Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

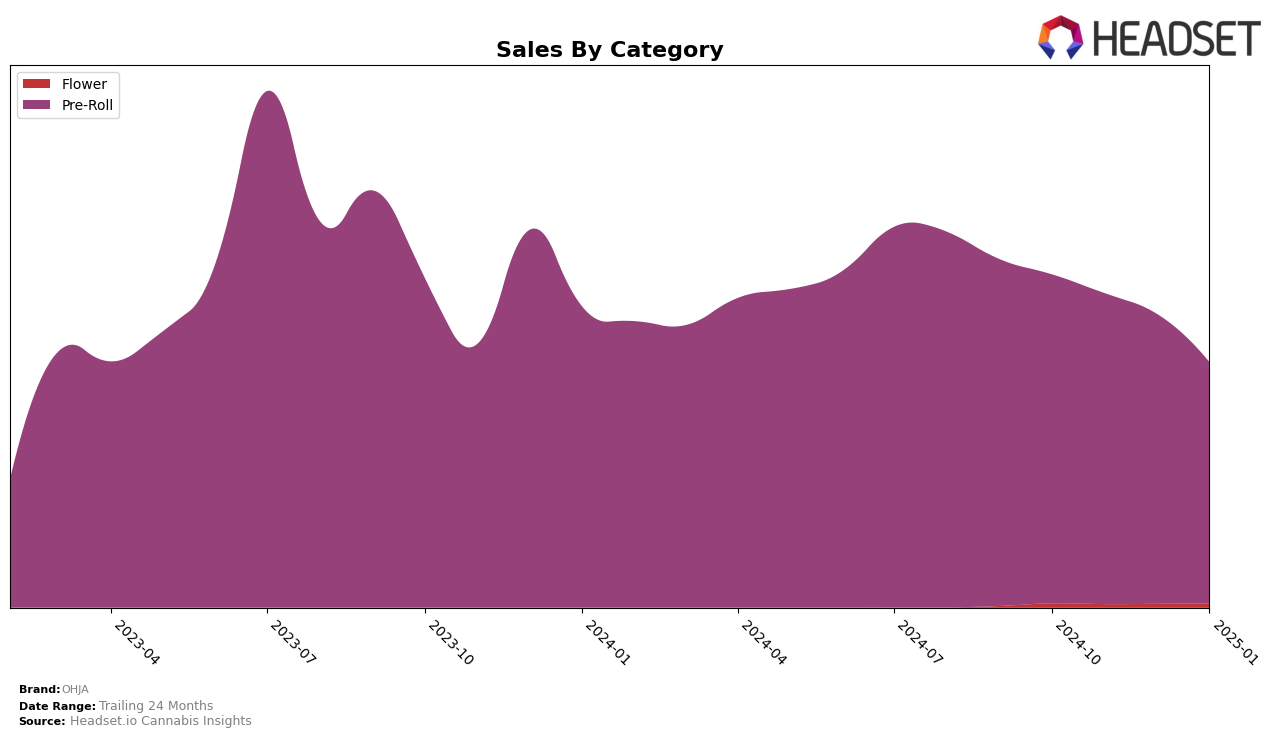

OHJA's performance in the Pre-Roll category across Canadian provinces shows a mix of stability and challenges. In Saskatchewan, OHJA maintained a relatively strong presence, ranking 20th in October 2024 and improving to 18th in November before experiencing slight fluctuations in December and January 2025. This suggests a stable demand for their products in this region, with sales showing a moderate increase in November. In contrast, Ontario presented more challenges, as OHJA's ranking slipped from 26th in October to 34th by January 2025. This decline in ranking, coupled with a significant drop in sales from October to January, indicates potential competitive pressures or market dynamics affecting their performance.

Meanwhile, in Alberta, OHJA did not break into the top 30 brands in the Pre-Roll category throughout the period analyzed, reflecting a tougher competitive landscape or perhaps a need for strategic adjustments. Despite this, the brand's sales figures in Alberta, while on a declining trend from October to January, still represent a significant market presence. The varying performance across these provinces underscores the importance of regional strategies tailored to the unique market conditions in each area. The data suggests that while OHJA has a foothold in some areas, there is room for growth and improvement in others.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, OHJA has experienced a slight decline in its ranking over the past few months, moving from 26th in October 2024 to 34th by January 2025. This downward trend is mirrored in its sales figures, which have also seen a decrease. Notably, Sheeesh!, a competitor, maintained a higher rank than OHJA throughout this period, despite its own sales decline. Meanwhile, The Loud Plug and Happy & Stoned have shown more stability in their rankings, although their sales figures are lower than OHJA's. This suggests that while OHJA is still a strong player in terms of sales volume, its market position is being challenged by competitors who are either maintaining or improving their rankings, indicating a need for strategic adjustments to regain competitive advantage.

Notable Products

In January 2025, the top-performing product from OHJA was the Lemon Mintz Pre-Roll 10-Pack (3.5g), which maintained its leading position from December, with sales figures reaching 5163 units. The Lemon Cherry Gelato Pre-Roll 10-Pack (3.5g) slipped to second place, experiencing a notable drop in sales compared to the previous month. El Jefe Pink Pre-Roll 10-Pack (3.5g) remained steady at third place, marking consistent performance over the months. Amnesia Haze Pre-Roll 10-Pack (3.5g) held its fourth position, while Lime Mjto Pre-Roll 10-Pack (3.5g) continued at fifth, both showing a gradual decrease in sales. Overall, the rankings for January 2025 showed minor shifts, with Lemon Mintz maintaining its dominance despite a general decline in sales figures across the board.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.