Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

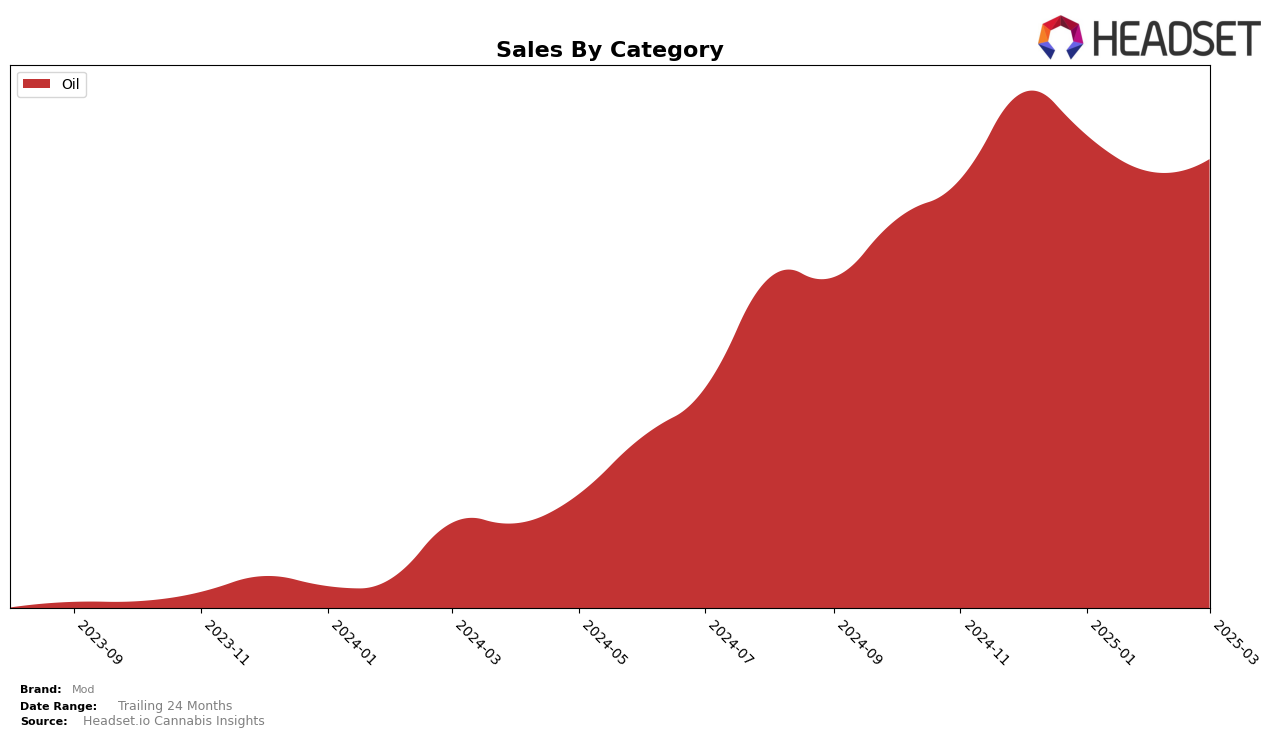

Mod has demonstrated a strong performance in the Oil category within Ontario, consistently maintaining a top-three position from December 2024 through March 2025. The brand held the third rank in both December and January, before advancing to the second position in February and March. This upward movement in rankings suggests a growing consumer preference and strong market presence in the province. Despite a slight dip in sales from December to February, Mod managed to regain momentum in March, reflecting resilience in its market strategy and product appeal.

Interestingly, the absence of Mod from the top 30 brands in other categories or states suggests a more focused approach or possibly a niche market strategy that prioritizes the Oil category in Ontario. This could be seen as a strategic decision to consolidate market leadership in a specific segment rather than diluting efforts across multiple categories or geographies. Such a strategy might indicate either a limitation in brand reach or a deliberate choice to dominate a particular market segment, which can be both advantageous and limiting depending on long-term brand goals.

Competitive Landscape

In the Ontario oil category, Mod has shown a promising upward trajectory in its market position over the first quarter of 2025. Starting from a rank of 3rd in December 2024, Mod improved to 2nd place by February 2025, maintaining this position through March. This advancement indicates a positive reception and growing consumer preference for Mod's products. In contrast, MediPharm Labs, which held the 2nd position in December and January, slipped to 3rd place in February and March, suggesting a shift in consumer loyalty or competitive pricing strategies by Mod. Meanwhile, Redecan consistently held the top spot, indicating a strong market presence that Mod is steadily challenging. The consistent ranking of NightNight at 4th place highlights a stable but less competitive position compared to Mod's dynamic growth. These insights suggest that Mod's strategic initiatives are effectively enhancing its market share and positioning it as a formidable competitor in the Ontario oil market.

Notable Products

In March 2025, Mod's top-performing product was the THC Variety Pack Oil Drops 4-Pack (12ml), maintaining its position at the top of the rankings for four consecutive months with sales of 4410 units. The THC 1000 Unflavoured Oil Drops 10-Pack (30ml) held steady in second place, showing a slight sales increase from February. The THC Berry Drops (3ml) remained in third place, while the THC Lime Drops (2ml) consistently ranked fourth. Notably, the THC 1000 Unflavoured Oil Drops have shown resilience by climbing from third place in December 2024 to securing the second spot in January 2025 and holding it since. Overall, the rankings have remained stable from the previous months, indicating consistent consumer preferences for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.