Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

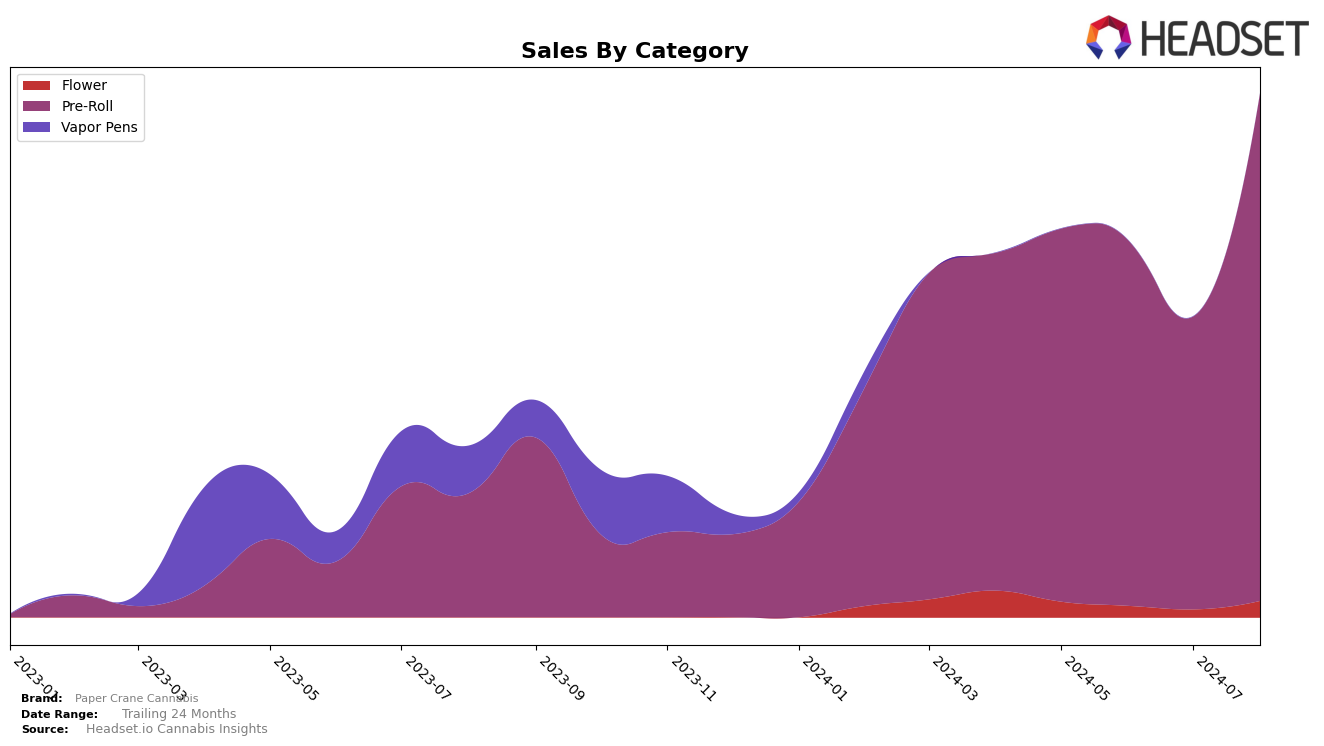

Paper Crane Cannabis has shown significant fluctuations in its performance across various states and categories over the past few months. In Massachusetts, the brand's ranking in the Pre-Roll category has seen a notable improvement from being outside the top 30 in May, June, and July, to securing the 30th position in August. This upward movement is indicative of a positive trend for Paper Crane Cannabis in this category, suggesting that their strategies or product offerings might be resonating better with consumers in this state. Despite this improvement, the brand's earlier absence from the top 30 rankings in the preceding months highlights areas for potential growth and consistency.

While Massachusetts shows a promising trend, the absence of Paper Crane Cannabis in the top 30 rankings in other states or categories is a point of concern. This lack of presence in multiple markets could suggest challenges in market penetration or competition with other established brands. The brand's sales figures also reflect these dynamics, with a significant increase in August sales compared to previous months, which could be a result of seasonal demand or effective marketing campaigns. Overall, while there are positive signs of growth in certain areas, Paper Crane Cannabis needs to address its inconsistencies to achieve a more robust and widespread market presence.

Competitive Landscape

In the competitive landscape of the Massachusetts pre-roll category, Paper Crane Cannabis has shown significant volatility in its rankings and sales. Notably, Paper Crane Cannabis experienced a dramatic rise from rank 50 in July 2024 to rank 30 in August 2024, reflecting a substantial increase in sales. This upward trend is contrasted by the performance of competitors such as Khalifa Kush, which consistently improved its rank from 55 in May 2024 to 33 in August 2024, and El Blunto, which maintained a strong presence, peaking at rank 29 in August 2024. Meanwhile, Lazy River Products showed steady performance, hovering around the mid-30s in rank. Despite the competitive pressure, Paper Crane Cannabis's recent surge in rank and sales indicates a positive momentum, suggesting potential for further growth if this trend continues. However, it remains crucial for Paper Crane Cannabis to maintain this trajectory to compete effectively against established brands like Trees Co. (TC), which, despite a slight decline, still holds a strong position in the market.

Notable Products

In August 2024, the top-performing product for Paper Crane Cannabis was Glazed Apricot Gelato Pre-Roll (1g), maintaining its rank from July with notable sales of 4376 units. Mimosa Pre Roll (1g) followed closely in second place, showing a significant increase from its previous rank, with sales reaching 4366 units. Runtz Pre-Roll (1g) climbed up to third place from fifth in July, with sales of 2752 units. Sour Diesel Pre-Roll (1g) dropped to fourth place from its previous ranks in May and June, with sales of 2595 units. South Humboldt OG Kush Pre-Roll (1g) entered the top five for the first time, securing the fifth position with 1722 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.