Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

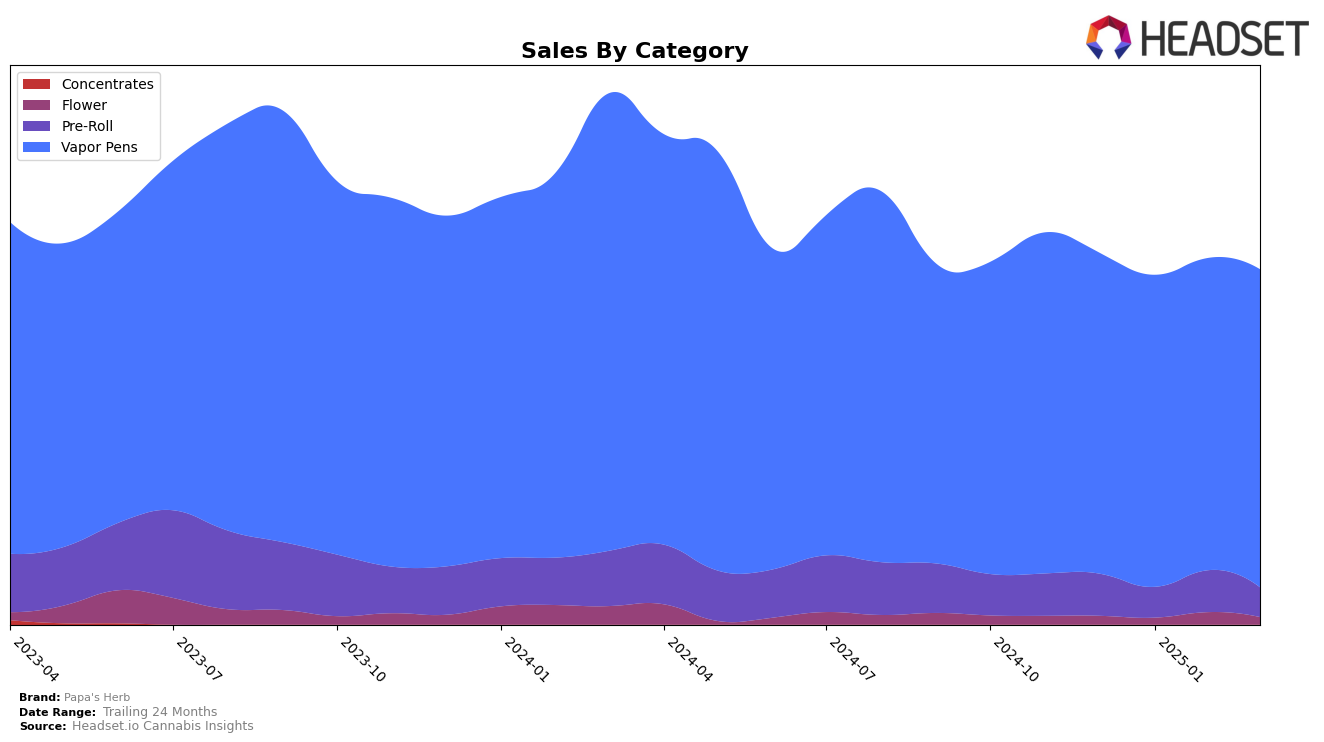

Papa's Herb has demonstrated varied performance across different states and categories. In Alberta, the brand showed notable progress in the Vapor Pens category, climbing from a rank of 51 in December 2024 to 37 by March 2025. This upward trajectory indicates a growing acceptance and popularity of the brand in this region. Conversely, in Arizona, while also in the Vapor Pens category, Papa's Herb experienced fluctuations, dropping from 31 in December 2024 to 42 in January 2025, before stabilizing around the mid-30s in the following months. This suggests a competitive market environment where maintaining a consistent position can be challenging.

In California, the brand's performance in the Pre-Roll category was inconsistent, with a significant leap to rank 37 in February 2025 before dropping back to 61 in March 2025. This movement indicates potential volatility or market dynamics affecting this category. On the other hand, in the Vapor Pens category within California, Papa's Herb maintained a more stable presence, consistently ranking in the top 20, which reflects a strong foothold in this segment. Meanwhile, in Ontario, the brand's position remained relatively stable in the Vapor Pens category, hovering around the mid-30s, which suggests a steady but moderate performance in this Canadian market.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in California, Papa's Herb has shown resilience and adaptability, maintaining a steady presence in the top 20 brands from December 2024 to March 2025. Despite fluctuations in rank, Papa's Herb improved from 19th in December 2024 to 17th in February 2025, before settling at 18th in March 2025. This upward trend in February is notable, as it coincided with a peak in sales, suggesting effective strategies in product positioning or promotions. Meanwhile, competitors like Kurvana and ABX / AbsoluteXtracts experienced more stable but lower sales growth, with Kurvana not making it into the top 20 until March 2025. Clsics showed a strong performance, moving from 20th in December 2024 to 17th in March 2025, indicating a competitive push that Papa's Herb must watch closely. The brand Gelato consistently outperformed, although its rank slipped from 13th to 16th over the period, which could suggest opportunities for Papa's Herb to capture market share if Gelato's momentum continues to wane.

Notable Products

In March 2025, the top-performing product for Papa's Herb was the Blueberry Zlushie Liquid Diamonds Disposable (1g) in the Vapor Pens category, maintaining its position as the number one ranked product. The Blueberry Zlushie Distillate Cartridge (1g) also performed well, securing the second rank, a consistent position from the previous month. The Fruit Punch Liquid Diamonds Disposable (1g) showed improvement, moving up to the third rank from an unranked position in February. Notably, the Watermelon Z Distillate Cartridge (1g) entered the rankings at fourth place, indicating a strong sales debut. The Runtz Live Resin Cartridge (1g) completed the top five, suggesting a positive reception for new product entries in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.