Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

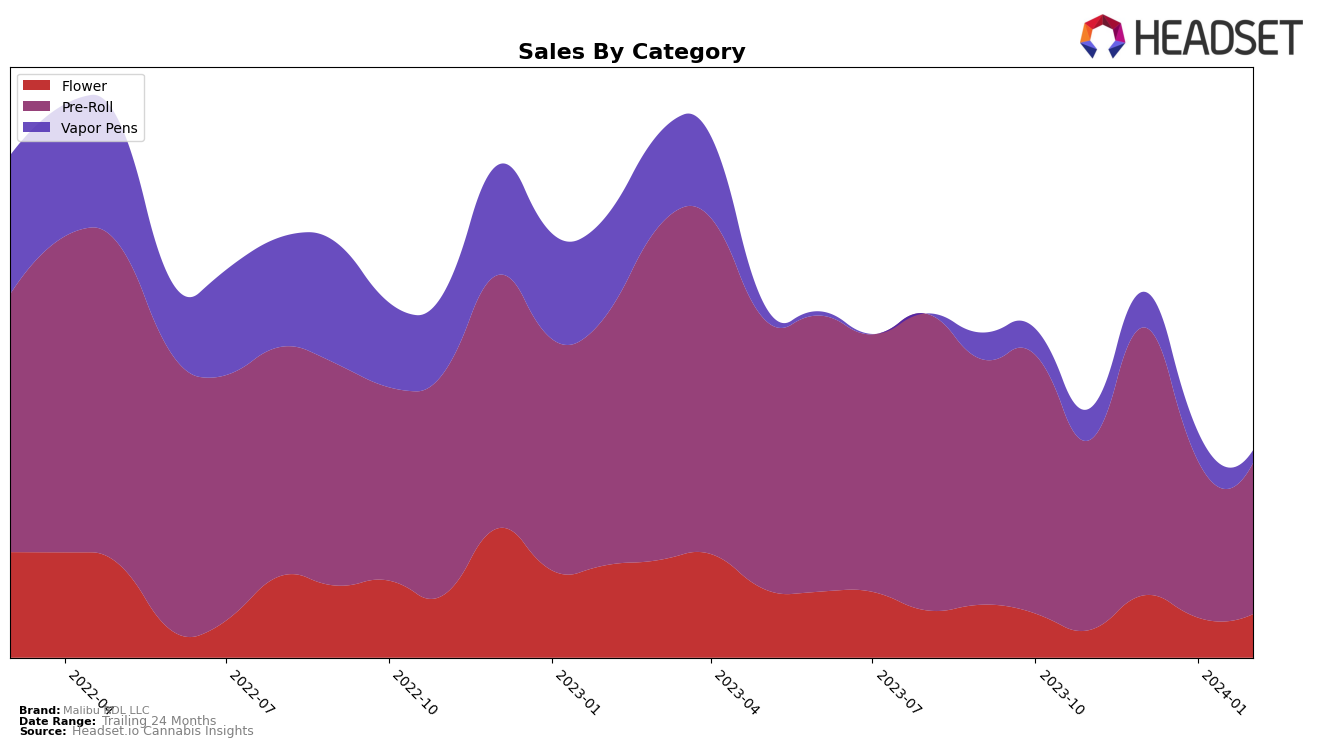

In California, Malibu RDL LLC has shown a notable presence in the Pre-Roll category, with its rankings fluctuating within the top 30 brands over the recent months. Starting from November 2023, where they ranked 25th, they experienced a positive movement to 18th in December 2023, showcasing their peak performance with sales reaching approximately $711,065. However, this upward trend did not maintain, as they saw a decline to 30th in January 2024 and slightly improved to 27th in February 2024. This volatility highlights the competitive nature of the Pre-Roll market in California, suggesting that while Malibu RDL LLC can reach notable highs, maintaining a consistent top position amidst fierce competition remains a challenge.

Contrastingly, their performance in the Vapor Pens category within the same state tells a different story. Malibu RDL LLC struggled to break into the top 30, with rankings in the 90s across November 2023 to January 2024, and no rank in February 2024, indicating they were not among the top 30 brands for that month. This consistent positioning far below the top contenders points to significant challenges in gaining a foothold in the Vapor Pens market. The absence of a ranking in February 2024 could be interpreted as either a sign of further decline or simply a strategic shift in focus. Nevertheless, this stark difference in performance across categories underscores the brand's varying success rates and the highly segmented nature of consumer preferences within the California cannabis market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, Malibu RDL LLC has experienced fluctuations in its market position, indicating a dynamic market environment. Initially ranked 25th in November 2023, Malibu RDL LLC improved to the 18th position by December, showcasing a significant increase in sales. However, the following months saw a decline, with the brand dropping to 30th in January 2024 and slightly recovering to 27th in February. This trajectory suggests challenges in maintaining its market share against competitors. Notably, Raw Garden and Cruisers have shown a consistent presence in the rankings, albeit with Raw Garden experiencing a slight decline. Conversely, KOA Exotics and Coastal Sun Cannabis have been moving closely with Malibu RDL LLC, indicating a tight competition. Coastal Sun Cannabis, in particular, demonstrated a notable surge in December, surpassing Malibu RDL LLC in sales and rankings, highlighting the competitive volatility Malibu RDL LLC faces in maintaining and enhancing its market position within California's Pre-Roll sector.

Notable Products

In February 2024, Malibu RDL LLC saw its top product as Low Tide Diamond Infused (3.5g) from the Flower category, maintaining a strong presence with a sales figure of 1235 units. Following closely was High Tide Diamond Infused Flower (3.5g), also in the Flower category, ranking second after previously holding the top position in January 2024. The third spot was secured by Most Wanted Diamond Infused Flower (3.5g), consistent in its ranking from the previous month. Notably, Boogie Boards - High Tide Infused Pre-Roll 6-Pack (4.2g) made a significant entry into the rankings at fourth place, showcasing the growing popularity of the Pre-Roll category. Meanwhile, Snowboards - Cotton Candy Infused Pre-Roll 6-Pack (4.2g) experienced a slight decline, moving to fifth in February from fourth in January, indicating a shift in consumer preferences within Malibu RDL LLC's product range.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.