Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

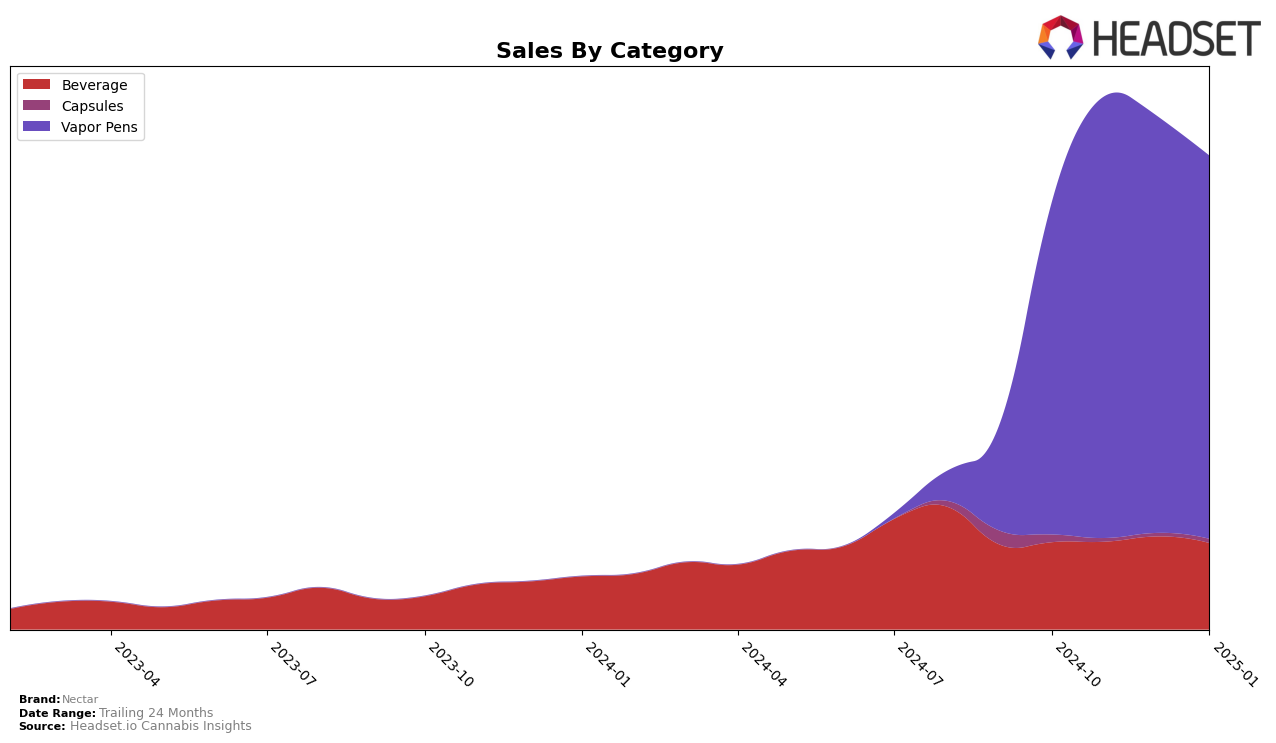

Nectar has shown a consistent performance in the Massachusetts market across the Beverage and Vapor Pens categories. In the Beverage category, Nectar maintained a presence within the top 15, although there was a gradual decline from 8th in October 2024 to 11th by January 2025. This downward trend might be worth monitoring, even though their sales figures remained relatively stable, indicating a possible increase in market competition or shifting consumer preferences. The Vapor Pens category showed a different pattern, with Nectar fluctuating around the 30th position, notably dropping out of the top 30 in December 2024 before rebounding to 29th in January 2025. This volatility could suggest challenges in maintaining a competitive edge in this segment.

The performance of Nectar in Massachusetts highlights some intriguing dynamics. While the Beverage category saw a slight decline in ranking, the sales figures did not show a significant drop, suggesting that Nectar's products still hold a strong appeal to a loyal customer base. The Vapor Pens category, however, presents a more complex picture, with Nectar's ranking dipping below the top 30 in December 2024, which could indicate a need for strategic adjustments to capture more market share. This fluctuation in rankings and sales performance across different categories and months underscores the importance of adaptability and market analysis to sustain growth in the competitive cannabis industry.

Competitive Landscape

In the Massachusetts Vapor Pens category, Nectar has shown a dynamic performance over the recent months, indicating a competitive presence amidst fluctuating market conditions. Starting from a rank of 33 in October 2024, Nectar improved to 30 in November, experienced a slight dip to 34 in December, and then climbed back to 29 in January 2025. This suggests a resilient market strategy, particularly when compared to competitors like Green Meadows, which peaked at rank 20 in November but fell to 27 by January. While Nectar's sales figures reflect a stable trend, competitors such as AiroPro have seen a consistent decline in sales, potentially opening opportunities for Nectar to capture more market share. Meanwhile, Glorious Cannabis Co. showed an upward sales trend, yet remained lower in rank than Nectar, indicating that while they are gaining traction, Nectar still holds a competitive edge in terms of market positioning.

Notable Products

In January 2025, Nectar's top-performing product was the Nitetime - CBD/THC 1:1 Lemon Chamomile Seltzer, maintaining its position as the leading product with sales of 1179 units. The Cherry Lime Haze Seltzer, which previously held the top spot in December, ranked second this month with a slight decrease in sales. Peaches 'n Cream Distillate Disposable showed notable improvement, climbing to third place from fifth in December. Meanwhile, Blue Raspberry Runtz Seltzer dropped to fourth place, continuing its downward trend from previous months. The DayTime - Orange Pineapple Seltzer made a reappearance in the top five, securing the fifth spot after being unranked in the prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.