Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

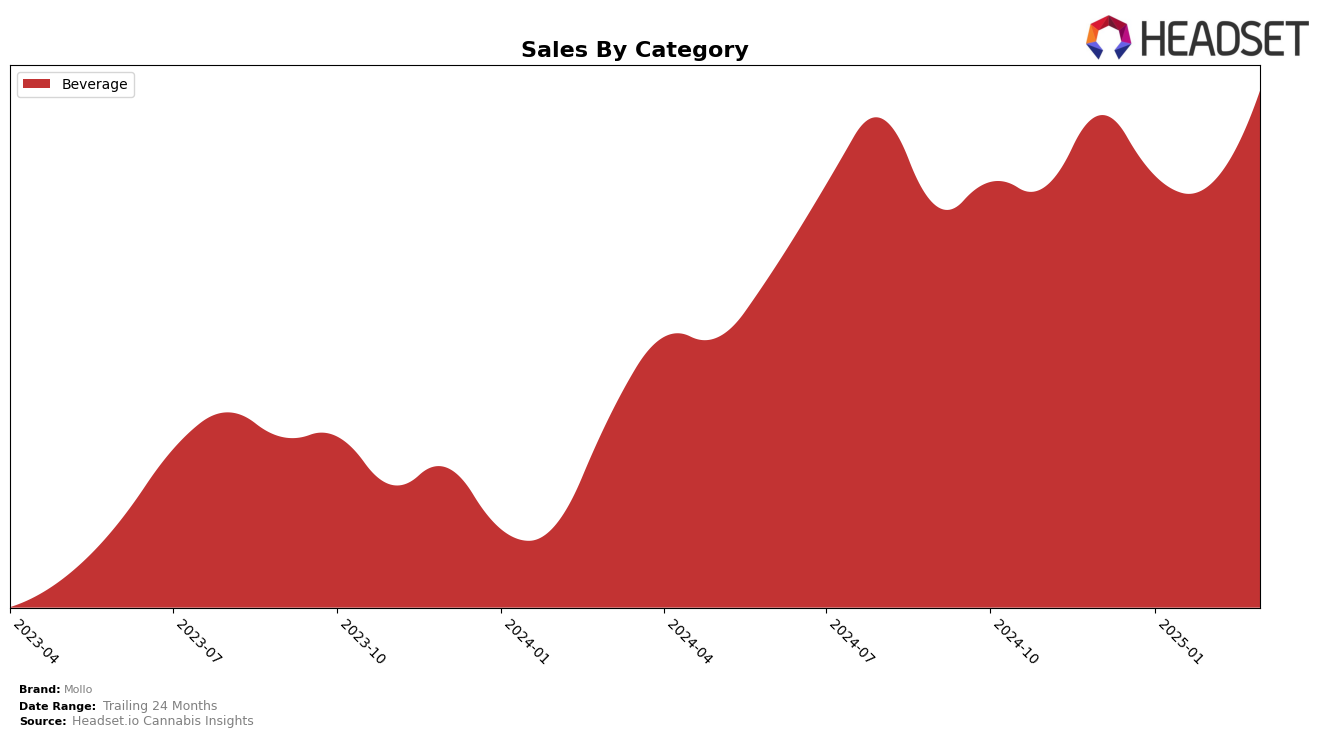

Mollo has shown consistent performance in the beverage category across several Canadian provinces. In Alberta, Mollo has maintained a steady third-place ranking from December 2024 through March 2025, indicating strong brand loyalty and consistent consumer demand. Similarly, in British Columbia, Mollo has held onto the fourth spot for the same period, reflecting stable market presence. Interestingly, Ontario saw a notable improvement in Mollo's ranking, climbing from sixth place in December 2024 to fourth place by January 2025, where it remained through March. This upward movement in Ontario could suggest increased brand recognition or successful marketing strategies. Meanwhile, in Saskatchewan, Mollo improved its position from fourth to third in March 2025, hinting at a potential shift in consumer preferences or competitive dynamics.

While Mollo's sales figures in Alberta and British Columbia have shown a positive trend, with March 2025 sales peaking in these provinces, Ontario presents a more complex picture. Despite a decline in sales from December 2024 to February 2025, Mollo's position remained stable, suggesting resilience amidst fluctuating consumer spending. The slight dip in sales in Saskatchewan from January to March 2025 did not prevent an improvement in ranking, which might indicate that competitors faced even steeper challenges. The absence of rankings outside the top four in these provinces underscores Mollo's strong foothold in the Canadian beverage market. However, the brand's performance in other provinces and potential expansion strategies remain areas for further exploration.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Mollo has demonstrated a consistent performance, maintaining its rank at 4th place from January to March 2025, after an initial rise from 6th place in December 2024. This stability in rank suggests a strong market presence, although it trails behind Collective Project, which consistently holds the 3rd position, and Versus, which dominates the 2nd spot. Despite this, Mollo's sales have shown a positive trend, particularly in March 2025, where it experienced a notable increase, closing the gap with Sweet Justice, which saw a decline in sales and rank from 4th to 6th place over the same period. Meanwhile, Ray's Lemonade improved its rank slightly from 7th to 5th, but its sales remain lower than Mollo's. These dynamics indicate that while Mollo is not the top performer, its strategic positioning and sales momentum could potentially lead to further gains in market share.

Notable Products

In March 2025, the top-performing product for Mollo was the CBG/THC 2:1 Blackberry Seltzer (20mg CBG, 10mg THC, 355ml), maintaining its first-place ranking from February with sales reaching 20,920 units. The CBG/THC 2:1 Mango Seltzer moved up to the second spot, surpassing the Pineapple Seltzer, which dropped to third place. The THC/CBG 1:1 Orchard Chill'r Apple Cider Sparkling Beverage improved slightly to fourth place, recovering from a dip in February. Meanwhile, the CBG/THC 1:1 Mollo 10 Sparking Beverage remained consistent in fifth place throughout the period from December 2024 to March 2025. Overall, the Blackberry Seltzer has shown a significant increase in sales compared to previous months, solidifying its position as a top contender in Mollo's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.