Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

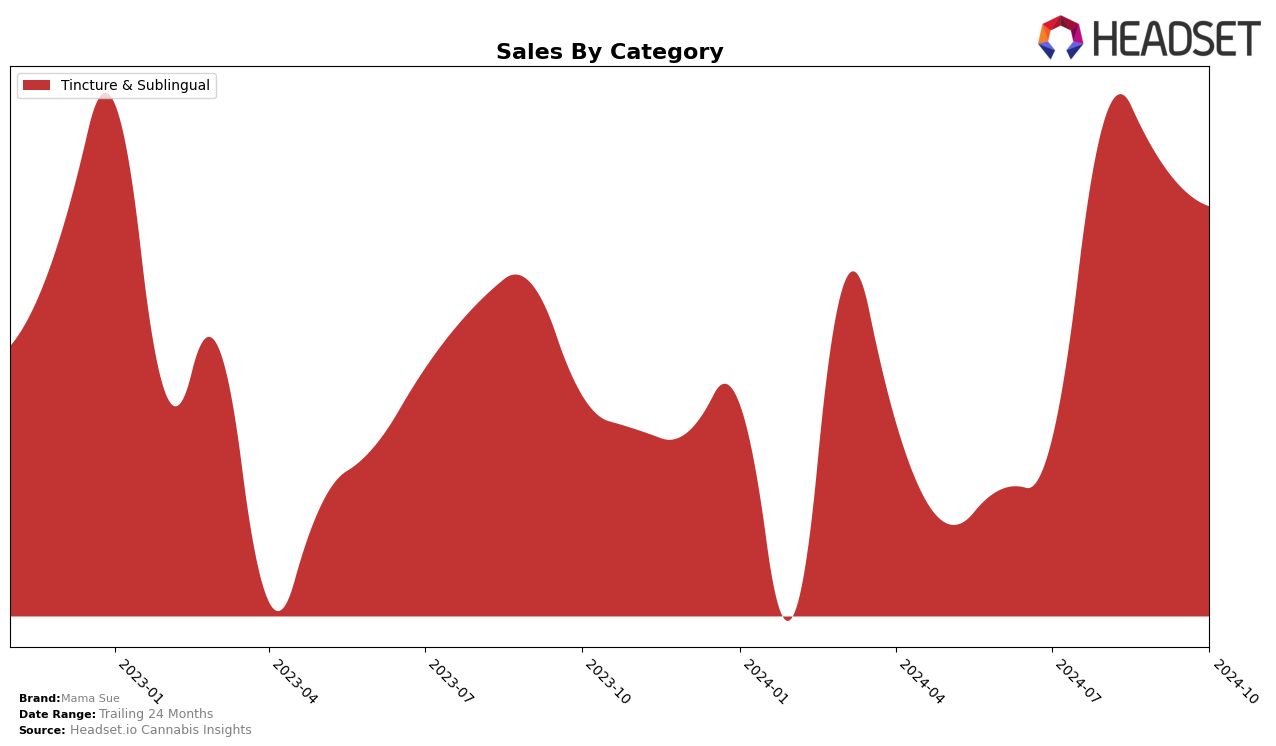

In the state of California, Mama Sue has shown a notable presence in the Tincture & Sublingual category. After not ranking in the top 30 for July 2024, the brand made a significant leap to secure the 22nd position by August 2024. This movement suggests a growing acceptance and popularity of Mama Sue's products within this category. However, it is important to note that the brand did not maintain its position in the subsequent months, as it failed to appear in the top 30 rankings for September and October. This fluctuation indicates a potential volatility in consumer demand or market competition that could be impacting their standing.

While Mama Sue's performance in California's Tincture & Sublingual category experienced some ups and downs, the absence of rankings for the other months might signal challenges in maintaining consistent market traction. The initial surge in August could reflect a successful marketing campaign or product launch, but the lack of sustained visibility suggests that the brand may need to strategize on how to capture and hold consumer interest over time. Observing these trends can provide insights into the brand's market dynamics and potential areas for growth or improvement. For a deeper understanding of Mama Sue's performance across other states and categories, further analysis would be required.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Mama Sue has faced notable challenges in maintaining its rank among the top 20 brands. As of October 2024, Mama Sue was not listed in the top 20, indicating a potential decline in market visibility compared to its competitors. For instance, High Gorgeous by Yummi Karma was ranked 20th in July 2024 but did not maintain its position in subsequent months, suggesting fluctuations in consumer preference or market dynamics. Meanwhile, High Power consistently held the 19th rank in August and September 2024, showcasing a more stable market presence. These insights highlight the competitive pressure on Mama Sue to enhance its brand strategy to regain and sustain a top-tier position, potentially through targeted marketing efforts or product innovation to boost sales and visibility in the California market.

Notable Products

In October 2024, Mama Sue's top-performing product was the CBD/CBN 1:1 Sleep Tincture, maintaining its number one rank consistently from July through October. This product achieved notable sales of 285 units in October, slightly down from its September peak. The CBD Extra Strength Relief Tincture, previously ranked second in July and August, was not present in the rankings for September and October, indicating a possible discontinuation or shift in consumer preference. The consistent top ranking of the Sleep Tincture highlights its strong market position and consumer demand throughout the months. Overall, the data suggests a stable performance for Mama Sue's leading product, with other products experiencing fluctuations in rankings and sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.