Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

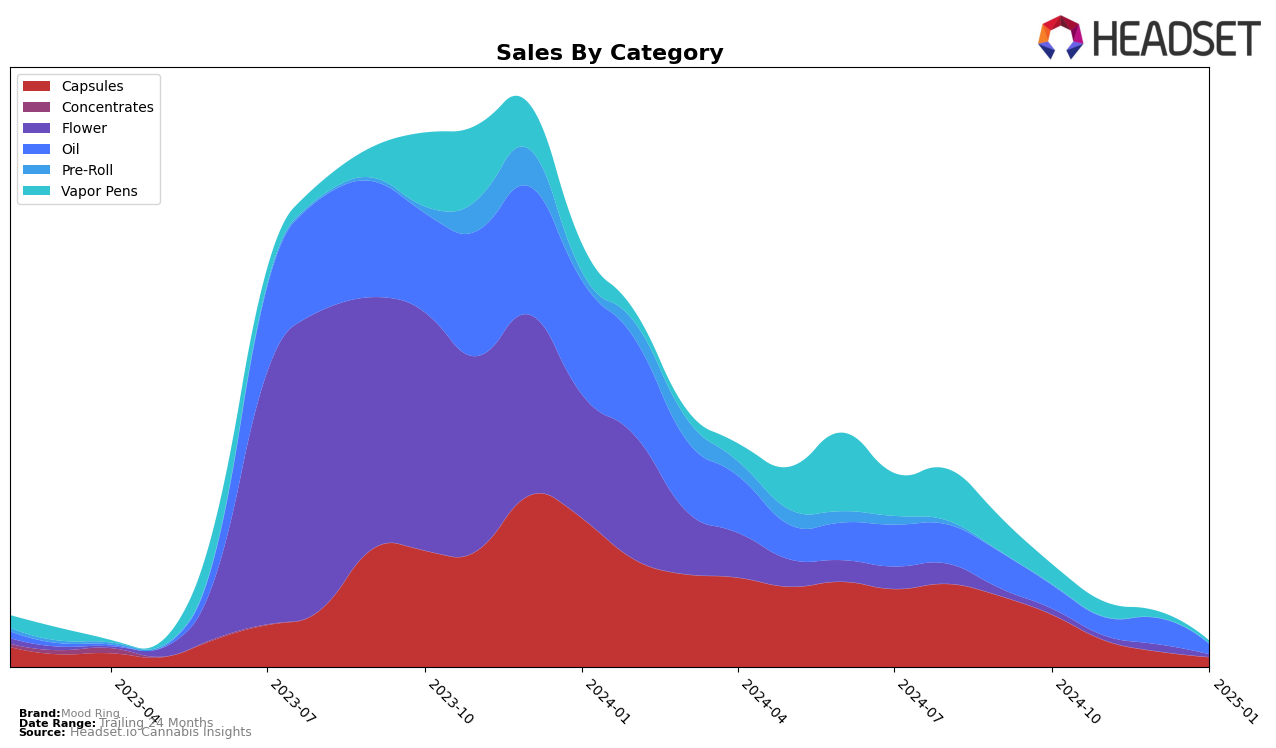

In the Canadian market, Mood Ring has shown varying performance across different categories and provinces. Specifically in Ontario, the brand's presence in the Capsules category has seen a noticeable shift. In October 2024, Mood Ring held the 13th rank, but by November, it had slipped to the 18th position. This decline in ranking is accompanied by a significant drop in sales from October to November. The absence of Mood Ring from the top 30 in December and January indicates a potential struggle in maintaining market share in this category, which could be a point of concern for the brand's strategy in Ontario.

While the data for other states or provinces is not provided, the trend observed in Ontario might suggest broader challenges or strategic shifts that Mood Ring is facing. The lack of ranking information for December and January could imply that the brand did not make a significant impact in those months, which might be indicative of either increased competition or a change in consumer preferences. Understanding these movements is crucial for stakeholders looking to evaluate Mood Ring's market positioning and potential growth areas in the coming months. Further detailed insights would be necessary to draw comprehensive conclusions about their performance across other regions and categories.

Competitive Landscape

In the competitive landscape of the Capsules category in Ontario, Mood Ring experienced a notable decline in its market position, dropping from 13th place in October 2024 to 18th in November 2024, and subsequently falling out of the top 20 by December 2024. This downward trend in rank is mirrored by a significant decrease in sales, from over 25,000 CAD in October to just over 12,000 CAD in November. In contrast, Vortex Cannabis Inc. maintained a strong presence, ranking 4th in October and 7th in November, with sales figures significantly higher than Mood Ring's, indicating a robust market performance. Meanwhile, Collective Project showed resilience, consistently ranking between 14th and 16th, with sales figures that suggest steady consumer interest. Spring Hill Cannabis Co. also demonstrated upward mobility, climbing from 17th in October to 15th by January 2025, which indicates potential growth opportunities. These dynamics highlight the competitive pressures Mood Ring faces and underscore the importance of strategic adjustments to regain market share in Ontario's Capsules category.

Notable Products

In January 2025, the top-performing product for Mood Ring was High CBD Capsules 30-Pack (900mg CBD), maintaining its number one rank from November 2024 with sales of 102 units. High THC Oil (30ml) held the second position, consistent with its rank in November 2024. High CBD Oil (30ml) dropped to third place from its peak in December 2024, when it was the top-selling product. High THC Capsules 30-Pack (300mg) ranked fourth, a position it has seen since December 2024, after starting as the top product back in October 2024. The new entry, S.A.G.E (3.5g), debuted in the rankings at fourth place in January 2025, indicating a promising start for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.