Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

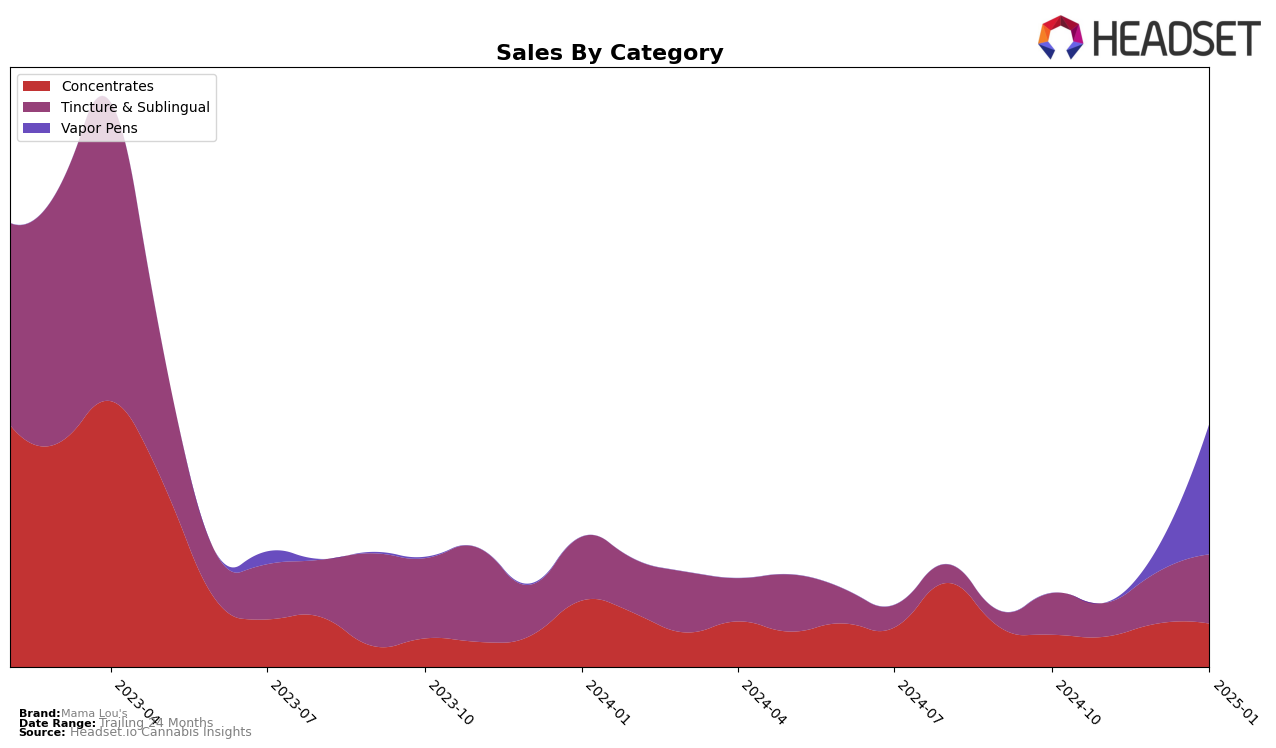

In the state of Oregon, Mama Lou's has faced some challenges in the Vapor Pens category, as indicated by its absence from the top 30 rankings from October 2024 through January 2025. This suggests that the brand has not been able to capture a significant market share in this category within Oregon during this period. The sales figures for January 2025 show $15,523, which indicates a potential area for growth if the brand can improve its visibility and consumer appeal in the Vapor Pens category.

The lack of ranking in the top 30 for any month during this time frame is a critical point for Mama Lou's to address, as it highlights a competitive market landscape in Oregon. This absence from the rankings could be seen as a challenge, but it also presents an opportunity for strategic adjustments and market penetration efforts. Understanding consumer preferences and competitor strategies in Oregon could provide valuable insights for Mama Lou's to enhance its performance in the Vapor Pens category.

Competitive Landscape

In the Oregon Vapor Pens category, Mama Lou's has shown a notable presence, entering the top 20 brands in January 2025 with a rank of 78. This entry marks a significant milestone for Mama Lou's, especially considering the competitive landscape. Brands like Concrete Jungle and Focus North have experienced fluctuating ranks, with Concrete Jungle dropping from 73 in October 2024 to 76 in January 2025, and Focus North showing a more stable performance, ranking 75 in January 2025. Meanwhile, Benson Arbor and Sunshine Oil have seen more volatility, with Benson Arbor's rank improving to 82 in January 2025 after a dip, and Sunshine Oil also improving to 83. The sales trends indicate that while Mama Lou's is a newer entrant in the top ranks, it has the potential to capture more market share, especially as other brands experience sales declines or rank fluctuations.

Notable Products

In January 2025, the top-performing product for Mama Lou's was the Grandaddy Purp Distillate Cartridge (1g) in the Vapor Pens category, securing the first rank with sales of 639 units. The Blueberry Headband Distillate Cartridge (1g) followed closely, improving its rank from third in December 2024 to second in January 2025. Chocolate Diesel Distillate Cartridge (1g) also saw an upward trend, advancing from fourth to third place. The THC RSO (1g) from the Concentrates category experienced a slight decline, moving from second in December 2024 to fourth in January 2025. Meanwhile, the CBD/THC/CBG 1:1:1 Calm Tincture (324mg CBD, 378mg THC, 297mg CBG, 1oz) entered the top five, ranking fifth in January 2025.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.