Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

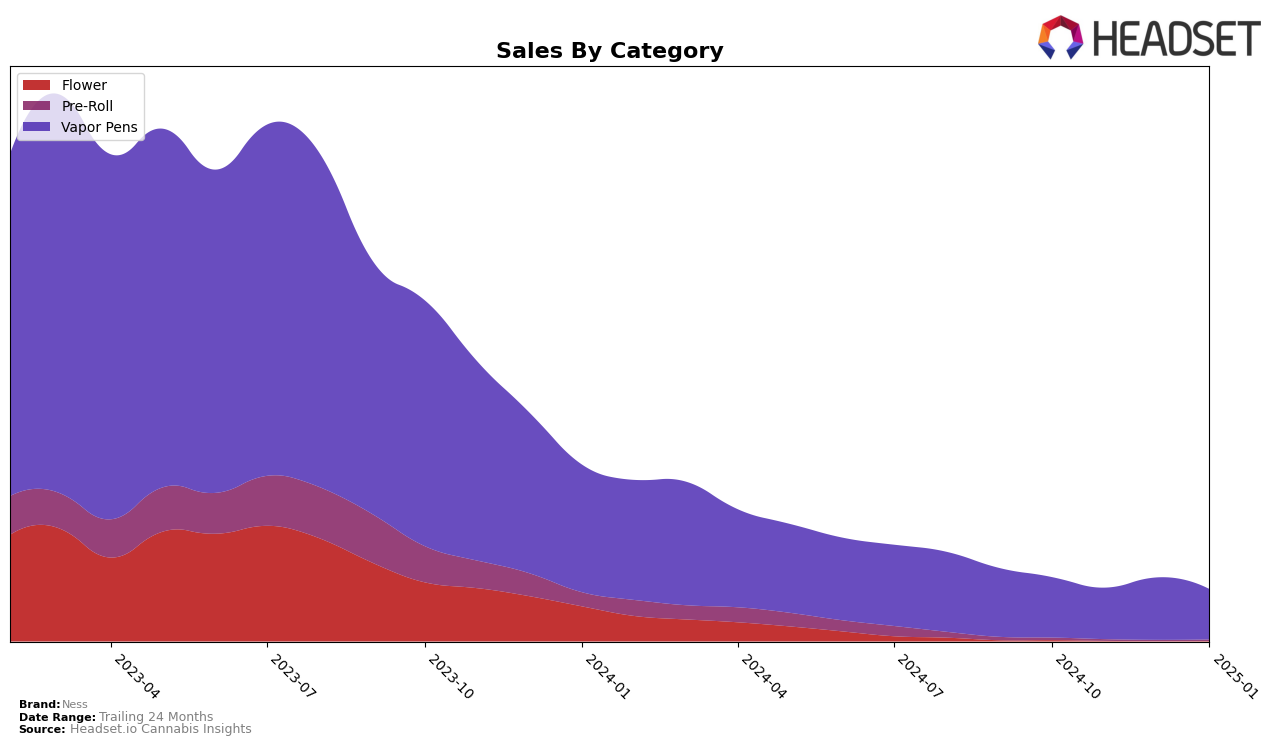

In the province of Alberta, Ness has shown a notable upward trend in the Vapor Pens category. Starting from a rank of 43 in October 2024, the brand climbed to the 25th position by December 2024, before settling at the 30th rank in January 2025. This movement signifies a significant improvement in market presence and suggests a growing consumer preference for Ness in this region. The sales figures also reflect this positive trajectory, with a peak in December before a slight decrease in January, indicating a potential seasonal demand or a temporary market fluctuation.

In contrast, the performance of Ness in British Columbia has been relatively stable, maintaining a rank around the mid-30s for the Vapor Pens category. This steadiness suggests a consistent consumer base, though it also highlights the challenge of breaking into the top 30. Meanwhile, in Ontario, Ness experienced a downward trend, dropping from 19th to 28th place over the same period. This decline in ranking, despite having substantial sales figures, could be indicative of increased competition or changing consumer preferences in the region. Such data points offer valuable insights into regional market dynamics and the competitive landscape Ness faces across different provinces.

Competitive Landscape

In the Ontario Vapor Pens category, Ness has experienced a notable decline in its market position over the recent months. Starting from October 2024, Ness was ranked 19th but saw a steady drop to 28th by January 2025. This downward trend in ranking is mirrored by a decrease in sales, from October's peak to a lower figure in January. In contrast, competitors such as Platinum Vape have shown a consistent improvement in both rank and sales, moving from 35th to 27th, indicating a strengthening market presence. Similarly, GREAZY made a significant leap from being outside the top 20 in October to securing the 24th position by November, maintaining a competitive edge over Ness. Meanwhile, Tasty's (CAN) also experienced a decline, though not as steep as Ness, suggesting potential market volatility. These dynamics highlight the competitive pressures Ness faces, emphasizing the need for strategic adjustments to regain its footing in the Ontario Vapor Pens market.

Notable Products

In January 2025, the top-performing product from Ness was the Ninja Fruit Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent number one rank since October 2024, with sales reaching 6,565 units. The Squish'd Berry Distillate Cartridge (1g) held the second position, showing a stable performance from December 2024. Blue Kiwi Distillate Cartridge (1g) remained in third place, consistent with its ranking from the previous month. Dark Cherry Distillate Cartridge (1g) continued to hold the fourth position across all months from October 2024. Notably, the Ninja Fruit Infused Pre-Roll (0.5g) maintained its fifth place throughout the observed period, indicating steady demand despite fluctuating sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.