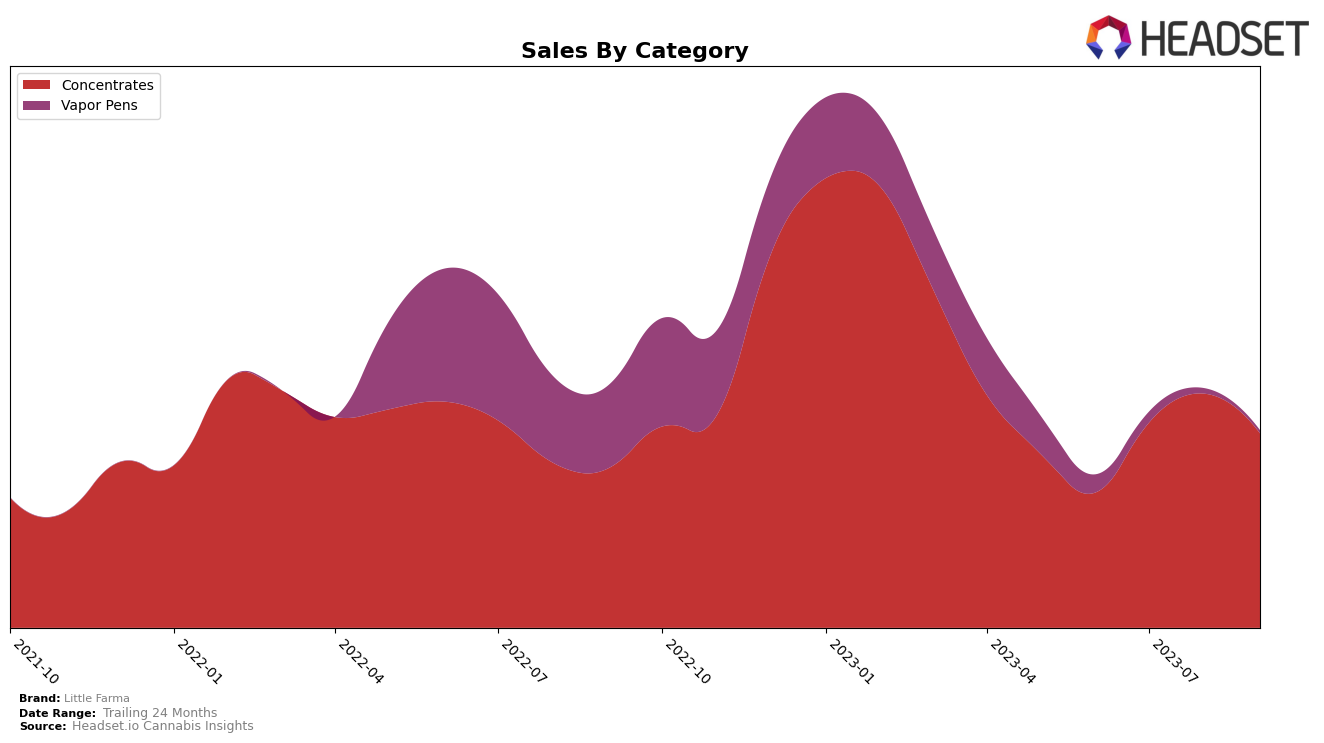

In Ontario, Little Farma has shown a steady performance in the Concentrates category. Although the brand did not make it to the top 20 in the months of August and September 2023, it maintained a consistent ranking in the mid-20s. This suggests a stable customer base and steady demand for their concentrates. Interestingly, there was a noticeable increase in sales from June to August 2023, suggesting that while the brand may not be among the top performers, it is showing promising growth.

Contrastingly, in Saskatchewan, Little Farma's performance in the Concentrates category showed significant fluctuation. The brand jumped from not being in the top 20 in June 2023 to ranking 5th and 7th in August and September 2023 respectively. This dramatic rise in ranking indicates a surge in popularity and customer preference for Little Farma's concentrates in this region. However, despite the improved ranking, sales in September 2023 were lower than in August, indicating a potential shift in market dynamics or consumer preferences.

Competitive Landscape

In the Concentrates category within Ontario, Little Farma has been experiencing a slight improvement in its ranking, moving from 28th in June and July 2023 to 26th in September 2023. However, it's worth noting that this still places them outside the top 20 brands for these months. In comparison, Original Stash and Shatterizer have maintained a more stable position, although they too are outside the top 20. DEBUNK has seen a slight drop in rank but remains ahead of Little Farma. Holy Mountain has the lowest rank among these brands, indicating a potential opportunity for Little Farma to gain market share. In terms of sales, all brands have experienced fluctuations, with Little Farma showing a slight increase in sales from June to September 2023, but still trailing behind its competitors.

Notable Products

In September 2023, the top-performing product from Little Farma was the Bruce Banner Shatter (1g), which maintained its position as the number one product for the fourth consecutive month. It achieved sales of 1089 units, demonstrating its consistent popularity among customers. The second best-selling product was the Bruce Banner x Tropicana Cookies Shatter 2-Pack (1g), also holding its rank from previous months with sales reaching 998 units. The Tropicali Live Terpene Cartridge (1g) and Sunset Sherbert Honey Shatter (1g) ranked third and fourth respectively, just like in previous months. In summary, Little Farma's top products showed a consistent performance over the past four months, with no changes in their rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.