Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

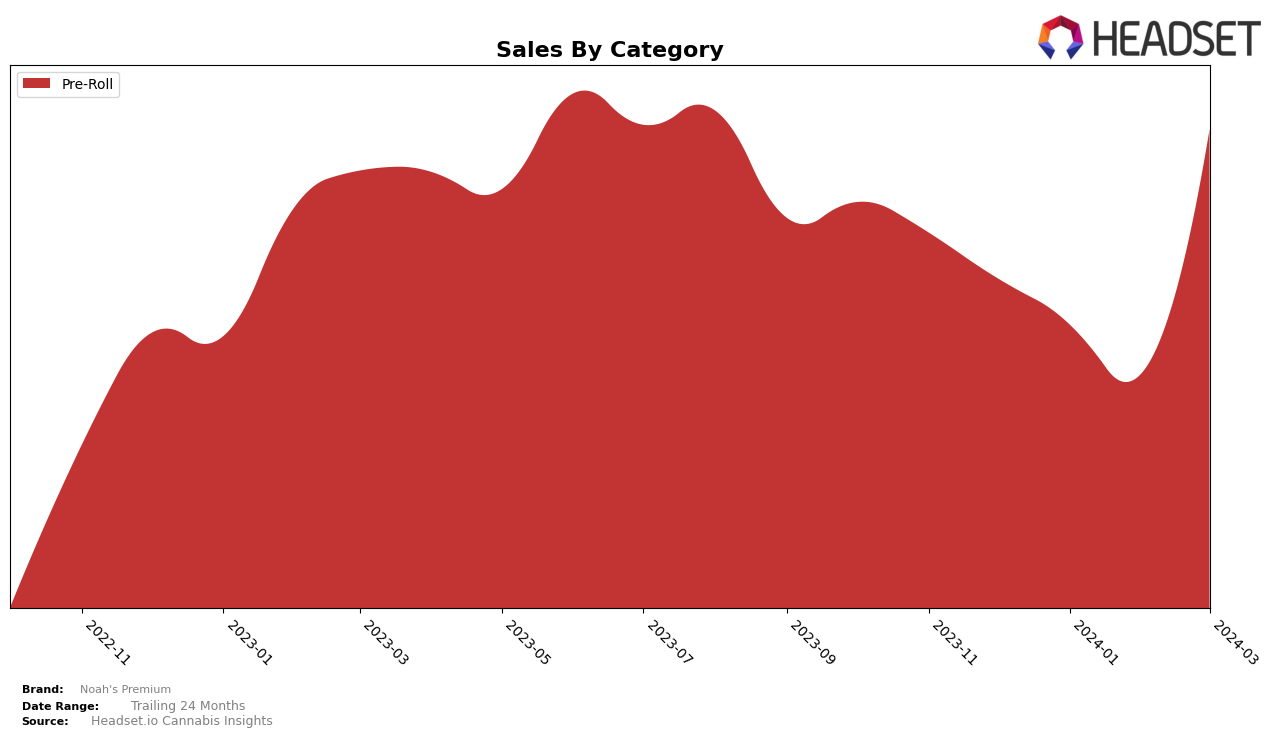

In the competitive cannabis market of California, Noah's Premium has shown a noteworthy performance within the Pre-Roll category. Starting from December 2023, the brand was ranked 49th, indicating a struggle to break into the top positions. However, over the subsequent months, there was a positive shift in its ranking, culminating in a significant jump to the 30th position by March 2024. This upward trajectory suggests a growing consumer preference for Noah's Premium Pre-Rolls in California. Despite experiencing a dip in sales from December 2023 to February 2024, March saw a remarkable rebound, with sales increasing to 370,564.0, highlighting a strong recovery and potential market resilience.

While specific rankings for other states or provinces were not provided, the data from California alone illustrates an important trend for Noah's Premium. The initial rankings outside the top 30 in December 2023 could have been seen as a setback, yet the brand's ability to not only re-enter but also climb higher in the rankings by March 2024 is commendable. This performance indicates a strategic adjustment or increased consumer acceptance, which is crucial for maintaining and improving market position. The absence of rankings in other states or provinces leaves room for speculation on the brand's overall performance and strategy outside of California. However, the detailed movement within the California market provides valuable insights into Noah's Premium's potential and areas for growth.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, Noah's Premium has shown a remarkable improvement in its market position. Initially ranked outside the top 20 brands at the end of 2023, Noah's Premium made a significant leap to the 30th position by March 2024. This upward trajectory is notable, especially when compared to its competitors. For instance, Cookies and Littles have experienced fluctuations but remained within a closer range of their initial rankings, ending at 31st and 29th respectively in March 2024. Coastal Sun Cannabis also saw improvement, moving up to the 28th position by March. Meanwhile, "Eighth Brother, Inc." had a similar trajectory to Noah's Premium but ended slightly higher at the 32nd position in March. The significant rank improvement for Noah's Premium, coupled with a substantial increase in sales from February to March 2024, positions it as a brand with noteworthy momentum in the California Pre-Roll market, suggesting a growing consumer preference and market share amidst stiff competition.

Notable Products

In March 2024, Noah's Premium saw the Alien Milk Live Rosin Diamond Infused Pre-Roll 5-Pack (2.5g) topping the charts with remarkable sales of 1429 units, marking a significant leap from its previous rank in February. Following closely, the Cookie Glue Pre-Roll 20-Pack (20g) maintained its strong performance, securing the second position with a slight decrease in sales when compared to the leading product. The Alien Milk Live Rosin Diamond Infused Pre-Roll 10-Pack (5g) climbed to the third spot, showing a notable improvement from its absence in the rankings in February. The Platinum Pie Live Rosin Diamond Infused Pre-Roll 10-Pack (5g) also made a comeback, ranking fourth after not being listed in the previous month. Lastly, the Ghost Crack Pre-Roll 20-Pack (20g) experienced a slight drop to the fifth position, illustrating a competitive shift in consumer preferences within Noah's Premium's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.