Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

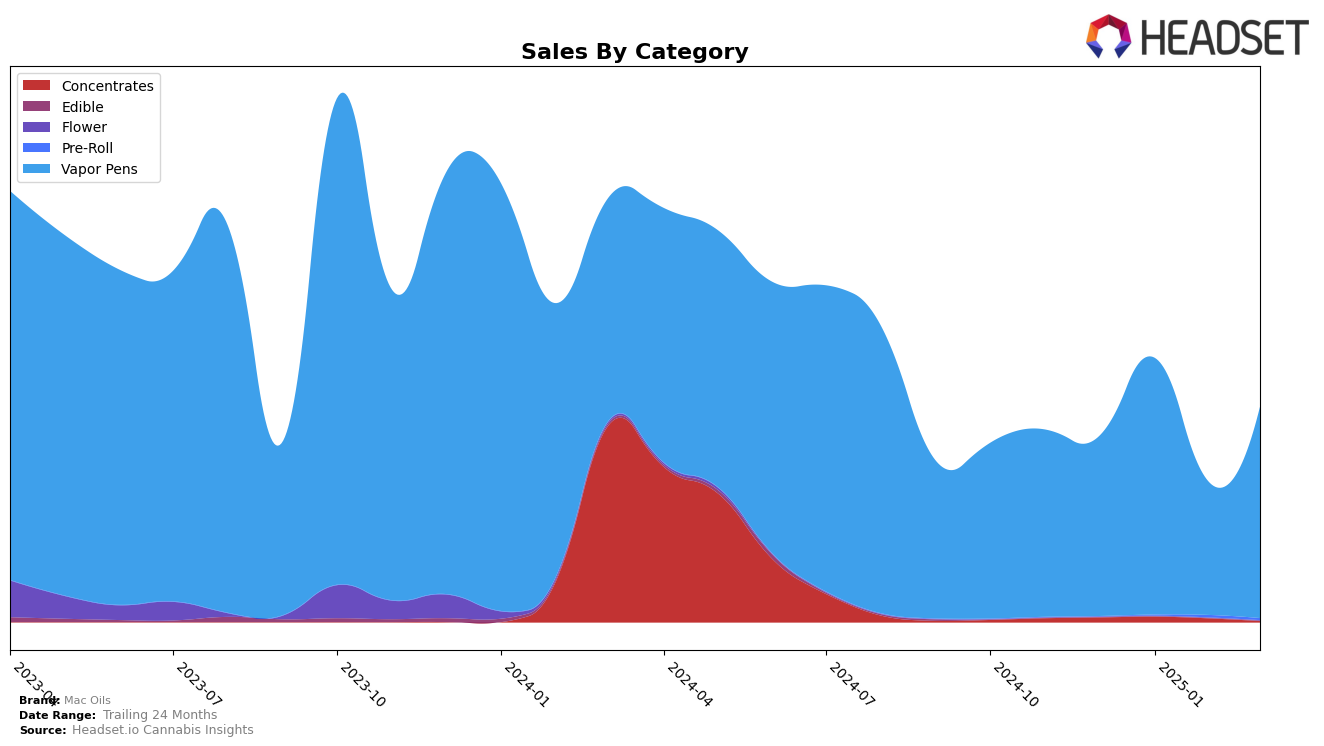

Mac Oils has shown varied performance across different states and categories, with notable movements in rankings that highlight both opportunities and challenges for the brand. In the Vapor Pens category in Michigan, Mac Oils climbed from a rank of 38 in December 2024 to 25 by January 2025, suggesting a strong start to the year. However, the brand faced a setback in February 2025, dropping to rank 44, before recovering to 27 in March 2025. This fluctuation indicates a competitive market landscape where Mac Oils is striving to maintain its presence. The brand's ability to rebound in March demonstrates resilience and potential for further growth, although maintaining a consistent upward trajectory remains a challenge.

Interestingly, Mac Oils did not make the top 30 brands in the Vapor Pens category in February 2025, which could be seen as a point of concern for the company. This absence highlights the volatility and competitive nature of the market in Michigan. Despite this, the brand's sales figures reflect a positive trend, with a notable increase from December 2024 to January 2025, suggesting effective strategies or promotions that resonated with consumers. The mixed performance across months underscores the importance of strategic planning and adaptability in response to market dynamics. More insights into their strategies and broader market positioning could provide a clearer picture of their long-term potential.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Mac Oils has demonstrated notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 38th in December, Mac Oils made a significant leap to 25th in January, indicating a strong start to the new year. However, this momentum was not sustained as the brand slipped to 44th in February, before recovering to 27th in March. This volatility suggests a dynamic market environment where consumer preferences may be rapidly shifting. In comparison, Bloom maintained a relatively stable position, hovering around the 26th to 28th ranks, while North Cannabis Co. experienced a decline, falling out of the top 20 entirely by February. Meanwhile, Hyman showed a remarkable recovery, climbing from 75th in January to 28th in March, which could pose a competitive threat to Mac Oils if this upward trend continues. Giggles also demonstrated a consistent improvement, reaching 25th by March. These shifts highlight the competitive pressures Mac Oils faces and underscore the importance of strategic marketing and product differentiation to maintain and improve its market position.

Notable Products

In March 2025, the top-performing product from Mac Oils was the Rainbow Runtz Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from January 2025 with sales of 6,732 units. The Jealousy Distillate Cartridge (1g) climbed to the second position, improving from third place in February 2025. Lemon Cherry Burst Distillate Cartridge (1g) rose to third place, showing a consistent upward trend from its fifth-place ranking in previous months. Banangie Distillate Cartridge (1g) slipped to fourth place, having previously been ranked as high as first in December 2024. Finally, the Mango Lychee Distillate Cartridge (1g) rounded out the top five, dropping from its peak position in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.