Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

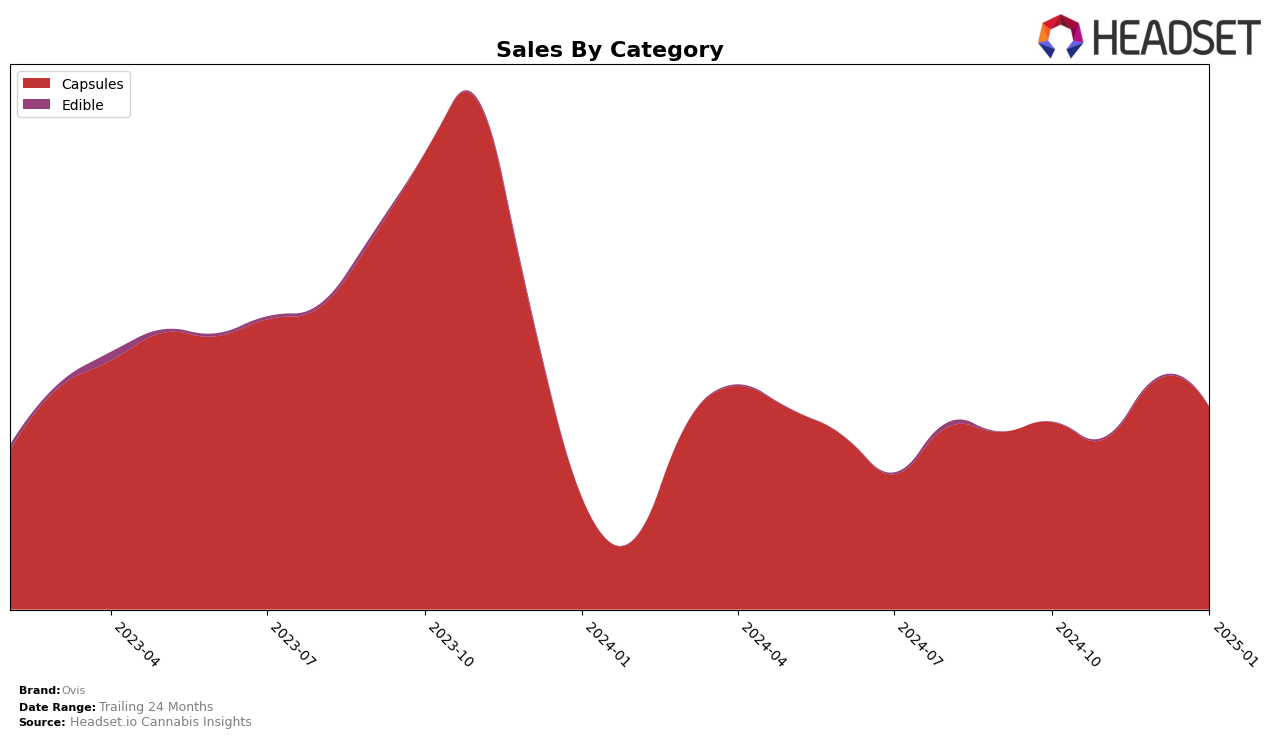

Ovis has demonstrated notable performance in the Canadian province of Alberta, particularly in the Capsules category. The brand consistently maintained a top 10 position from October 2024 through January 2025, with slight fluctuations in their ranking. Specifically, Ovis held the 10th position in October and November, improved to 8th place in December, before slightly dropping to 9th in January. This movement indicates a resilient presence in the market, with a noticeable peak in December, suggesting a possible seasonal increase in consumer demand or successful marketing strategies during that period.

In terms of sales, Ovis experienced a steady increase from November to January, with a significant uptick in December, where sales jumped from 27,863 units in November to 35,048 units in December. This upward trajectory continued into January, reaching 35,890 units. The consistent presence in the top 10 rankings in Alberta highlights the brand's strong foothold in the Capsules category. However, it's worth noting that Ovis's absence from the top 30 in other states or categories could suggest areas for potential growth and expansion.

Competitive Landscape

In the competitive landscape of the capsules category in Alberta, Ovis has shown a dynamic performance over the past few months. Starting from October 2024, Ovis was ranked 10th, and despite a slight dip in November, it climbed to 8th place by December, maintaining a strong position into January 2025. This upward trend in rank is indicative of Ovis's growing market presence, especially as it outperformed Dosecann, which consistently ranked lower. However, Ovis faces stiff competition from brands like Indiva, which has maintained a top position, consistently ranking 6th or better. Meanwhile, Portals has shown fluctuating ranks, suggesting volatility that Ovis could capitalize on. The absence of Solei from the top 20 in October and November further highlights the competitive shifts in this market. Overall, Ovis's ability to improve its rank amidst these dynamics suggests a positive trajectory in sales and brand strength, positioning it as a formidable contender in Alberta's capsules market.

Notable Products

In January 2025, Blue THC Softgel 15-Pack (150mg) maintained its leading position as the top-selling product for Ovis, with sales reaching 1761 units. The CBD:THC 1:1 Balanced Full Spectrum Softgels 30-Pack (150mg CBD, 150mg THC) saw a significant rise, moving from fifth place in December 2024 to second place. The Blue THC Softgel 50-Pack (125mg) climbed from an unranked position in December to secure third place in January. CBD:THC 50:5 Softgels 15-Pack (750mg CBD, 75mg THC) remained stable, holding its fourth-place rank from the previous month. Meanwhile, CBG/CBD/THC 1:1:1 Softgels 15-Pack (75mg CBG, 75mg CBD, 75mg THC) dropped from second to fifth place, indicating a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.