Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

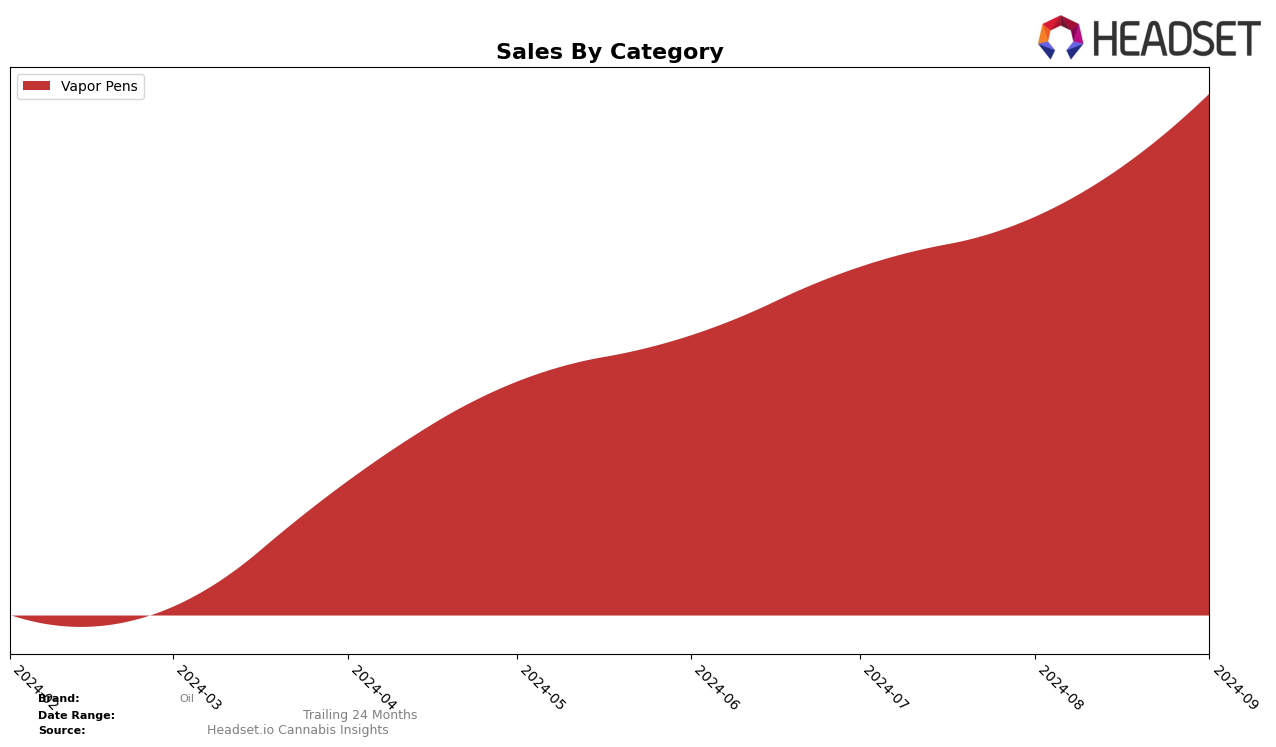

In the state of Colorado, the cannabis brand Oil has demonstrated a notable upward trajectory in the Vapor Pens category. Starting from a position outside the top 30 in June 2024, the brand climbed to rank 29 by September 2024. This steady improvement suggests a growing consumer preference for Oil's products within the state, as evidenced by the increase in sales from $97,331 in June to $179,021 in September. Such a movement into the top 30 indicates a positive reception and potentially increased market share in the Colorado vapor pens market.

Despite this positive trend in Colorado, it is important to note that Oil's performance in other states and categories remains undisclosed, which could imply varying levels of success or challenges in different markets. The absence of rankings in other states or categories might suggest that Oil has yet to make a significant impact or break into the top 30 in those areas. This could either indicate untapped potential for growth or highlight areas where the brand may need to refine its strategy to enhance its market presence. Understanding these dynamics could be crucial for stakeholders looking to capitalize on Oil's upward momentum in the vapor pens category.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Oil has shown a promising upward trajectory in recent months. Starting from a rank of 47 in June 2024, Oil has climbed steadily to reach the 29th position by September 2024. This improvement in rank is indicative of a positive trend in sales performance, as Oil's sales figures have consistently increased over this period. In comparison, Seed and Smith (LBW Consulting) experienced fluctuations, peaking at rank 21 in August before dropping to 27 in September, suggesting a less stable market presence. Meanwhile, Classix and Sauce Essentials have shown gradual improvements, yet their ranks remain lower than Oil's latest position. AO Extracts, despite a dip in August, surged to rank 30 in September, indicating a competitive push. Overall, Oil's consistent rise in rank and sales positions it as a formidable player in the Colorado vapor pen market, with a clear upward momentum that could potentially outpace its competitors in the near future.

Notable Products

In September 2024, the top-performing product from Oil was the Tangerine Haze Distillate Cartridge (1g) in the Vapor Pens category, achieving the number one rank with notable sales of 1083 units. The Maui Wowie Oil Cartridge (1g) maintained its consistent performance, holding the second rank for four consecutive months with September sales reaching 802 units. Watermelon Ice Distillate Cartridge (1g) remained steady in third place, showing a slight increase in sales compared to August. Purple Punch Oil Cartridge (1g) dropped from its top position in July to fourth place in September, indicating a decline in sales momentum. The Hawaiian Sour Oil Disposable (4g) entered the rankings in September at fifth place, marking its debut in the dataset.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.