Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

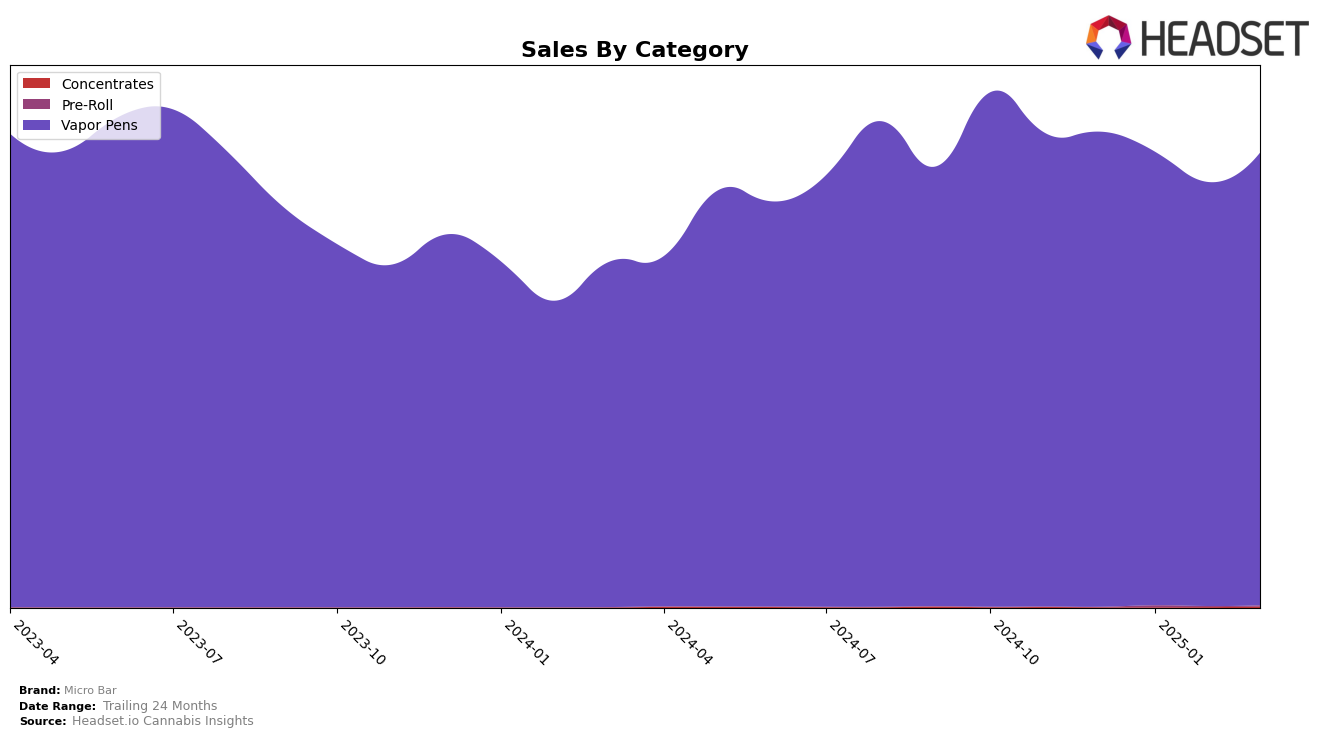

Micro Bar has demonstrated varied performance across different states and categories, with notable fluctuations in their rankings. In Arizona, Micro Bar experienced a slight decrease in ranking from 19th in December 2024 to 22nd in March 2025 within the Vapor Pens category. Meanwhile, in California, the brand maintained a relatively stable position, hovering around the 21st to 23rd rank, despite a decrease in sales from January to March 2025. It's important to highlight that in Massachusetts, Micro Bar was not in the top 30 brands in December 2024, but managed to climb to 38th in January 2025 before dropping again, indicating potential volatility or market challenges in that state.

In Washington, Micro Bar has consistently performed well, maintaining a top 5 position throughout the observed months. This stability in Washington contrasts with the more fluctuating rankings in other states, suggesting a strong foothold in that market. Despite these positive indicators, the brand's performance in Massachusetts remains a concern, as it failed to secure a consistent presence in the top 30, peaking at 38th in January 2025 before dropping again. This indicates a need for strategic adjustments to strengthen their market presence. Overall, while Micro Bar shows resilience in certain markets, there are opportunities for growth and improvement in others.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Micro Bar has experienced fluctuations in its rank, moving from 4th place in December 2024 to 5th in January and February 2025, before reclaiming the 4th position in March 2025. This shift highlights the brand's resilience and ability to recover its standing amidst strong competition. Notably, Crystal Clear consistently held the 2nd rank, showcasing its dominance in the market with significantly higher sales. Meanwhile, Sticky Frog maintained a steady 3rd position, although its sales showed a downward trend over the months. Plaid Jacket and Full Spec also presented stable competition, with Plaid Jacket briefly overtaking Micro Bar in January and February. These dynamics suggest that while Micro Bar faces robust competitors, its ability to regain rank indicates potential for growth and strategic opportunities to enhance its market position.

Notable Products

In March 2025, the top-performing product from Micro Bar was the White Razz Flavored Distillate Disposable (1g) in the Vapor Pens category, achieving the number one rank with sales of 7,292 units. The Watermelon Mimosa Distillate Disposable (1g) followed closely at rank two, maintaining a strong presence after leading in previous months. The Pineapple Express Distillate Disposable (1g) held steady at third place, showing consistent performance since January 2025. Pink Lychee Distillate Disposable (1g) improved its position to fourth place, up from its fifth-place ranking in February. Meanwhile, Blue Hawaiian Punch Flavored Distillate Disposable (1g) rounded out the top five, showing a slight decline from its earlier performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.