Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

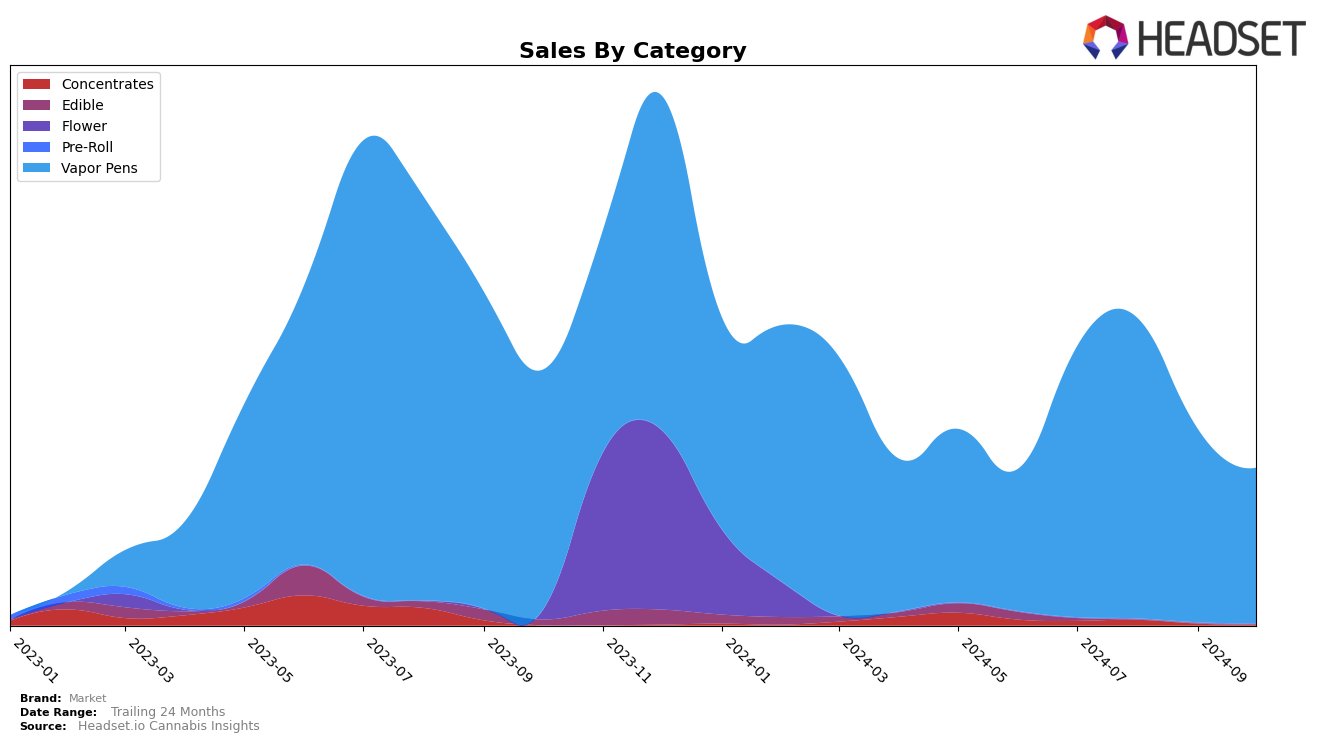

In the state of Michigan, Market has shown a fluctuating performance in the Vapor Pens category over the past few months. Starting from July 2024, Market was ranked 22nd, moving up to 20th in August, but then slipping to 27th in September and further down to 30th by October. This downward trend in rankings indicates a potential challenge in maintaining a competitive edge in this category. Despite the drop in rankings, Market's sales figures reveal that August was a peak month with sales reaching $576,543, suggesting a strong performance during that period before the decline in subsequent months.

The presence of Market in the top 30 brands in Michigan's Vapor Pens category throughout the observed months is significant, yet the downward trend in their ranking is noteworthy. The fact that by October, Market barely held onto the top 30 position could be a point of concern for the brand. This pattern suggests that while Market has managed to maintain visibility, its position is precarious, and there might be a need for strategic adjustments to regain and improve its standing in the competitive landscape of Michigan's Vapor Pens market. The absence of Market from any other state's top 30 rankings during this period could imply either a focused market strategy or challenges in penetrating other regional markets.

Competitive Landscape

In the Michigan Vapor Pens category, Market experienced a notable fluctuation in its ranking and sales over the past few months. Starting from a strong position at rank 22 in July 2024, Market improved to rank 20 in August, before slipping to 27 in September and further to 30 in October. This downward trend in rank coincided with a significant decrease in sales from August to October. Meanwhile, competitors like Mozey Extracts showed a remarkable improvement, jumping from rank 62 in July to 28 in October, with sales peaking in September. Similarly, Bossy saw a resurgence in October, climbing to rank 29, just ahead of Market. These shifts highlight the competitive pressure Market faces, as brands like Packwoods and Bloom also maintained strong positions, indicating a dynamic market landscape that Market must navigate to regain its footing.

Notable Products

In October 2024, the top-performing product for Market was Free Ride Distillate Cartridge (1g) in the Vapor Pens category, maintaining its rank from the previous month with a notable sales figure of 5,415 units. Cherry Gelato Distillate Cartridge (1g) emerged as the second best-seller, while Space Rocks Distillate Cartridge (1g) secured the third position. Both Cherry Gelato and Space Rocks did not appear in prior months' rankings, indicating a strong entry into the market. Potholder Distillate Cartridge (1g) and Cherry Diesel Pie Distillate Cartridge (1g) rounded out the top five, also debuting in October. These rankings highlight a significant shift in consumer preference towards these new products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.