Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

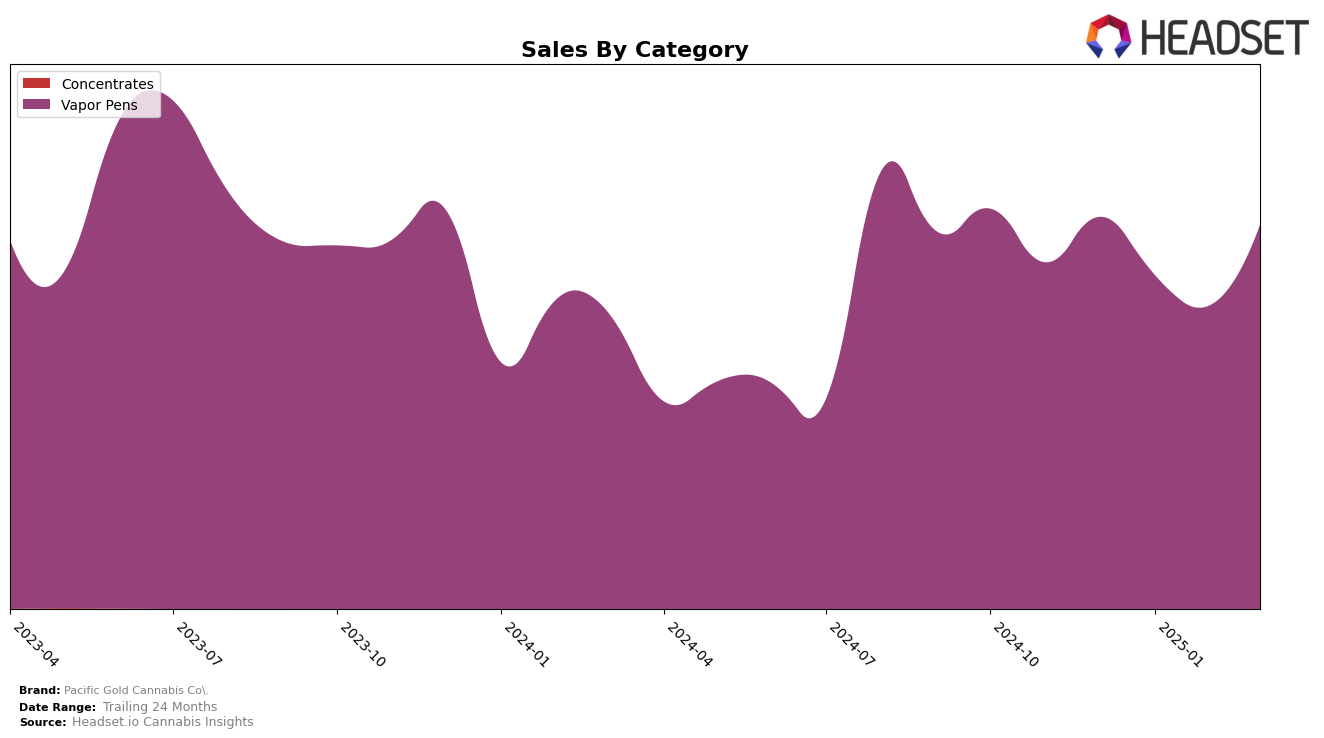

Pacific Gold Cannabis Co. has demonstrated a consistent performance in the vapor pens category within Ohio. The brand maintained a steady presence in the top 20 rankings from December 2024 through March 2025. Specifically, they ranked 15th in December, slipped slightly to 18th in January and February, and then regained their 15th position in March. This fluctuation suggests a resilience in maintaining market share despite some competitive pressures. The sales figures reflect a similar trend, with a notable dip in January and February, followed by a recovery in March, indicating potential seasonal influences or successful promotional efforts that helped bounce back sales.

However, it is worth noting that Pacific Gold Cannabis Co. did not appear in the top 30 rankings in other states or categories during this period, which might be a point of concern for the brand's broader market penetration strategy. This absence highlights potential opportunities for growth and expansion, especially if the brand can leverage its strength in Ohio to enter other markets. The brand's ability to maintain a top 20 position in Ohio's vapor pens category suggests a strong foothold that could be a valuable asset if they choose to diversify their product offerings or expand into new regions.

Competitive Landscape

In the competitive landscape of the Ohio vapor pens market, Pacific Gold Cannabis Co. has experienced some fluctuations in its ranking and sales performance. Over the period from December 2024 to March 2025, Pacific Gold Cannabis Co. maintained a relatively stable position, starting at rank 15 in December, dropping to 18 in January and February, and then climbing back to 15 in March. This indicates a resilient performance amidst a competitive environment. Notably, Vapen consistently outperformed Pacific Gold Cannabis Co., holding a higher rank throughout the months, despite a decline in sales from December to March. Meanwhile, Timeless and Firelands Scientific showed more variability in their rankings, with Timeless dropping to 19 in January before recovering slightly, and Firelands Scientific experiencing a significant dip in February. The entry of Seed & Strain Cannabis Co. into the top 20 in January, despite not ranking in December, suggests a dynamic market where Pacific Gold Cannabis Co. must continuously innovate to maintain and improve its market position.

Notable Products

In March 2025, the top-performing product from Pacific Gold Cannabis Co. was Strawberry Diesel Cookies Distillate Disposable (1g) in the Vapor Pens category, maintaining its top position from February with sales of 1684 units. Blueberry Distillate Disposable (1g) climbed back to the second rank from fourth place in February, showing a significant increase in sales. Super Lemon Haze Distillate Disposable (1g) moved down one spot to third, despite a rise in sales figures. Purple Urkle Distillate Disposable (1g) remained stable at fourth place, maintaining its position from February. Pineapple Express Distillate Disposable (1g) dropped to fifth place, showing a consistent decline in sales since its peak in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.