Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

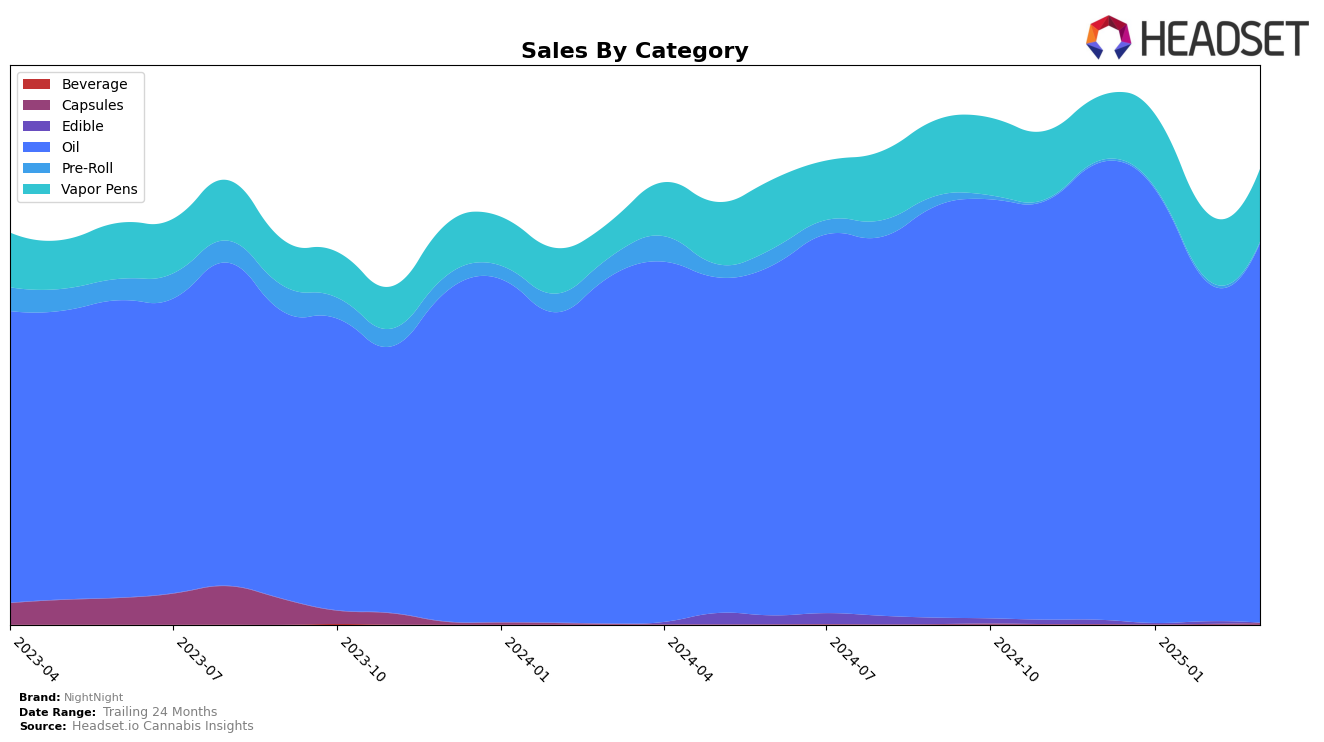

NightNight's performance in the Oil category has shown notable consistency across multiple provinces. In Alberta, the brand maintained a steady presence within the top five, consistently ranking 5th in December 2024, February 2025, and March 2025, with a slight improvement to 3rd in January 2025. This suggests a strong foothold in the Alberta market. Similarly, in British Columbia, NightNight demonstrated a slight upward trend, moving from 5th place in December 2024 to 4th place by March 2025, indicating a positive reception in this region. Meanwhile, in Ontario, NightNight consistently held the 4th position throughout the observed months, showing stable performance in a competitive market.

In the Vapor Pens category, NightNight's performance varied significantly across provinces. In British Columbia, the brand was not in the top 30 in December 2024, but it showed gradual improvement, reaching the 51st position by March 2025. This upward trend indicates a growing interest and potential for expansion in this product line. Conversely, in Ontario, NightNight's ranking in the Vapor Pens category remained outside the top 30, consistently hovering around the 80th position. This could suggest challenges in gaining traction in this specific category within the Ontario market. These movements highlight the varying degrees of market penetration and consumer preference for NightNight's products across different regions and categories.

Competitive Landscape

In the competitive landscape of the Ontario oil category, NightNight consistently held the 4th rank from December 2024 through March 2025, indicating a stable market position amidst fluctuating sales figures. Despite a decrease in sales over this period, NightNight maintained its rank, suggesting a strong brand loyalty or niche market presence. In contrast, MediPharm Labs and Mod have been dominant players, consistently occupying the top three positions, with Mod even climbing to the 2nd rank by February 2025. Meanwhile, Viola and Glacial Gold showed a slight rank interchange between 5th and 6th positions, reflecting their competitive rivalry. This stable ranking for NightNight, despite the sales decline, highlights the importance of strategic marketing and customer retention efforts to potentially improve its position or safeguard against further sales drops.

Notable Products

In March 2025, NightNight's top-performing product was CBN:CBD 1:3 Full Spectrum Oil (30ml), maintaining its position as the leading product for the fourth consecutive month with sales of 6419 units. Following closely, the CBD:CBN:Delta 8 THC 3:2:1 K.O Oil (30ml) also held steady in the second position, consistent with its ranking since December 2024. The CBN+CBD Full Spectrum Cartridge (1g) secured the third spot, showing a gradual increase in sales over the months. CBN Pure Oil (30ml) and K.O. - CBD:CBN: Delta 8 3:2:1 Blue Widow Distillate Cartridge (1g) remained in fourth and fifth places respectively, with both products experiencing a decline in sales figures compared to previous months. Overall, the rankings of NightNight's top products have remained stable from December 2024 through March 2025, with notable consistency in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.