Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

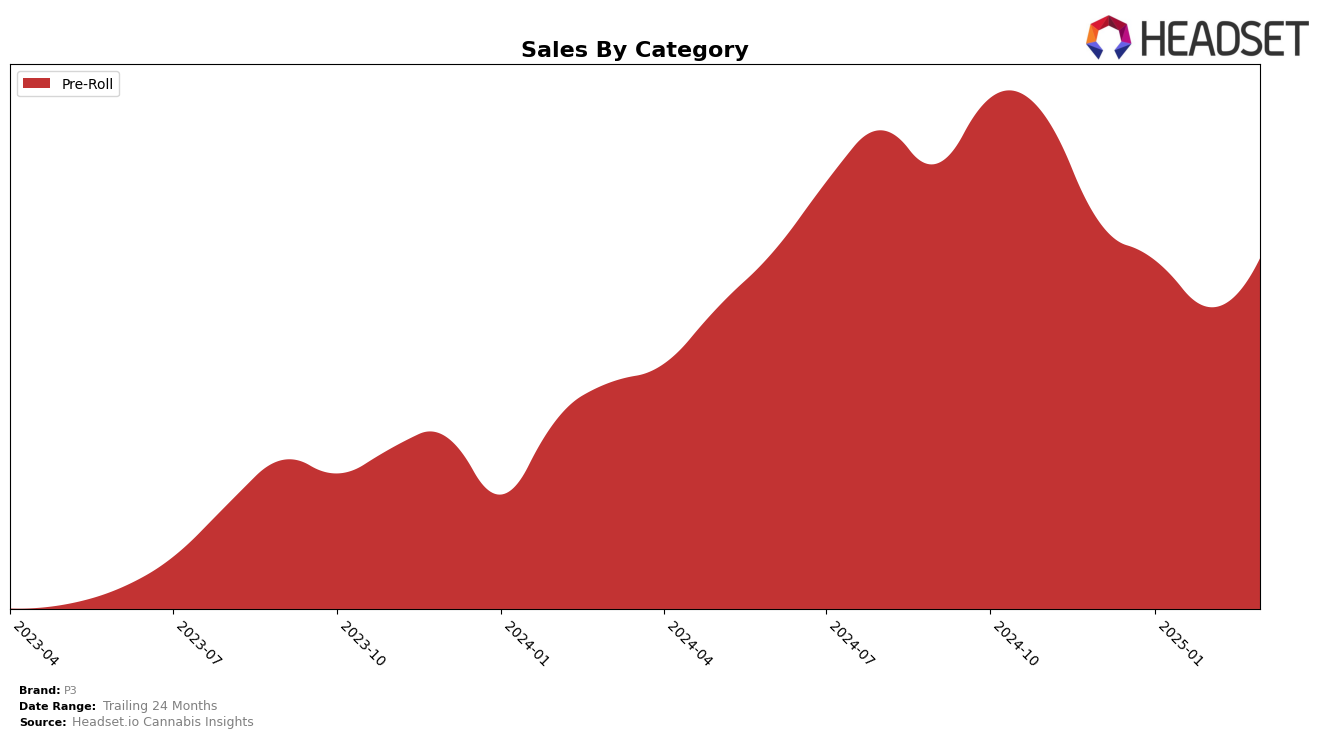

P3's performance in the Pre-Roll category has shown notable variations across different states, with some areas highlighting significant improvement while others indicate a decline. In Colorado, P3 made a strong comeback from not being in the top 30 in December 2024 to ranking 22nd by March 2025, indicating a positive trajectory in market presence. This upward movement is mirrored by a substantial increase in sales, which more than doubled from January to March 2025. Conversely, Maryland experienced a downward trend, as P3's rank slipped from 22nd in December 2024 to 46th by March 2025, accompanied by a significant drop in sales figures. Such contrasting performances highlight the brand's varying reception and competitive dynamics in different markets.

Meanwhile, in Illinois, P3 maintained a relatively stable position within the top 40, with a slight improvement from 39th in February to 32nd in March 2025. This suggests a consistent demand in this region, with sales peaking in March. New York presents a different picture, where P3 consistently held its ground around the 24th to 25th rank across the months, indicating a steady foothold in the market. Despite the stability in rankings, the sales figures in New York show a gradual increase, suggesting a slow but steady growth in consumer interest. These insights reveal P3's diverse market performance, with certain states offering more opportunities for growth than others.

Competitive Landscape

In the competitive landscape of the New York Pre-Roll category, P3 has maintained a relatively stable position, with its rank fluctuating slightly between 24th and 25th from December 2024 to March 2025. This consistency in rank suggests a steady performance, albeit at the lower end of the top 25 brands. In contrast, brands like Dogwalkers and KOA Exotics have experienced more volatility, with Dogwalkers dropping out of the top 20 by February 2025 and KOA Exotics making a significant leap into the top 25 in January 2025. Meanwhile, Hepworth has shown stronger performance, consistently ranking higher than P3, although it too saw a dip in March 2025. The sales trends indicate that while P3's sales figures are stable, they are lower compared to these competitors, which could be a factor in its lower rank. This competitive environment highlights the need for P3 to innovate or enhance its market strategies to climb higher in the rankings and boost sales.

Notable Products

In March 2025, Blueberry AK Limeade Infused Pre-Roll (1g) emerged as the top-performing product for P3, climbing from its consistent third-place ranking in previous months to first, with notable sales of 5,030 units. Loaded Banana Milkshake Infused Blunt (2g) closely followed in second place, maintaining a strong position despite fluctuating rankings from first in January to fourth in February. Wilson We Need More Mangoes Infused Pre-Roll (1g) secured the third spot, showing improvement from February's second-place. Sour Meltdown Infused Blunt (2g) held steady at fourth, while Choco Berry Chuck Infused Pre-Roll (1g) dropped from a leading position in February to fifth in March. Overall, March saw significant shifts in product rankings, reflecting dynamic consumer preferences within P3's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.