Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

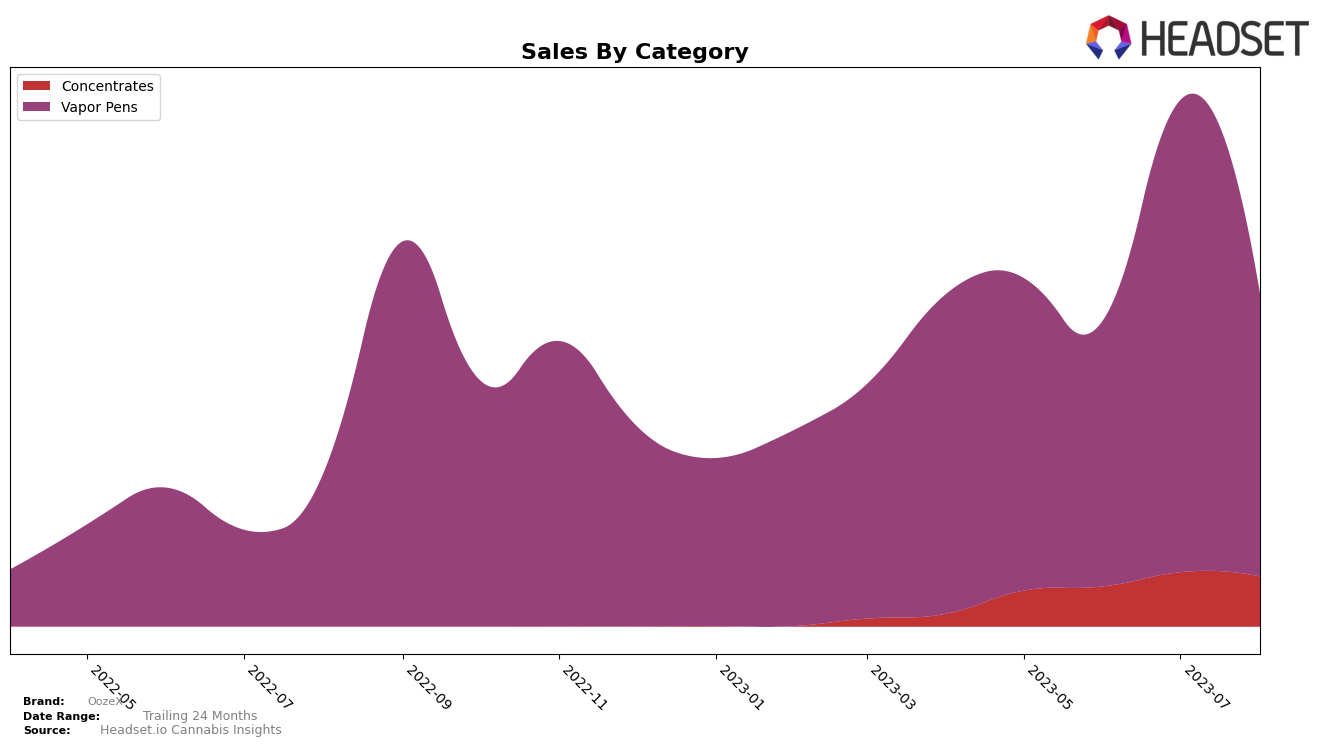

In the category of Concentrates, the OozeX brand has exhibited a fluctuating performance in the state of Michigan. From May to August 2023, the brand's ranking hovered around the 50th position, with a slight improvement in July (47th rank) followed by a dip in August (51st rank). It's worth noting that despite not being in the top 20, OozeX has seen a steady increase in sales over these months, indicating a growing consumer base for their concentrates.

Contrastingly, in the Vapor Pens category, OozeX has consistently ranked within the top 20 in Michigan. The brand saw its best performance in July 2023, ranking 15th, but experienced a slight drop to the 18th position in August. While the brand's ranking has seen minor fluctuations, the sales trend has been somewhat volatile, with a significant spike in July followed by a drop in August. This could suggest a highly competitive market for Vapor Pens or reflect seasonal consumer behavior trends.

Competitive Landscape

In the Vapor Pens category in Michigan, OozeX has shown a fluctuating performance in terms of rank and sales. In August 2023, OozeX ranked 18th, a drop from its 15th position in July 2023, but an improvement from its 22nd position in June 2023. This indicates a volatile market position for OozeX. In terms of sales, OozeX experienced a significant drop in August 2023 compared to July 2023, but the longer-term trend shows a general increase in sales. Among its competitors, Church Cannabis Co. consistently ranked within the top 20, while True North Collective showed a similar fluctuating pattern to OozeX. Bossy and Dragonfly Cannabis had a lower rank, indicating they were not in the top 20 in some months, but they show an upward trend, indicating growing competition in this category.

Notable Products

In August 2023, the top-performing product from OozeX was the Orange Burst Distillate Disposable (1g), with sales reaching 2883 units. This is a significant rise from its third position in May 2023. The Raspberry Cotton Candy Distillate Disposable (1g) maintained a strong performance as well, securing the second spot in August, consistent with its position in June and July. However, the Green Apple Twist Distillate Disposable (1g), which was the top product in May, dropped to the fifth position in August. Meanwhile, the Blueberry Rock Pops Distillate Disposable (1g) saw a steady increase, moving from fifth in June to third in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.