Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

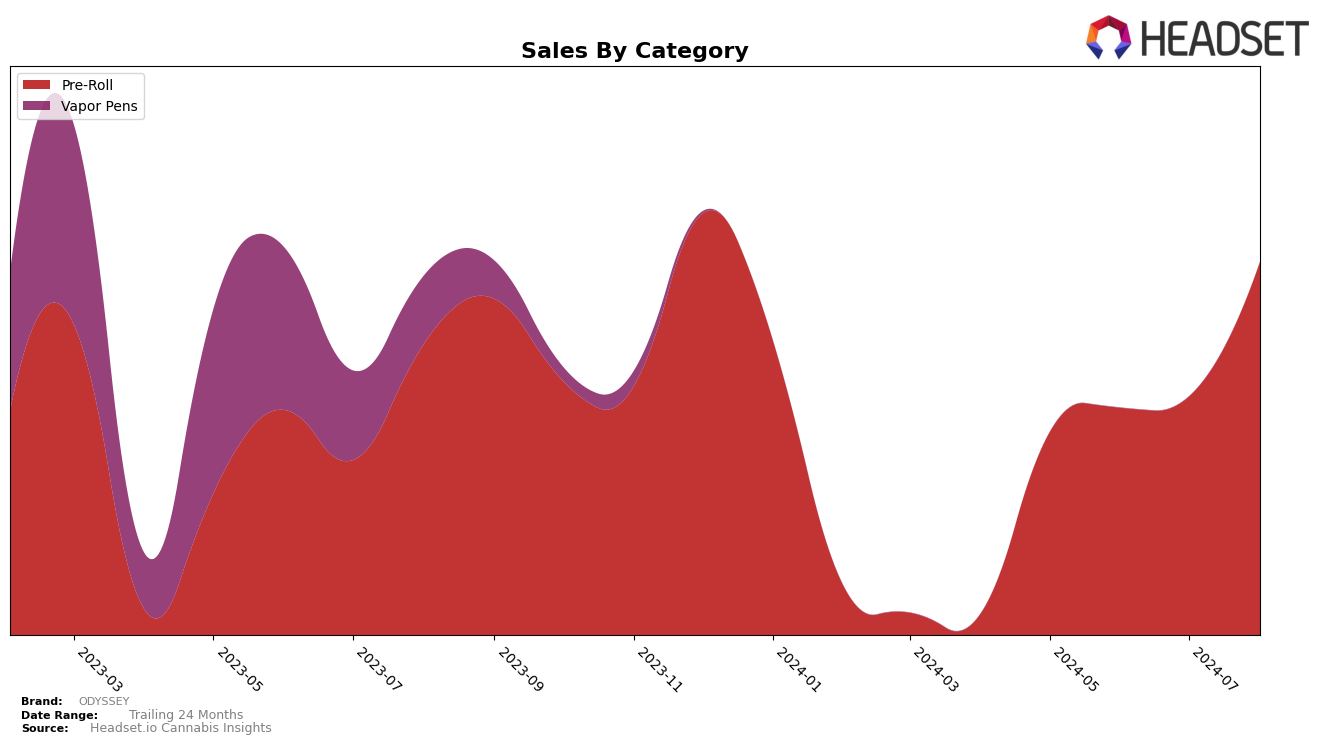

ODYSSEY has shown a varied performance across different states and categories. In Michigan, the brand struggled to make a significant impact in the Pre-Roll category, failing to secure a top 30 ranking from May to August 2024. This trend is indicative of a challenging market environment or potential issues with brand penetration in Michigan. On the other hand, in Missouri, ODYSSEY demonstrated a strong upward trajectory. The brand moved from a ranking of 47th in May to an impressive 20th by August, reflecting a growing consumer base and increasing market share in the Pre-Roll category.

Despite the lack of presence in Michigan's top 30, ODYSSEY's performance in Missouri highlights a noteworthy growth pattern. Sales figures in Missouri show a significant increase, with August sales reaching 146,232 USD, a substantial jump from May's 43,381 USD. This indicates a successful strategy or product reception in Missouri's market. The contrasting performances in these two states underscore the importance of regional strategies and market-specific approaches for cannabis brands like ODYSSEY.

Competitive Landscape

In the highly competitive Missouri pre-roll market, ODYSSEY has shown a remarkable upward trajectory in recent months. Starting from a rank of 47 in May 2024, ODYSSEY climbed to rank 20 by August 2024, indicating a significant improvement in market presence and consumer acceptance. This upward movement is particularly notable when compared to competitors like Willie's Reserve, which fluctuated but remained relatively stable around the 21st position, and TRIP, which also saw a steady rise, reaching the 19th rank in August 2024. Another key competitor, Plume Cannabis (MO), maintained a strong position within the top 20 throughout the period, peaking at rank 18 in August 2024. Interestingly, Jelly Roll experienced a decline, dropping from rank 16 in May 2024 to rank 22 in August 2024, which could indicate a shift in consumer preferences or market dynamics favoring ODYSSEY. This competitive landscape highlights ODYSSEY's potential for continued growth and the importance of strategic positioning to capitalize on emerging market trends.

Notable Products

In August 2024, the top-performing product for ODYSSEY was Cookies n Cream Pre-Roll (1g) in the Pre-Roll category, which jumped to the first position with an impressive sales figure of 18,122 units. Following closely, Hippie Crasher Pre-Roll (1g) rose to the second spot from its previous fourth position in July. Garlic Breath Pre-Roll (1g) secured the third rank, showing consistent performance since it first appeared in June. Premium Hybrid Blend Pre-Roll (1g) entered the rankings at fourth place, indicating a strong debut. Ice Cream Mints Pre-Roll (1g) dropped to fifth place, a notable decline from its third position in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.