Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

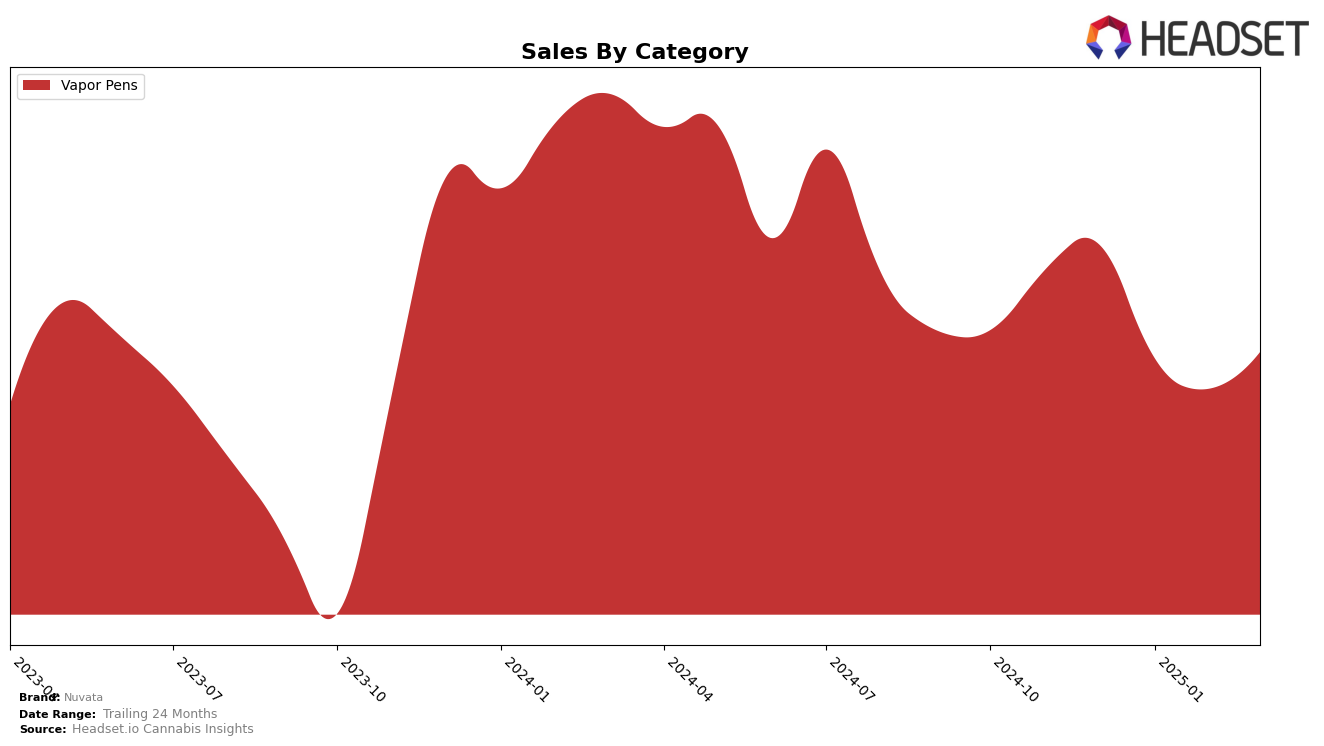

Nuvata has exhibited varied performance across different states and categories, notably in the Vapor Pens category. In Arizona, the brand showed a promising upward trend, moving from a rank of 63 in December 2024 to 47 by March 2025. This improvement is indicative of a growing presence and possibly an expanding consumer base in the state. In contrast, California presented a more volatile scenario, with Nuvata's rank fluctuating between 96 and 80 over the same period, suggesting potential challenges in maintaining consistent market traction. Interestingly, in Illinois, Nuvata maintained a steady presence within the top 30, though it experienced a slight decline from rank 20 to 26, indicating a need for strategic adjustments to sustain competitive positioning.

Focusing on sales trends, Nuvata's performance in Arizona saw a notable increase in sales from December 2024 to March 2025, reflecting a positive reception of their Vapor Pens. Meanwhile, in California, despite some fluctuations in ranking, the brand achieved a notable sales rebound in March 2025 after a dip in February, hinting at potential market recovery efforts. In Illinois, while sales figures demonstrated a downward trajectory from December to February, there was a slight recovery in March, suggesting that the brand might be stabilizing its operations. Overall, Nuvata's performance across these states highlights both opportunities and challenges, with each market presenting unique dynamics that the brand must navigate carefully.

Competitive Landscape

In the Illinois Vapor Pens category, Nuvata's competitive positioning has shown some fluctuations in recent months, impacting its rank and sales performance. Starting from December 2024, Nuvata held the 20th position, but by March 2025, it had slipped to 26th. This decline in rank is mirrored by a decrease in sales, from a high in December to a lower figure in March. In contrast, Generic AF started strong in December at 19th but experienced a similar downward trend, falling to 25th by March. Meanwhile, Verano demonstrated resilience, improving its rank from 26th in December to 24th in March, accompanied by a significant increase in sales during the same period. Dabstract and Generic IL remained relatively stable, with minor fluctuations in their rankings and sales. These dynamics suggest that while Nuvata faces challenges in maintaining its competitive edge, there are opportunities to learn from the strategies of brands like Verano, which have managed to enhance their market position despite the competitive pressures in the Illinois market.

Notable Products

In March 2025, the top-performing product from Nuvata was the CBD/THC 1:9 Strawberry Full Mind Distillate Disposable (0.5g) in the Vapor Pens category, reclaiming its number one rank from December 2024 with sales reaching 2647. The CBD/THC 1:9 Wild Grape Full Body Distillate Disposable (0.5g) moved up to the second position from February's absence, showing a strong sales resurgence. Flow - CBD/THC 1:1 Apricot Distillate Disposable (0.5g) maintained consistent performance, rising to third place from its fourth position in February. The CBD/THC 1:9 Blueberry Body Dominant Distillate Disposable (0.5g) saw a drop to fourth place from its top position in January, indicating a slight decline in demand. Notably, the CBD/THC 1:9 Lime Body Balance Distillate Disposable (0.5g) made its debut in the rankings at fifth place, suggesting emerging interest from consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.