Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

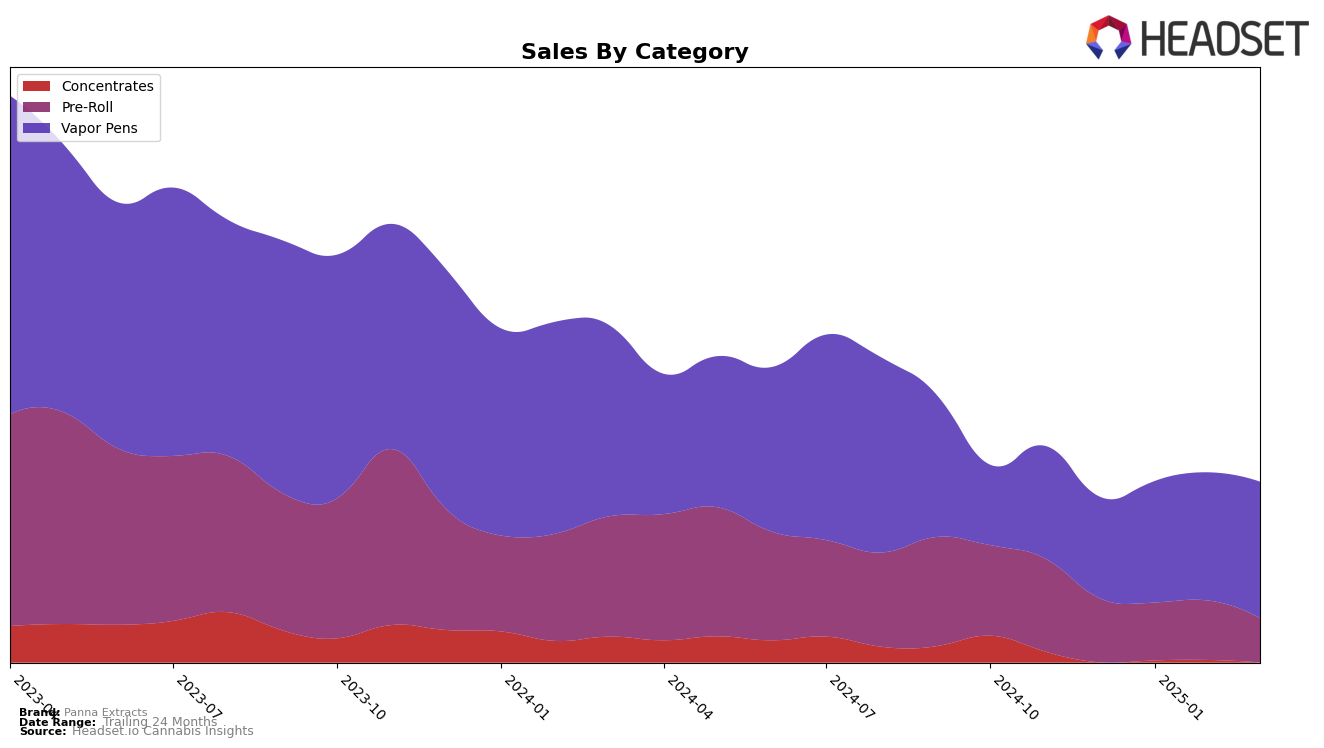

Panna Extracts has shown a mixed performance across different categories and states. In the Pre-Roll category in Nevada, the brand maintained a steady position at rank 28 from December 2024 through February 2025, before dropping out of the top 30 in March 2025. This decline indicates a potential challenge in maintaining market share within this category. On the other hand, the Vapor Pens category in Nevada tells a different story, with Panna Extracts improving its rank from 27 in December 2024 to 21 by February 2025, before a slight dip to 23 in March 2025. This upward trend suggests that the brand is gaining traction and popularity among consumers in the Vapor Pens category, even as their Pre-Roll performance wanes.

Despite the fluctuations in rankings, Panna Extracts' sales figures in the Vapor Pens category reveal a positive trajectory, with increasing sales from December 2024 through March 2025. This growth contrasts with their performance in the Pre-Roll category, where sales declined over the same period. Such trends highlight the brand's stronger foothold and potential for growth in the Vapor Pens market compared to Pre-Rolls in Nevada. The data suggests that while Panna Extracts faces challenges in maintaining its position in certain categories, it also has opportunities to capitalize on its strengths in others. Further analysis could provide insights into the strategic adjustments needed to enhance their overall market presence.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Panna Extracts has shown a promising upward trajectory in terms of rank and sales. Starting from a rank of 27 in December 2024, Panna Extracts climbed to 23 by January 2025, further improving to 21 in February before slightly dropping back to 23 in March. This positive trend is indicative of a strong market presence and growing consumer preference. In comparison, Bonanza Cannabis Company has maintained a relatively stable rank, hovering around the mid-20s, while Mojo (Edibles) experienced a significant boost in January but fell to 24 by March. Meanwhile, Spiked Flamingo and Hippies have shown fluctuating ranks, with Spiked Flamingo ending March at 21 and Hippies at 22. The data suggests that Panna Extracts is effectively capturing market share, potentially due to strategic marketing or product differentiation, as evidenced by its consistent sales growth over the months.

Notable Products

In March 2025, the top-performing product from Panna Extracts was the Watermelon Kush Cured Resin Cartridge (0.5g) in the Vapor Pens category, which climbed to the number one spot with sales reaching 921 units. This product showed a significant improvement from its previous rank of second in February and fifth in January. The Banana Mimosa Cured Resin Cartridge (0.5g) secured the second position, maintaining strong sales performance despite not being ranked in February. Blueberry OG Live Resin Cartridge (0.5g) held steady at the third position, demonstrating consistent popularity over the months. Meanwhile, Shamrock Cookie Cured Resin Cartridge (0.5g) made a notable entry into the rankings at fourth place, showcasing a promising rise in demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.